The Hole Truth: Celebrating a Huge Day in Doughnut History

Whether you’re a Dunkin’ devotee or are crazy for Krispy Kremes, July 9 is a date you should celebrate.

On that date back in 1872, the doughnut took a big step toward becoming the billion-dollar business it is today: John F. Blondel of Thomaston, Maine received a patent for a “new and useful” improvement in doughnut-cutters that would speed the production and consumption of the humble pastry in the United States.

The device described in Patent No. 128,783 was intended to automate the process of cutting those dastardly doughnuts — holes and all — as efficiently as a hole punch. The desired edge could be plain or scalloped. This ingenious contraption would push the dough out of the center tube, leaving it free for making the next doughnut.

Related: Made in the USA: 24 Iconic American Foods

But as Art Cashin — the director of floor operations for UBS Financial Services who regularly sprinkles historical tidbits into his commentary — pointed out in a note Wednesday, before you can talk about Blondel’s doughnut innovation, you have to know the story of one Hanson Crockett Gregory, the young genius who forever changed what you and I get when we order our plain, glazed or chocolate with sprinkles. While the history of the doughnut is disputed, Gregory claimed to have invented “the first doughnut hole ever seen by mortal eyes” as a 16-year-old sailor on a lime-trading ship and then taught the technique to his mother, Elizabeth Gregory.

In case you’re still hungry for more doughnut history, this Friday, July 10, Krispy Kreme is celebrating its 78th birthday by offering a sticky sweet deal at participating locations: Buy any dozen doughnuts at regular price and get a second dozen for 78 cents.

Oh, and if you want to purchase those pesky doughnut holes that get unceremoniously shoved from the middle? You can buy those, too. They’re simply called Doughnut Holes, and they can be bought by cup or box in assorted flavors of Original Glazed, Dipped Chocolate, Powdered, Chocolate Cake, Blueberry Cake and Plain Glazed Cake.

Hanson Crockett Gregory would no doubt be amazed.

Coming Soon: Deductible Relief Day!

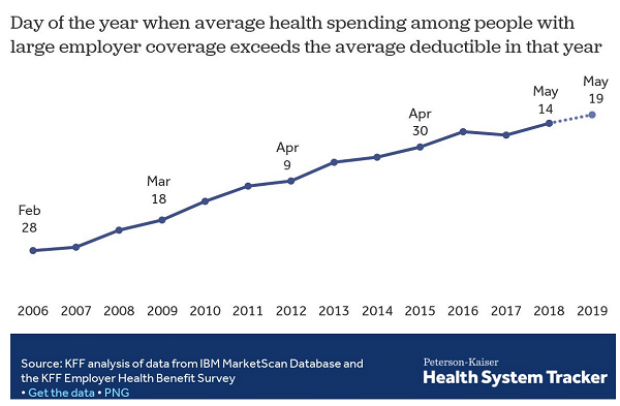

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

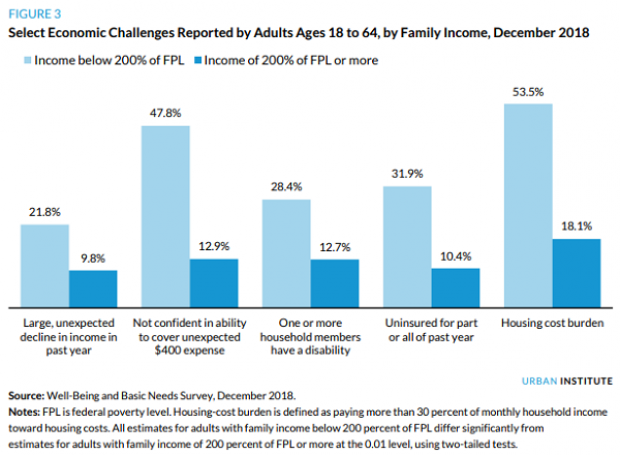

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

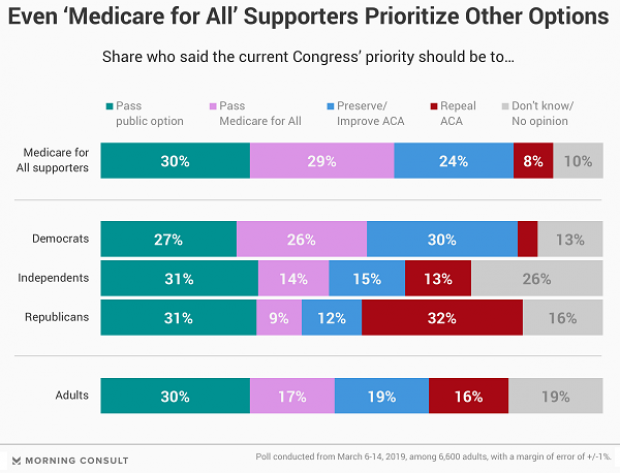

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

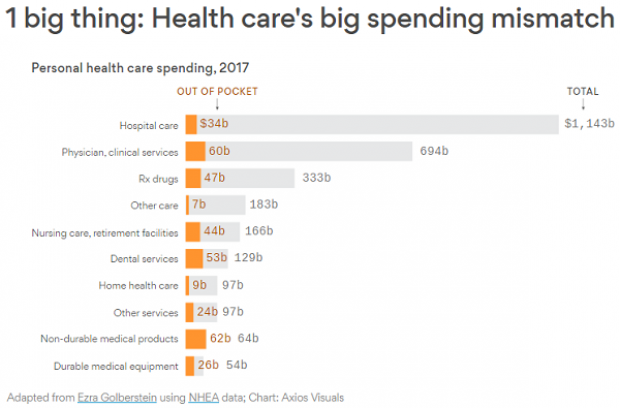

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.