After Hanging Back, Cameron Vows to Escalate Air Strikes Against ISIS

After losing a crucial 2013 parliamentary vote authorizing military force in Syria, Prime Minister David Cameron noticeably pulled Great Britain back from global affairs, effectively allowing other countries to address Russia’s invasion of Ukraine and the alarming growth in strength of ISIS.

Last January, President Obama reportedly told Cameron that Britain must adhere to its military spending commitment to NATO or set a damaging example to its European allies. Obama and other U.S. military officials have said that Britain’s failure to hit a military spending target of two percent of its Gross Domestic Product would be a serious blow to the military alliance.

Related: Britain Hangs Back As the U.S. Pays $2.2 Billion to Fight ISIS

In an about-face, Cameron on Sunday said he hopes to step up his country’s role in the allied air campaign against ISIS while also adopting new tough measures at home to try to stem the rise of jihadist activities.

In an interview with NBC’s Meet the Press, Cameron said talks were underway in Parliament about what more can be done to allow his country to take part in the U.S. led campaign against ISIS in Syria, as well as in Iraq.

Cameron’s Conservative Party won a surprisingly resounding reelection victory in May, and since then he has been talking about the need for Britain to step up to the plate more in helping the U.S. and other allies halt the spread of ISIS throughout the Middle East and North Africa. Although Parliament in 2013 rejected air strikes against ISIS in Syria, media reports last week revealed that British pilots embedded with coalition forces have been taking part in operations in Syria.

"In Syria we're helping not just with logistics, but surveillance and air-to-air refueling,” Cameron confirmed yesterday. “But we know we have to defeat ISIS, we have to destroy this caliphate whether it is in Iraq or in Syria--that is a key part of defeating this terrorist scourge that we face. I want Britain to do more. I'll always have to take my parliament with me," said Cameron.

Related: Why America’s War with ISIS Will Take Years

Cameron was expected to announce a five-year plan for fighting the terrorist group on Monday, according to The Sunday Times.

"I want to work very closely with President Obama, with other allies,” Cameron said. “Britain is now committed to its NATO two per cent defense spending target all the way through this decade. We've already carried out more air strikes in Iraq than anyone else other than the U.S., but I want us to step up and do more, what I call a full spectrum response,” he said on Meet the Press.”

Until recently, Cameron has sought to steer his country on a centrist path that included tough austerity measures and a dramatic scaling back of the United Kingdom’s military presence overseas. Those policies were only reinforced by Cameron’s strong showing at the polls.

Since the Great Recession, the British Army lost fully 20 percent of its troops--from 102,000 to 82,000 since 2010.

Related: How ISIS Could Drag the U.S. into a Ground Fight

British aircraft and unmanned drones have been used to attack ISIS emplacements in Iraq with more than 200 bombs and missiles, according to a recent report by The Guardian. ISIS targets included 20 buildings, at least two containers and 65 trucks. As the Guardian noted, British air operations are a small fraction of those carried out by U.S. aircraft and drones, which have struck more than 6,000 targets as part of Operation Inherent Resolve, according to recent Pentagon figures.

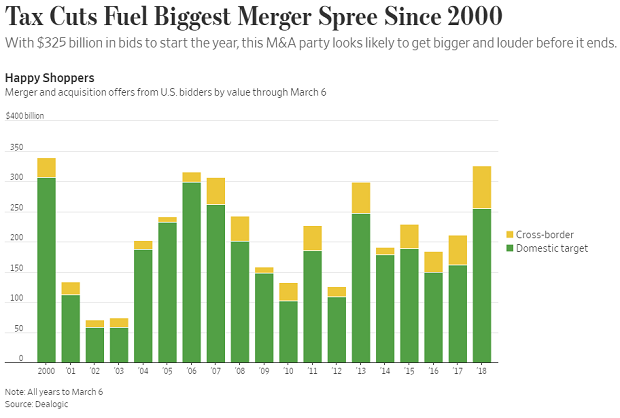

Chart of the Day: A Buying Binge Driven by Tax Cuts

The Wall Street Journal reports that the tax cuts and economic environment are prompting U.S. companies to go on a buying binge: “Mergers and acquisitions announced by U.S. acquirers so far in 2018 are running at the highest dollar volume since the first two months of 2000, according to Dealogic. Thomson Reuters, which publishes slightly different numbers, puts it at the highest since the start of 2007.”

Number of the Day: 5.5 Percent

Health care spending in the U.S. will grow at an average annual rate of 5.5 percent from 2017 through 2026, according to new estimates published in Health Affairs by the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS).

The projections mean that health care spending would rise as a share of the economy from 17.9 percent in 2016 to 19.7 percent in 2026.

Trump Clearly Has No Problem with Debt and Deficits

A self-proclaimed “king of debt,” President Trump has produced a budget that promises red ink as far as the eye can see. With last year's $1.5 trillion tax cut reducing revenues, the White House gave up even trying to pretend that its budget would balance anytime soon, and even the rosy economic projections contained in the budget couldn’t produce enough revenues, however fanciful, to cover the shortfall.

The Trump budget spends as much over 10 years as any budget produced by President Barack Obama, according to Jim Tankersley of The New York Times. And it projects total deficits of more than $7 trillion over the next decade — "a number that could double if the administration turns out to be overestimating economic growth and if the $3 trillion in spending cuts the White House has floated do not materialize in Congress,” Tankersley says.

Trump — who once promised to both balance the budget and pay down the national debt — isn’t the only one throwing off the shackles of fiscal restraint. Republicans as a whole appear to be embracing a new set of economic preferences defined by lower taxes and higher spending, in what Bloomberg describes as a “striking turnabout” in attitudes toward deficits and the national debt.

But some conservatives tell Tankersley that the GOP's core beliefs on spending and debt remain intact — and that spending on Social Security and Medicare, the primary drivers of the national debt, are all that matters when it comes to implementing fiscal restraint.

“They know that right now, a fundamental reform of entitlements won’t happen," John H. Cochrane, an economist at Stanford University’s Hoover Institution, tells Tankersley. "So, they have avoided weekly chaos and gotten needed military spending through by opening the spending bill, and they got an important reduction in growth-distorting marginal corporate rates through by accepting a bit more deficits. They know that can’t be the end of the story.”

Democrats, of course, have warned that the next chapter in the tale will involve big cuts to Social Security and Medicare. Even before we get there, though, Tankersley questions whether the GOP approach stands up to scrutiny: "This is a bit like saying, only regular exercise will keep America from having a fatal heart attack, so, you know, it's ok to eat a few more hamburgers now."

Part of the Shutdown-Ending Deal: $31 Billion More in Tax Cuts

Margot Sanger-Katz and Jim Tankersley in The New York Times: “The deal struck by Democrats and Republicans on Monday to end a brief government shutdown contains $31 billion in tax cuts, including a temporary delay in implementing three health care-related taxes.”

“Those delays, which enjoy varying degrees of bipartisan support, are not offset by any spending cuts or tax increases, and thus will add to a federal budget deficit that is already projected to increase rapidly as last year’s mammoth new tax law takes effect.”

IRS Paid $20 Million to Collect $6.7 Million in Tax Debts

Congress passed a law in 2015 requiring the IRS to use private debt collection agencies to pursue “inactive tax receivables,” but the financial results are not encouraging so far, according to a new taxpayer advocate report out Wednesday.

In fiscal year 2017, the IRS received $6.7 million from taxpayers whose debts were assigned to private collection agencies, but the agencies were paid $20 million – “three times the amount collected,” the report helpfully points out.

Like what you're reading? Sign up for our free newsletter.