Love Selfies? Now They Can Keep Your Credit Card Safe

MasterCard is appealing to America’s obsession with selfies in an effort to reduce credit card identity theft.

The credit card company is launching a new program that will allow consumers to approve online purchases with a facial scan. At the checkout page, you’ll be asked to take a picture of yourself using your phone instead of entering a password.

Currently, customers can stop hackers from using their credit card on the Web by setting up a “SecureCode,” which requires a password when shopping online. The password system was used in 3 billion transactions last year.

This fall MasterCard will launch a small pilot program involving 500 customers using fingerprints and facial scans. If the test is a success, the company plans on rolling it out publicly afterward. The company is also looking ahead to one day apply voice recognition technology.

To use the new selfie system, customers need to download the MasterCard phone app. Once you pay for something, a pop-up will appear asking for your authorization with either a fingerprint or facial recognition. Using facial recognition, customers stare at the phone, blink once — and bam! All done. The blink is a security measure so thieves can’t just hold up a photo of you. A fingerprint only requires a touch.

Passwords are easily forgotten, stolen or cracked, so the new system is a way to prove your identity using biometrics. Critics of the new system are uncomfortable that the photo or fingerprint a customer puts into his or her phone will transmit to the company’s computer servers. Cybersecurity experts worry the transfer of such information across devices is too big of a privacy risk.

MasterCard wasn’t the first company to develop a facial recognition app — Chinese shopping brand Alibaba demonstrated one in March, but had to postpone the technology’s launch because of security risks found by China’s central bank and police ministry.

The 10 Worst States to Have a Baby

The birth rate in the U.S. is finally seeing an uptick after falling during the recession. Births tend to fall during hard economic times because having a baby and raising a child are expensive propositions.

Costs are not the same everywhere, though. Some states are better than others for family budgets, and health care quality varies widely from place to place.

A new report from WalletHub looks at the cost of delivering a baby in the 50 states and the District of Columbia, as well as overall health care quality and the general “baby-friendliness” of each state – a mix of variables including average birth weights, pollution levels and the availability of child care.

Mississippi ranks as the worst state to have a baby, despite having the lowest average infant-care costs in the nation. Unfortunately, the Magnolia State also has the highest rate of infant deaths and one of lowest numbers of pediatricians per capita.

Related: Which States Have the Most Unwanted Babies?

On the other end of the scale, Vermont ranks as the best state for having a baby. Vermont has both the highest number of pediatricians and the highest number of child centers per capita. But before packing your bags, it’s worth considering the frigid winters in the Green Mountain State and the amount of money you’ll need to spend on winter clothing and heat.

Here are the 10 worst and 10 best states for having a baby:

Top 10 Worst States to Have a Baby

1. Mississippi

- Budget Rank: 18

- Health Care Rank: 51

- Baby Friendly Environment Rank: 29

2. Pennsylvania

- Budget Rank: 37

- Health Care Rank: 36

- Baby Friendly Environment Rank: 51

3. West Virginia

- Budget Rank: 13

- Health Care Rank: 48

- Baby Friendly Environment Rank: 50

4. South Carolina

- Budget Rank: 22

- Health Care Rank: 43

- Baby Friendly Environment Rank: 49

5. Nevada

- Budget Rank: 39

- Health Care Rank: 35

- Baby Friendly Environment Rank: 46

6. New York

- Budget Rank: 46

- Health Care Rank: 12

- Baby Friendly Environment Rank: 47

7. Louisiana

- Budget Rank: 8

- Health Care Rank: 50

- Baby Friendly Environment Rank: 26

8. Georgia

- Budget Rank: 6

- Health Care Rank: 46

- Baby Friendly Environment Rank: 43

9. Alabama

- Budget Rank: 3

- Health Care Rank: 47

- Baby Friendly Environment Rank: 44

10. Arkansas

- Budget Rank: 12

- Health Care Rank: 49

- Baby Friendly Environment Rank: 37

Top 10 Best States to Have a Baby

1. Vermont

- Budget Ranks: 17

- Health Care Rank: 1

- Baby Friendly Environment Rank: 5

2. North Dakota

- Budget Rank: 10

- Health Care Rank: 14

- Baby Friendly Environment Rank: 10

3. Oregon

- Budget Rank: 38

- Health Care Rank: 2

- Baby Friendly Environment Rank: 14

4. Hawaii

- Budget Rank: 31

- Health Care Rank: 25

- Baby Friendly Environment Rank: 1

5. Minnesota

- Budget Rank: 32

- Health Care Rank: 5

- Baby Friendly Environment Rank: 12

6. Kentucky

- Budget Rank: 1

- Health Care Rank: 33

- Baby Friendly Environment Rank: 20

7. Maine

- Budget Rank: 25

- Health Care Rank: 10

- Baby Friendly Environment Rank: 15

8. Wyoming

- Budget Rank: 22

- Health Care Rank: 17

- Baby Friendly Environment Rank: 7

9. Iowa

- Budget Rank: 14

- Health Care Rank: 25

- Baby Friendly Environment Rank: 9

10. Alaska

- Budget Rank: 50

- Health Care Rank: 6

- Baby Friendly Environment Rank: 2

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Americans Are About to Get a Nice Fat Pay Raise

- You’re Richer Than You Think. Really.

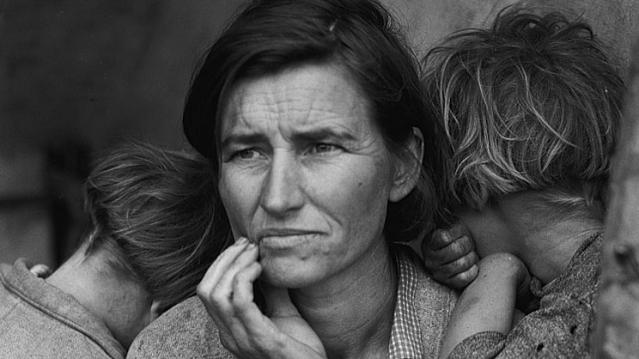

Worried About a Recession? Here’s When the Next Slump Will Hit

The next recession may be coming sooner than you think.

Eleven of the 31 economists recently surveyed by Bloomberg believed the American recession would hit in 2018, and all but two of them expected the recession to begin within the next five years.

If the recession begins in 2018, the expansion would have lasted nine years, making it the second-longest period of growth in U.S. history after the decade-long expansion that ended when the tech bubble burst in 2001. This average postwar expansion averages about five years.

The recent turmoil in the stock market and the slowdown in China has more investors and analysts using the “R-word,” but the economists surveyed by Bloomberg think we have a bit of time. They pegged the chance of recession over the next 12 months to just 10 percent.

Related: Stocks Are Sending a Recession Warning

While economists talk about the next official recession, many average Americans feel like they’re still climbing out of the last one. In a data brief released last week, the National Employment Law Project found that wages have declined since 2009 for most U.S. workers, when factoring in cost of living increases.

A full jobs recovery is at least two years away, according to an analysis by economist Elise Gould with the Economic Policy Institute. “Wage growth needs to be stronger—and consistently strong for a solid spell—before we can call this a healthy economy,” she wrote in a recent blog post.

Top Reads from The Fiscal Times:

- This CEO Makes 1,951 Times More Than Most of His Workers

- Seven Reasons Why the Fed Won’t Hike Interest Rates

- $42 Million for 54 Recruits: U.S. Program to Train Syrian Rebels Is a Disaster