Hackers’ Delight: 1 Million Miles for Reporting United Airlines Security Flaws

Now here’s a rewards program Julian Assange could love. United Airlines has confirmed that it paid 1 million frequent flier miles each to two hackers who found serious flaws and security breaches in its computer systems.

Related: Millions of Samsung Galaxy Phones May Be Vulnerable to Hackers

This past May, United started a “bug bounty” program to find loopholes in its security, but it’s hardly the first corporate entity to do so. Google, Facebook and Yahoo all offer rewards or incentives to hackers who report bugs to them privately. Netscape engineer Jarrett Ridlinghafer is largely credited with coming up with the concept of rewarding good, or “white hat,” hackers for trouble-shooting in 1995.

Jordan Wiens, founder of cybersecurity company Vector 35, was one of two winners to claim a million airline miles for his prize. He posted a screenshot of his mileage account on Twitter. (He submitted the bug on May 15, got a response on May 19, a validation notice on June 24 and then the payout on July 10.) A second bug he reported won a lesser prize of 250,000 miles. Kyle Lovett from Montgomery, Calif., was the other million-mile winner. Lovett Tweeted that he will use some of the miles to fly out his mother and brother to California.

Wow! @united really paid out! Got a million miles for my bug bounty submissions! Very cool. pic.twitter.com/CEclmhmyUq

— Jordan Wiens (@psifertex) July 10, 2015

No doubt the airline saved a ton of money in preventing computer issues. In recent months United has had to ground it flights twice as a result of computer system glitches. On June 2, an automation issue affected 150 flights, or 8 percent of its morning schedule. On July 8, a network connectivity issue due to a router malfunction locked up its reservations system and grounded thousands of flights worldwide.

Looks like the airline has more miles to dole out, too: Twitter was full of happy pronouncement from hackers claiming smaller prizes and begging Delta to do the same.

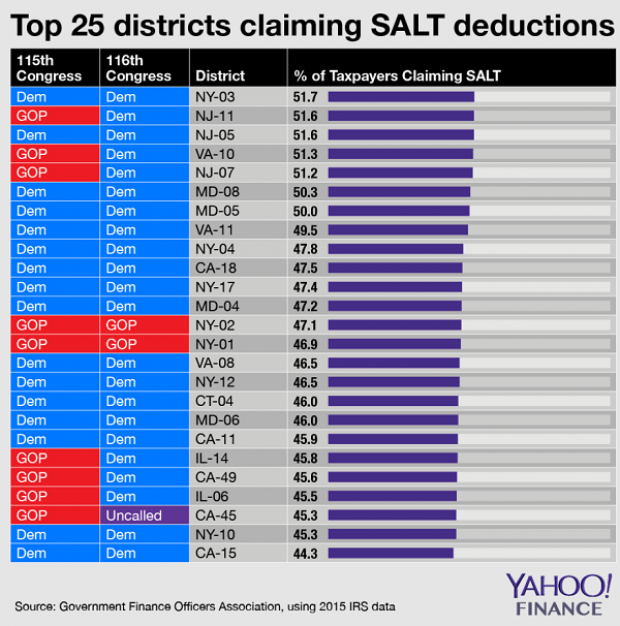

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

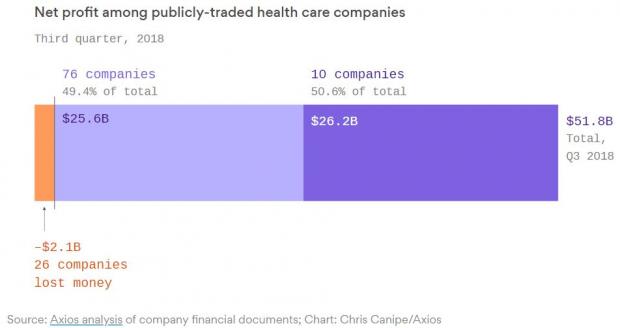

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

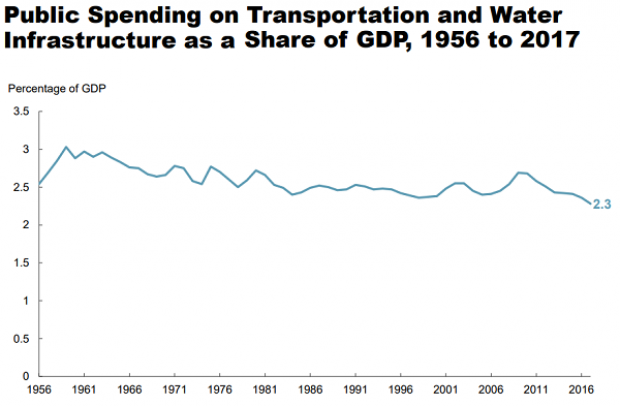

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.