Get Ready for Your 'Daily Glitch'—The NYSE, WSJ and United Were Just the Beginning

“Glitch” is clearly the word of the moment, after a series of pesky little technical problems forced United Airlines to ground flights, halted New York Stock Exchange trading and took down The Wall Street Journal website homepage all on the same day. If that wasn’t enough technical trouble, Seattle’s 911 system went down briefly. And a couple of NASA spacecraft also suffered “glitches” in recent days.

We deal routinely with glitches these days — a Wi-Fi connection goes down, an app freezes, a plug-in (usually Shockwave) stops responding, an email doesn’t load properly — which may help explain why, aside from lots of grumbling from delayed airline passengers, the reaction to Wednesday’s glitches was rather muted. The NYSE problems were reportedly caused by a “configuration issue” after a software update and United blamed its problem on “degraded network connectivity.” We see those issues every day, just not on as large a scale.

But that’s the problem.

At the risk of sounding like a high school term paper, let us note that the Merriam-Webster definition of glitch is “an unexpected and usually minor problem; especially: a minor problem with a machine or device (such as a computer).” The full definition describes it as a minor problem that causes a temporary setback.

Sure, Wednesday’s setbacks were all temporary. The Wall Street Journal site came back up quickly. Seattle’s 911 service was restored. Action on the NYSE itself was stopped for nearly four hours, but even then traders were still able to buy and sell NYSE-listed stocks on other exchanges. United grounded about 3,500 flights, which meant some people missed a wedding or a crucial business meeting. That will take time to sort out, but it will get sorted out.

In aggregate, though, the problems add up — and the word “glitch” only minimizes what can be much bigger, more serious issues..

Stock exchanges have suffered from a series of stoppage-causing glitches in recent years, pointing to the value of having trading spread across numerous exchanges. United’s tech breakdown “marked the latest in a series of airline delays and cancellations in the last few years that experts blame on massive, interconnected computer systems that lack sufficient staff and financial backing,” the Los Angeles Times reports. Just ask any of the roughly 400,000 United passengers whose travel plans were messed up if this was a little glitch. Or maybe check with the engineers who had to troubleshoot and rebuild the HealthCare.gov site after its glitch-laden launch.

It may be some relief that these latest outages weren’t the result of external attacks, but as sociologist Zeynep Tufecki, an assistant professor at the School of Information at the University of North Carolina, writes at The Message, “The big problem we face isn’t coordinated cyber-terrorism, it’s that software sucks. Software sucks for many reasons, all of which go deep, are entangled, and expensive to fix.”

These foul-ups are now mundane, and to some extent they may be inevitable as we rely more and more on complicated computer systems in every aspect of our lives. That’s the real issue, and it’s a lot bigger than a glitch.

Trump and Schumer Will Try to Scrap the Debt Ceiling

The president and the Senate Democratic leader agreed to seek out a more permanent debt ceiling solution that would end the perpetual cycle of fiscal standoffs. “There are a lot of good reasons to do that, so certainly that’s something that will be discussed," Trump said Thursday. It might not be easy, though, as conservatives see the borrowing limit as a way to keep government spending in check. Paul Ryan said Thursday he opposes doing away with the debt ceiling.

Is a Fix for Obamacare Taking Shape?

Senators on the Committee on Health, Education, Labor and Pensions heard from governors Thursday in the second of four scheduled hearings on stabilizing Obamacare. The common theme emerging from the testimony was flexibility: "Returning control to the states is prudent policy but also prudent politics," said Utah Gov. Gary Herbert, a Republican. He was joined by Democrat John Hickenlooper of Colorado, who said that states need room to innovate and learn from their mistakes. Much of what the governors said was in line with what the Senate panel is already considering, including the continuation of cost-sharing subsidies to insurance companies. (CBS News, Axios)

Senate Approves Trump's Deal with Dems. Will the House Go Along?

The Senate on Thursday voted to fund the government and increase the federal borrowing limit through December 8 as part of a deal that also included $15.25 billion in hurricane disaster relief funding and a short-term extension of the National Flood Insurance Program. The bill passed by a vote of 80-to-17, with only Republicans voting against the bill.

The package now goes back to the House, where it likely faces more strenuous resistance. The Republican Study Committee, a conservative caucus with more than 155 members, on Thursday announced it opposed the deal because it does not include spending cuts. Rep. Mark Walker, the group's chairman, sent a letter to House Speaker Paul Ryan listing 19 policy changes to "address the growing debt burden" or "begin draining the swamp" that could win conservative support for raising the debt ceiling. Some Democrats may also vote against the deal to signal their frustration with an agreement that they say weakened their hand in trying to protect undocumented immigrants who were brought into the country as children.

White House Backs Off Shutdown Threat…for Now

“Believe me, if we have to close down our government, we’re building that wall,” President Trump said of his planned border wall with Mexico 10 days ago. Just two days later, though, White House officials told Congress that a short-term spending bill to fund the government into December wouldn’t have to include $1.6 billion for the wall, The Washington Post reports.

Trump still wants money for the wall to be included in a December budget bill, and he could follow through on his shutdown threat at that point. For now, though, an agreement on a “continuing resolution” to keep the government running after September 30 seems likelier, allowing Congress to deal with some of the other pressing issues it faces this month.

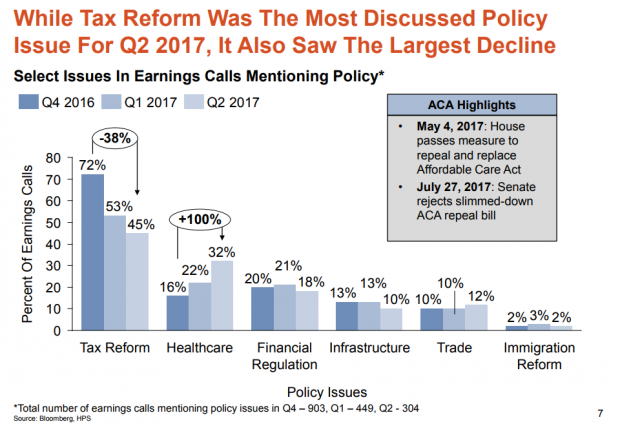

Which Trump Agenda Items Are Companies Talking About With Wall Street?

Hamilton Place Strategies, a public affairs consulting firm, analyzed transcripts of earnings calls by publicly traded U.S. companies over the last three quarters. They found that tax reform was the policy issue companies discussed most on those calls with Wall Street analysts — but that mentions of the subject dropped by 38 percent from the fourth quarter of 2016 to the second quarter of 2017. Overall, the percentage of earnings calls mentioning government or policy issues fell from 41 percent to 16 percent. Health-care reform saw the largest increase.

Does this mean that businesses have given up on tax reform this year? Perhaps. More likely, it's simply the result of a lack of action on the tax overhaul. Hamilton Place notes that mentions of tax policy peaked in February just after the Senate Finance Committee advanced Treasury Secretary Steven Mnuchin's nomination and have spiked after other tax-related announcements. So mentions of tax reform on earnings calls could surge again the fall.

One other note about what businesses have been discussing: Calls mentioning President Trump fell by 84 percent from January to late August.

08312017_HPS_Chart_of_the_day.PNG