They’re Leaving Las Vegas: Fewer I Do’s in Last Decade

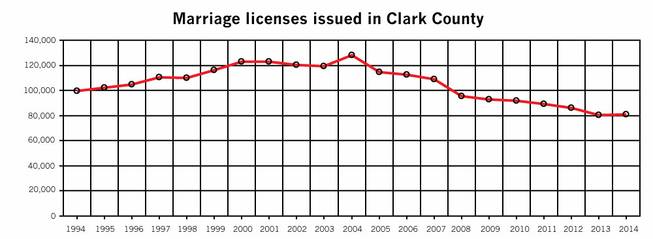

When it comes to destination weddings, Las Vegas has lost that loving feeling. The Las Vegas Sun reports that the wedding rate in Sin City has plummeted 37 percent in the past decade—nearly 47,000 fewer couples got married in 2014 than in 2004.

By comparison, 2004 was a boom year for weddings in Sin City. There were 128,000 weddings that year—including Britney Spears’ 55-hour marriage to Jason Allen Alexander at A Little White Wedding Chapel.

Related: Marriage?? Young Americans Aren’t Even Shacking Up

Who knows why gambling on love in Sin City has become a losing bet? Perhaps the dip reflects a national trend of millennials waiting to tie the knot or choosing to stay single. The marriage rate in the U.S. neared a record low in 2015 and is expected to drop further in 2016. Then there’s the expense. According to the TheKnot, the average wedding cost (excluding the honeymoon) is $31,213, with many couples looking for more unusual venues.

Clark County Clerk Lynn Goya, who took office in January, wants to change that trend in Vegas. The current fee for a marriage license in Las Vegas is $60, but Goya is asking for a $14 increase in the cost of wedding licenses to support marketing efforts targeting engaged couples. Last year 81,000 weddings happened in Las Vegas—and she’s hoping that wedding vow renewals and gay weddings will help boost those numbers even more. In New York, the legalization of gay marriage in 2011 led to an estimated $259 million in spending and $16 million in revenues for New York City.

Related: The $2.6 Billion Gay Wedding Boom

Then again it may be hard for Las Vegas to shake that quickie, drive-thru wedding image. Sin City has always had an illustrious history of celebrity weddings, with many more misses than hits: Cher’s nine-day union to rocker Gregg Allman in 1975, Mia Farrow and Frank Sinatra in 1966, Demi Moore and Bruce Willis in 1987, Richard Gere and Cindy Crawford in 1991, and Angelina Jolie and Billy Bob Thornton in 2000. On the bright side, there’s Paul Newman and Joanne Woodward’s marriage, which endured for 50 years, Jon Bon Jovi and his wife, Dorothea’s 1987 wedding day, and Kelly Ripa and Mark Consuelo’s union from 1996, which is still standing.

Marco Rubio Says There’s No Proof Tax Cuts Are Helping American Workers

Sen. Marco Rubio (R-FL) told The Economist that his party’s defense of the massive tax cuts passed last year may be off base: “There is still a lot of thinking on the right that if big corporations are happy, they’re going to take the money they’re saving and reinvest it in American workers,” Rubio said. “In fact they bought back shares, a few gave out bonuses; there’s no evidence whatsoever that the money’s been massively poured back into the American worker.”

For Richer or Poorer: An Updated Marriage Bonus and Penalty Calculator

The Tax Policy Center has updated its Marriage Bonus and Penalty Calculator for 2018, including the new GOP-passed tax law. The tool lets users calculate the difference in income taxes a couple would owe if filing as married or separately. “Most couples will pay lower income taxes after they are married than they would as two separate taxpayers (a marriage bonus), but some will pay a marriage penalty," TPC’s Daniel Berger writes. “Typically, couples with similar incomes will be hit with a penalty while those where one spouse earns significantly more than the other will almost always get a bonus for walking down the aisle.”

Trump Administration Wants to Raise the Rent

Housing and Urban Development Secretary Ben Carson will propose increasing the rent obligation for low-income households receiving federal housing subsidies, as well as creating new work requirements for subsidy recipients. Some details via The Washington Post: “Currently, tenants generally pay 30 percent of their adjusted income toward rent or a public housing agency minimum rent not to exceed $50. The administration’s legislative proposal sets the family monthly rent contribution at 35 percent of gross income or 35 percent of their earnings by working 15 hours a week at the federal minimum wage -- or approximately $150 a month, three times higher than the current minimum.” (The Washington Post)

New Push for Capital Gains Tax Cut

Anti-tax activists in Washington are renewing their pressure on lawmakers to pass new legislation indexing capital gains taxes to inflation. The Hill provided an example of such indexing that Grover Norquist recently sent to Treasury Secretary Steven Mnuchin: “Under current policy, someone who made an investment of $1,000 in 2000 and sold it for $2,000 in 2017 would pay capital gains taxes on the $1,000 difference. But if capital gains were indexed, the investor would only pay taxes on $579, since $1,000 in 2000 would be equivalent to $1,421 in 2017 after adjusting for inflation.” Proponents of indexing say it’s just a matter of fairness, but critics claim that it would be just another regressive tax cut for the wealthy. Indexing would cost an estimated $10 billion a year in lost revenues. (The Hill)

Bernie Sanders to Propose Plan Guaranteeing a Job for Every American

Sen. Bernie Sanders (I-VT) is preparing to announce a plan for the federal government to guarantee a job paying $15 an hour and providing health-care benefits to every American “who wants one or needs one.” The jobs would be on government projects in areas such as infrastructure, care giving, the environment and education. The proposal is still being crafted, and Sanders’ representative said his office had not yet come up with a cost estimate or funding plan. Sen. Kirsten Gillibrand (D-NY) last week tweeted support for a federal jobs guarantee, but Republicans have long opposed such proposals, saying they would cost too much. (Washington Post)