After Hanging Back, Cameron Vows to Escalate Air Strikes Against ISIS

After losing a crucial 2013 parliamentary vote authorizing military force in Syria, Prime Minister David Cameron noticeably pulled Great Britain back from global affairs, effectively allowing other countries to address Russia’s invasion of Ukraine and the alarming growth in strength of ISIS.

Last January, President Obama reportedly told Cameron that Britain must adhere to its military spending commitment to NATO or set a damaging example to its European allies. Obama and other U.S. military officials have said that Britain’s failure to hit a military spending target of two percent of its Gross Domestic Product would be a serious blow to the military alliance.

Related: Britain Hangs Back As the U.S. Pays $2.2 Billion to Fight ISIS

In an about-face, Cameron on Sunday said he hopes to step up his country’s role in the allied air campaign against ISIS while also adopting new tough measures at home to try to stem the rise of jihadist activities.

In an interview with NBC’s Meet the Press, Cameron said talks were underway in Parliament about what more can be done to allow his country to take part in the U.S. led campaign against ISIS in Syria, as well as in Iraq.

Cameron’s Conservative Party won a surprisingly resounding reelection victory in May, and since then he has been talking about the need for Britain to step up to the plate more in helping the U.S. and other allies halt the spread of ISIS throughout the Middle East and North Africa. Although Parliament in 2013 rejected air strikes against ISIS in Syria, media reports last week revealed that British pilots embedded with coalition forces have been taking part in operations in Syria.

"In Syria we're helping not just with logistics, but surveillance and air-to-air refueling,” Cameron confirmed yesterday. “But we know we have to defeat ISIS, we have to destroy this caliphate whether it is in Iraq or in Syria--that is a key part of defeating this terrorist scourge that we face. I want Britain to do more. I'll always have to take my parliament with me," said Cameron.

Related: Why America’s War with ISIS Will Take Years

Cameron was expected to announce a five-year plan for fighting the terrorist group on Monday, according to The Sunday Times.

"I want to work very closely with President Obama, with other allies,” Cameron said. “Britain is now committed to its NATO two per cent defense spending target all the way through this decade. We've already carried out more air strikes in Iraq than anyone else other than the U.S., but I want us to step up and do more, what I call a full spectrum response,” he said on Meet the Press.”

Until recently, Cameron has sought to steer his country on a centrist path that included tough austerity measures and a dramatic scaling back of the United Kingdom’s military presence overseas. Those policies were only reinforced by Cameron’s strong showing at the polls.

Since the Great Recession, the British Army lost fully 20 percent of its troops--from 102,000 to 82,000 since 2010.

Related: How ISIS Could Drag the U.S. into a Ground Fight

British aircraft and unmanned drones have been used to attack ISIS emplacements in Iraq with more than 200 bombs and missiles, according to a recent report by The Guardian. ISIS targets included 20 buildings, at least two containers and 65 trucks. As the Guardian noted, British air operations are a small fraction of those carried out by U.S. aircraft and drones, which have struck more than 6,000 targets as part of Operation Inherent Resolve, according to recent Pentagon figures.

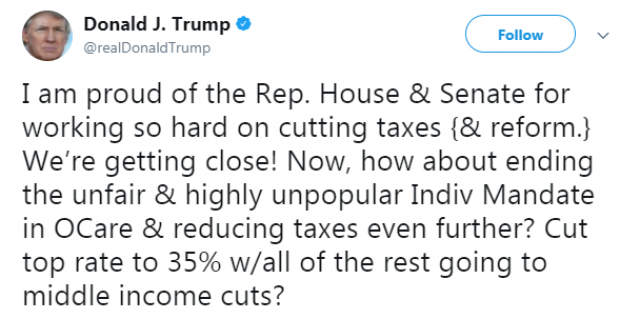

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.