After Hanging Back, Cameron Vows to Escalate Air Strikes Against ISIS

After losing a crucial 2013 parliamentary vote authorizing military force in Syria, Prime Minister David Cameron noticeably pulled Great Britain back from global affairs, effectively allowing other countries to address Russia’s invasion of Ukraine and the alarming growth in strength of ISIS.

Last January, President Obama reportedly told Cameron that Britain must adhere to its military spending commitment to NATO or set a damaging example to its European allies. Obama and other U.S. military officials have said that Britain’s failure to hit a military spending target of two percent of its Gross Domestic Product would be a serious blow to the military alliance.

Related: Britain Hangs Back As the U.S. Pays $2.2 Billion to Fight ISIS

In an about-face, Cameron on Sunday said he hopes to step up his country’s role in the allied air campaign against ISIS while also adopting new tough measures at home to try to stem the rise of jihadist activities.

In an interview with NBC’s Meet the Press, Cameron said talks were underway in Parliament about what more can be done to allow his country to take part in the U.S. led campaign against ISIS in Syria, as well as in Iraq.

Cameron’s Conservative Party won a surprisingly resounding reelection victory in May, and since then he has been talking about the need for Britain to step up to the plate more in helping the U.S. and other allies halt the spread of ISIS throughout the Middle East and North Africa. Although Parliament in 2013 rejected air strikes against ISIS in Syria, media reports last week revealed that British pilots embedded with coalition forces have been taking part in operations in Syria.

"In Syria we're helping not just with logistics, but surveillance and air-to-air refueling,” Cameron confirmed yesterday. “But we know we have to defeat ISIS, we have to destroy this caliphate whether it is in Iraq or in Syria--that is a key part of defeating this terrorist scourge that we face. I want Britain to do more. I'll always have to take my parliament with me," said Cameron.

Related: Why America’s War with ISIS Will Take Years

Cameron was expected to announce a five-year plan for fighting the terrorist group on Monday, according to The Sunday Times.

"I want to work very closely with President Obama, with other allies,” Cameron said. “Britain is now committed to its NATO two per cent defense spending target all the way through this decade. We've already carried out more air strikes in Iraq than anyone else other than the U.S., but I want us to step up and do more, what I call a full spectrum response,” he said on Meet the Press.”

Until recently, Cameron has sought to steer his country on a centrist path that included tough austerity measures and a dramatic scaling back of the United Kingdom’s military presence overseas. Those policies were only reinforced by Cameron’s strong showing at the polls.

Since the Great Recession, the British Army lost fully 20 percent of its troops--from 102,000 to 82,000 since 2010.

Related: How ISIS Could Drag the U.S. into a Ground Fight

British aircraft and unmanned drones have been used to attack ISIS emplacements in Iraq with more than 200 bombs and missiles, according to a recent report by The Guardian. ISIS targets included 20 buildings, at least two containers and 65 trucks. As the Guardian noted, British air operations are a small fraction of those carried out by U.S. aircraft and drones, which have struck more than 6,000 targets as part of Operation Inherent Resolve, according to recent Pentagon figures.

Coming Soon: Deductible Relief Day!

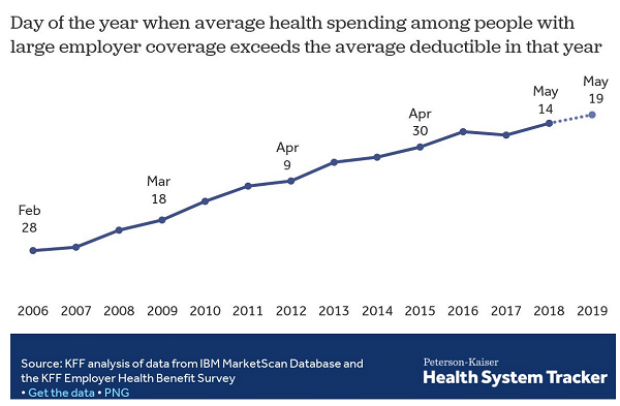

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

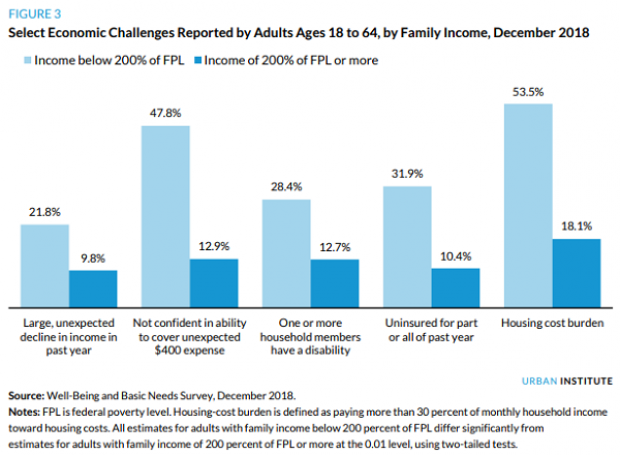

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

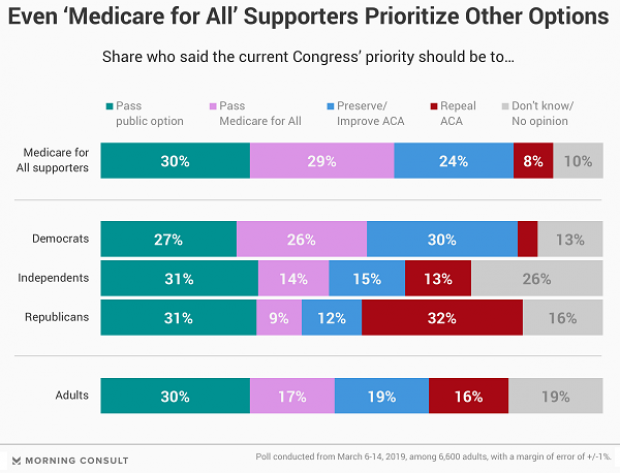

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

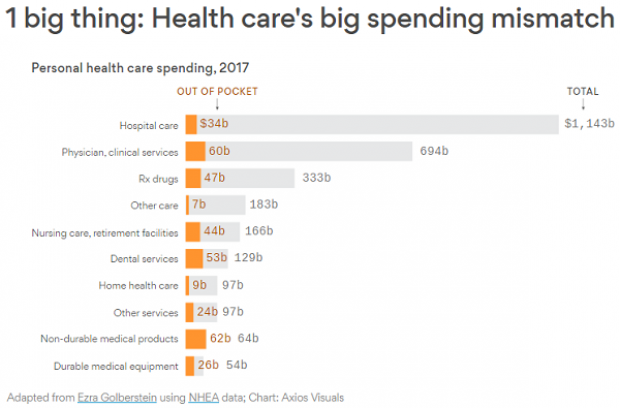

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.