Are Internet Ads Gender Biased?

In the most-watched soccer game in U.S. history, the U.S. trounced Japan in a 5-2 victory in the Women’s World Cup final. The U.S. team will receive $2 million from FIFA for the win. Last year, the German men’s team, which won the World Cup, collected a cool $35 million.

While FIFA is notorious for sexism among other dubious behaviors, a Carnegie Mellon University study confirms that other companies are also biased about women—especially when it comes to money. One troubling example: female job seekers on Google were less likely to be shown ads for high paying jobs than male job seekers.

Using an automated tool called AdFisher, researchers explored how Google’s automated ad server reacted when users with identical profiles--except for their gender--interacted with Google’s ads. The technology found that males were shown ads for a career coaching service for “$200k+” executive positions 1852 times, but the female group was shown those highly paid positions a mere 318 times. While the premier career coaching service ads were the top ads shown to males, the top ads shown to females were a regular job posting service and an auto dealer.

Google allows its advertisers to target a particular audience, so any company is allowed to promote different ads based on gender. In addition, the survey wasn’t able to pinpoint the source of the discrimination, whether it was Google, the advertiser, both of them, or the algorithm that was tracking the user behavior. Regardless of the cause, the research proves the inherent perils of customization and targeted ads.

The study was released just before a wave of criticism hit the tech industry, which was accused of gender bias in hiring practices. In general, at major companies like Facebook, Yahoo and Google, women hold few leadership posts and make up around 30 percent of employees.

To be fair, women have not exactly flocked to get degrees in computer science and related math and science areas. Those are the jobs tech companies value most since all new digital products require coding skills.

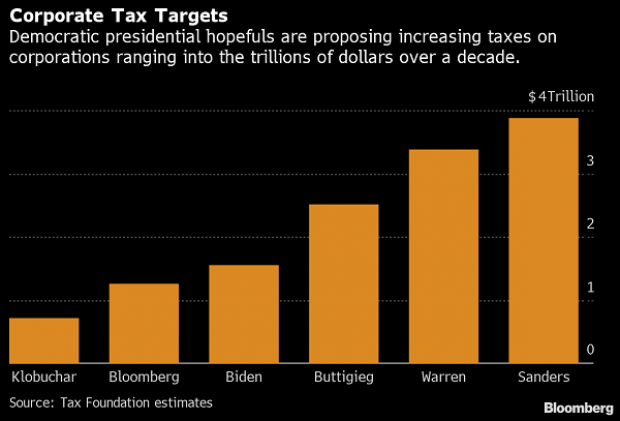

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

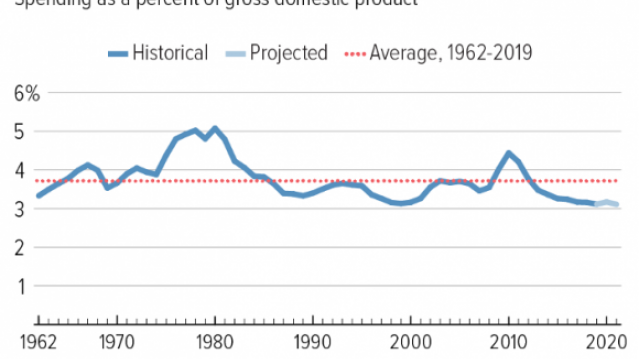

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

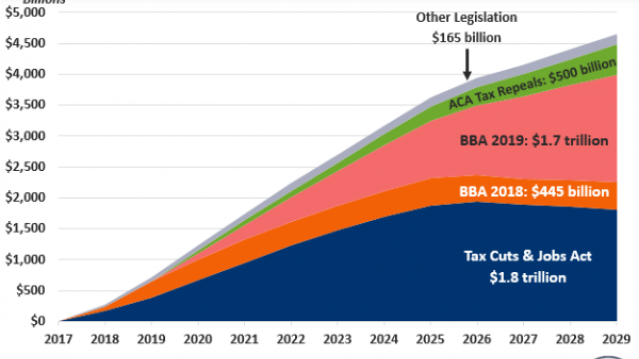

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

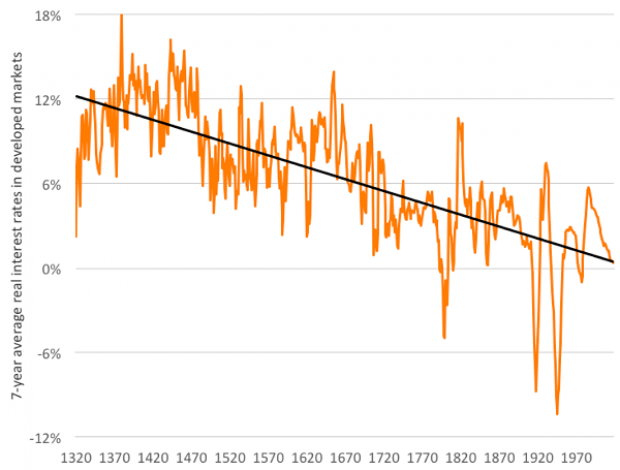

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

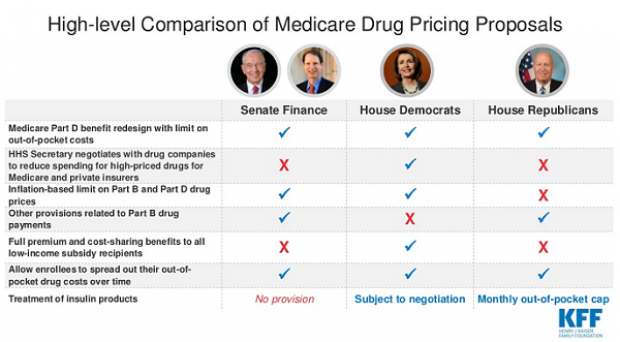

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.