The Hole Truth: Celebrating a Huge Day in Doughnut History

Whether you’re a Dunkin’ devotee or are crazy for Krispy Kremes, July 9 is a date you should celebrate.

On that date back in 1872, the doughnut took a big step toward becoming the billion-dollar business it is today: John F. Blondel of Thomaston, Maine received a patent for a “new and useful” improvement in doughnut-cutters that would speed the production and consumption of the humble pastry in the United States.

The device described in Patent No. 128,783 was intended to automate the process of cutting those dastardly doughnuts — holes and all — as efficiently as a hole punch. The desired edge could be plain or scalloped. This ingenious contraption would push the dough out of the center tube, leaving it free for making the next doughnut.

Related: Made in the USA: 24 Iconic American Foods

But as Art Cashin — the director of floor operations for UBS Financial Services who regularly sprinkles historical tidbits into his commentary — pointed out in a note Wednesday, before you can talk about Blondel’s doughnut innovation, you have to know the story of one Hanson Crockett Gregory, the young genius who forever changed what you and I get when we order our plain, glazed or chocolate with sprinkles. While the history of the doughnut is disputed, Gregory claimed to have invented “the first doughnut hole ever seen by mortal eyes” as a 16-year-old sailor on a lime-trading ship and then taught the technique to his mother, Elizabeth Gregory.

In case you’re still hungry for more doughnut history, this Friday, July 10, Krispy Kreme is celebrating its 78th birthday by offering a sticky sweet deal at participating locations: Buy any dozen doughnuts at regular price and get a second dozen for 78 cents.

Oh, and if you want to purchase those pesky doughnut holes that get unceremoniously shoved from the middle? You can buy those, too. They’re simply called Doughnut Holes, and they can be bought by cup or box in assorted flavors of Original Glazed, Dipped Chocolate, Powdered, Chocolate Cake, Blueberry Cake and Plain Glazed Cake.

Hanson Crockett Gregory would no doubt be amazed.

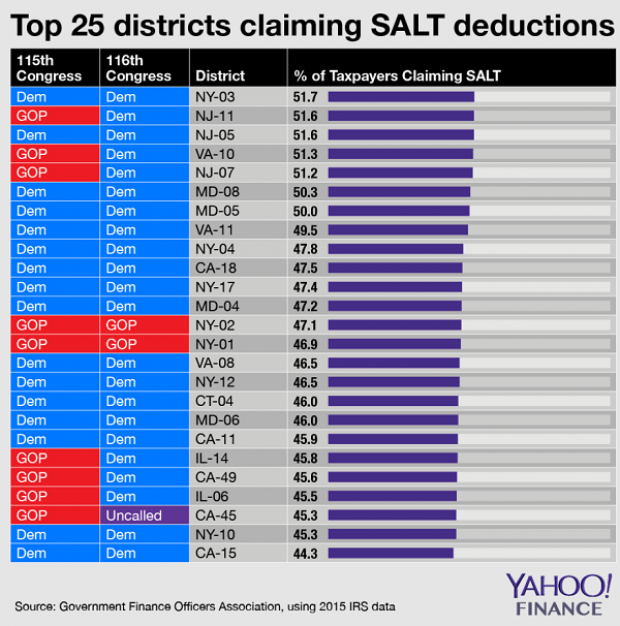

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

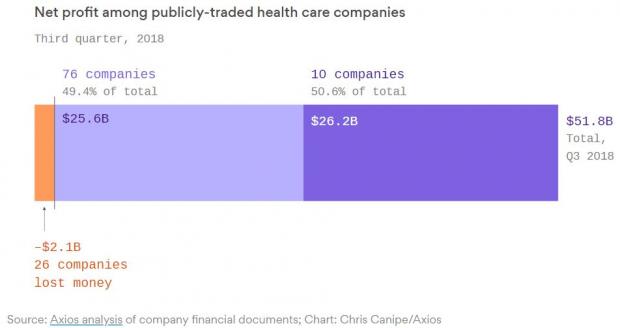

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

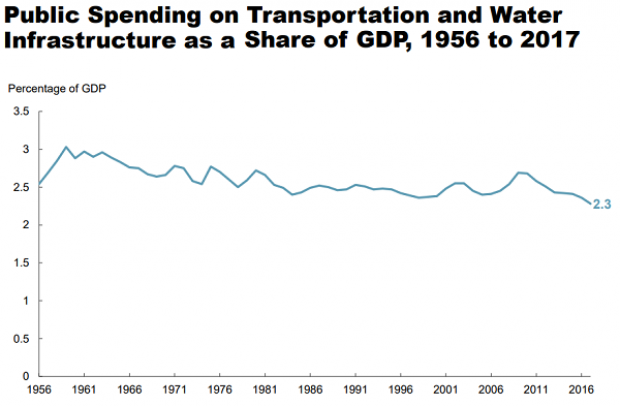

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.