They’re Leaving Las Vegas: Fewer I Do’s in Last Decade

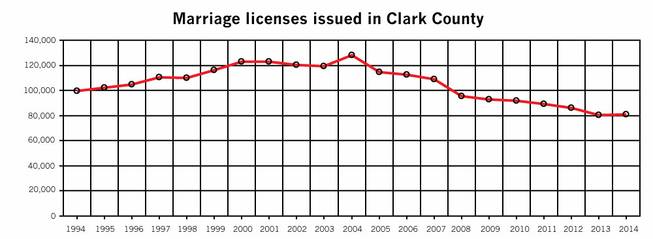

When it comes to destination weddings, Las Vegas has lost that loving feeling. The Las Vegas Sun reports that the wedding rate in Sin City has plummeted 37 percent in the past decade—nearly 47,000 fewer couples got married in 2014 than in 2004.

By comparison, 2004 was a boom year for weddings in Sin City. There were 128,000 weddings that year—including Britney Spears’ 55-hour marriage to Jason Allen Alexander at A Little White Wedding Chapel.

Related: Marriage?? Young Americans Aren’t Even Shacking Up

Who knows why gambling on love in Sin City has become a losing bet? Perhaps the dip reflects a national trend of millennials waiting to tie the knot or choosing to stay single. The marriage rate in the U.S. neared a record low in 2015 and is expected to drop further in 2016. Then there’s the expense. According to the TheKnot, the average wedding cost (excluding the honeymoon) is $31,213, with many couples looking for more unusual venues.

Clark County Clerk Lynn Goya, who took office in January, wants to change that trend in Vegas. The current fee for a marriage license in Las Vegas is $60, but Goya is asking for a $14 increase in the cost of wedding licenses to support marketing efforts targeting engaged couples. Last year 81,000 weddings happened in Las Vegas—and she’s hoping that wedding vow renewals and gay weddings will help boost those numbers even more. In New York, the legalization of gay marriage in 2011 led to an estimated $259 million in spending and $16 million in revenues for New York City.

Related: The $2.6 Billion Gay Wedding Boom

Then again it may be hard for Las Vegas to shake that quickie, drive-thru wedding image. Sin City has always had an illustrious history of celebrity weddings, with many more misses than hits: Cher’s nine-day union to rocker Gregg Allman in 1975, Mia Farrow and Frank Sinatra in 1966, Demi Moore and Bruce Willis in 1987, Richard Gere and Cindy Crawford in 1991, and Angelina Jolie and Billy Bob Thornton in 2000. On the bright side, there’s Paul Newman and Joanne Woodward’s marriage, which endured for 50 years, Jon Bon Jovi and his wife, Dorothea’s 1987 wedding day, and Kelly Ripa and Mark Consuelo’s union from 1996, which is still standing.

Small Business Owners Say They’re Raising Worker Pay

A record percentage of small business owners say they are raising pay for their workers, according to the latest monthly jobs report from the National Federation of Independent Business, based on a survey of 10,000 of the group’s members. A seasonally adjusted net 35 percent of small businesses say they are increasing compensation. “They are increasing compensation at record levels and are continuing to hire,” NFIB President and CEO Juanita Duggan said in a statement accompanying the report. “Post tax reform, concerns about taxes and regulations are taking a backseat to their worries over filling open positions and finding qualified candidates.”

The US Is Running Short on More Than 200 Drugs

The U.S. is officially running short on 202 drugs, including some medical staples like epinephrine, morphine and saline solution. “The medications most vulnerable to running short have a few things in common: They are generic, high-volume, and low-margin for their makers—not the cutting-edge specialty drugs that pad pharmaceutical companies’ bottom lines,” Fortune’s Erika Fry reports. “Companies have little incentive to make the workhorse drugs we use most.” And much of the problem — “The situation is an emergency waiting to be a disaster,” one pharmacist says — can be tied to one company: Pfizer. Read the full story here.

Chart of the Day: Could You Handle a Sudden $400 Expense?

More Americans say they are living comfortably or at least “doing okay” financially, according to the Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2017. At the same time, four in 10 adults say that, if faced with an unexpected expense of $400, they would not be able to cover it or would cover it by selling something or borrowing money. That represents an improvement from 2013, when half of all adults said they would have trouble handling such an expense, but suggests that many Americans are still close to the edge when it comes to their personal finances.

Kevin Brady Introduces Welfare Reform Bill

The Tax Policy Center’s Daily Deduction reports that Rep. Kevin Brady (R-TX), chair of the House Ways and Means Committee on Friday introduced The Jobs and Opportunity with Benefits and Services (JOBS) for Success Act (H.R. 5861). “The bill would rename the Temporary Assistance for Needy Families (TANF) program and target benefits to the lowest-income households. Although the House GOP leadership promised to include an expansion of the Earned Income Tax Credit as part of an upcoming welfare reform bill, this measure does not appear to include any EITC provisions.” The committee will mark up the bill on Wednesday.