Why You Should Shop Around for Car Insurance Right Now

If you haven’t shopped for auto insurance recently, you might want to spend an hour or so checking out other deals. It pays to review your policy and check what’s out there.

A new survey from insuranceQuotes.com shows that 66 percent of policyholders never or only rarely check to see if they could get the same or better coverage at a better price. The average American driver has been with the same auto insurance company for 12 years, and some have stayed with the same insurer for two to three decades, or longer.

Related: 5 Ways to Lower Your Car Insurance—Right Now

Millennials age 18 to 29 and senior citizens number among those least likely to shop around for auto insurance. At least six in 10 millennials with auto insurance assume you have to wait until your renewal date to switch insurance companies. And they’re not alone: 46 percent of Americans do not know that you can switch your auto insurance company at any time.

One of the reasons auto insurance may not be a priority for consumers? Auto pay options, while convenient, could be keeping car insurance payments and rates out of sight—and out of mind. Human nature and procrastination is another. “People think that it’s a task that might be difficult and time-consuming,” says senior analyst Laura Adams, “but it could be as simple as going to a website like insurancequotes.com, putting your information in for a free quote, and getting multiple quotes back. There’s no financial risk in looking for a new rate.”

Just spending an hour once a year to compare quotes from three different companies could potentially save you hundreds or thousands of dollars.

Related: A Quick Way to Save Big on Your Insurance

Experts suggest checking your car insurance rates the same way you would remember to change the oil in your car or swap the air filters in your home. Here are some tips to get started:

- Ask your current insurer if there are any company discounts you might be eligible for but don’t know about, such as the good-student discount. For college and grad students who have a B-average or better (or their parents) that could result in a significant discount.

- If you find a better deal, tell your current insurance company that you’re thinking of switching unless they can match the new offer or exceed it.

- If your current insurer refuses to negotiate, sign up for the new policy first—and then cancel the old one. “You always want to make sure you’re covered,” says Evans. “Insurance companies do not like to see a gap in coverage, and your rates could rise.”

- To get a wider variety of quotes, get online quotes from insurance company websites, consult with an independent agent, and look into companies that don’t use independent agents as well.

“Being married can cause your rate to decrease,” says Evan. “Marriage, getting good grades--these are all things that you have to self-report, which is why I recommend revisiting auto insurance at least once a year, as your life situation could change.”

This Is What America’s 'Dream Home' Looks Like

The dream home for today’s American consumer is just over 2,000 square feet and located outside of a major city, according to a report out today by Trulia.

Consumers polled by the real estate Web site said the top features in their dream home were a backyard deck, a gourmet kitchen, and an open floorplan.

Owning a home is still part of the American dream for 70 percent of those polled, down from 77 percent five years ago. The portion of Americans who want to buy a home one day was highest—hitting almost 90 percent—among millennials.

Related: 10 Luxury Home Amenities that Are Trending Up

Those findings echo the results of a Wells Fargo poll in June, which found that nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of.

Despite the desire for home ownership, only 14 percent of those surveyed by Trulia said they would buy a home this year. Nearly 70 percent said they planned on waiting at least two years to make a purchase.

The country’s home ownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

Just 36 percent of millennials who want to buy a home are currently saving to purchase one. As rents in many cities continue to skyrocket, however, homeownership may become more appealing.

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

CVS Quit Selling Cigarettes, but It’s Found a Patch for Sales

CVS executives knew that some of their sales would go up in smoke when they decided last year to stop selling cigarettes. The press release announcing that all 7,600 CVS stores nationwide would stop selling all tobacco products acknowledged that sales would take a hit. Still, the company said, “This is the right thing to do.”

The costs of the decision are now becoming clear. CVS Health’s general merchandise sales slumped 7.8 percent last quarter on a same-store basis, the company said Tuesday. The company claims non-pharmacy sales would have stayed the same if tobacco sales — and the other products cigarette buyers added to their baskets — were removed from sales figures for the same quarter in 2014.

Related: Why Smoking Is Even Worse Than We Thought

Same-store sales in the pharmacy category climbed 4.1 percent, boosting overall same-store sales growth to 0.5 percent compared with the second quarter of last year, down from a 1.2 percent year-over-year increase the previous quarter. Net revenue overall grew by 7.4 percent to $37.2 billion, helped by pharmacy services revenue that surged 11.9 percent ($2.6 billion) to $24.4 billion. The company has reportedly increased its market share in the health and beauty categories (it did, however, narrow its full-year earnings forecast).

So even as the move to drop cigarettes has cost the company, its bet on health as the source of future growth may be starting to pay off. CVS stock dropped in the wake of its earnings announcement, but shares are still up more than 15 percent on the year and 44 percent over the past 12 months.

Is the American Dream Dead? Most Parents Think Their Kids Will Be Less Well Off

Parents think their children will be happier and healthier in the future as adults, but also less well off, according to a new report commissioned by insurance company Haven Life.

Only one in eight Americans believe that their children will be better off financially, when compared to their parents. More than half of American parents believe their children will have less disposable income in the future, and only one in five Americans believe their children will enjoy greater quality of life.

Related: Should You Leave Your Home to Your Kids?

On the other hand, more than 60 percent of adults believe that future generations will lead “as healthy or healthier” lifestyles than adults today. And half of them think their children will grow up to be more environmentally conscious adults who lead greener lifestyles. More than half believe that this future generation will be more ethnically and racially diverse.

The study was done by YouGov for the Haven Life Insurance Agency. YouGov conducted an online poll with a representative sample of 1,124 U.S. adults in the first quarter of 2015.

Top Reads from The Fiscal Times

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

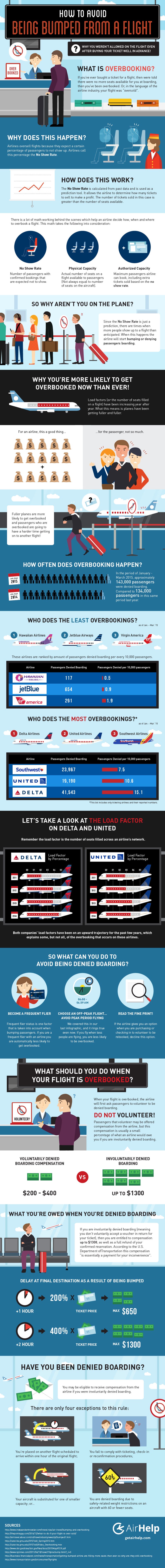

Travel Nightmares: How to Avoid Getting Bumped from Your Flight

You're finally on your way out for a summer vacation. The flight was booked months ago. Your bags are packed and ready. You arrive at the airport the recommended 90 minutes before the scheduled departure time (because it's a great long trip, and you've decided to check your bags). After enduring the inhumanity that is the TSA line, you get to your gate. Of course, everyone else has done the same thing, and you hear the familiar strains of "this flight is overbooked, we are offering a travel voucher if you are willing to fly on a later flight."

But you ignore that, as always, because, well, your bags are already on the plane, and you don't want to miss even a second of your long-awaited time away. Still, that $300 voucher sounds tempting. You could use it to help defray the cost of holiday travel in a few months.

Don't do it. Resisting that temptation can be even more rewarding: If the worst still happens and you get involuntarily bumped, you can get a full refund of your ticket price plus up to $1,300 in added compensation.

The AirHelp inforgraphic below lays out the basic dos and don'ts of dealing with an overbookd flight. You can also find more from AirHelp here.

(h/t lifehacker.com)

Blame China for Your Costly Lobster Roll

Looking for authentic, down-home Maine lobster? Head to China.

The upsurge in demand for lobster in China this year has caused the price of the succulent marine crustacean to shoot up to record highs in the U.S., according to Bloomberg News. Wholesale prices for lobsters have clawed 32 percent higher over the last year.

Lacking a lobster industry itself, China used to rely on Australian imports to meet the demand from an expanding middle class that views lobster as a status symbol. But in 2012, as catches off of Western Australia began dwindling and prices of lobster fell in the Gulf of Maine, China changed its main supplier to the U.S.

Related: McDonald’s Aims for a Classier Crowd with Lobster Rolls

Lobster exports from the East Coast are the main reason for the hike in fish and seafood exports to China in recent years, according to U.S. Department of Agriculture data. Over the past seven months, about 60,000 live North American lobsters a week make the 7,500-mile trek halfway across the world. The lobsters must still be alive by the time they arrive in China or else they lack appeal, so they’re packed in wet newspapers and Styrofoam coolers for a trip that must be made in 18 hours or less, according to Bloomberg.

Another reason for the surge in prices was the bitterly cold winter this year, which slowed the catch in Canada and delayed the summer harvest in Maine.

Holding off on your lobster roll until next summer in the hopes that prices will wane? Don’t count on it. The Chinese middle class is still growing rapidly, and the country already consumes 35 percent of the world’s seafood — a number likely to increase.

Top Reads from The Fiscal Times:

- Born in the USA: 24 Iconic American Foods

- America’s 10 Top Selling Medications

- You’re Richer Than You Think. Really.