Why Investors Prefer Real Estate to Stocks, Bond and Gold

Americans still feel skittish about the stock market. When it comes to long-term investments, real estate is still preferred over cash or the stock market, Bankrate.com reports in a new study. For long term investments over 10 years or more, 27 percent chose real estate, 23 percent preferred cash investments, and 17 percent opted for the stock market. Gold and precious metals came in fourth at 14 percent, and bonds debuted at 5 percent.

Related: Clinton’s Capital Gains Tax Plan Aims at Long-Term Investment

Although the S&P 500 has risen 27 percent over the past two years, Americans were only slightly more inclined to favor stocks in 2015 than they were in 2013.

The only exception to the brick and mortar policy? Households headed by college graduates were the most likely to prefer stocks. In the western U.S., real estate was preferred nearly two to one over any other investment choice.

The survey of 1,000 adults living in the continental U.S. yielded some surprises across gender, age, income, location, and political party. Men were more likely to favor real estate, while women were more likely to favor cash investments.

At 32 percent, the majority of millennials--those between 18 and 29 years old--favored cold, hard cash, while 32 percent of participants between the ages of 30 and 40 stuck with real estate.

Related: U.S. Real Estate ETF Rally Faces Test With Rate Rise

Lower-income workers with salaries of less than $50,000 felt “more secure” than their higher earning counterparts, who were making $50,000 to $74,900. And Republicans were three times more likely to say they felt “less secure” about their jobs as Democrats.

Bankrate’s Financial Security Index for July remained positive for the 14th consecutive month. However the July reading was the second lowest in 2015, due in part to a decline in job security with 22 percent feeling “more secure” about their jobs than 12 months ago and 14 percent feeling “less secure.” Sixty-two percent felt “about the same.”

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

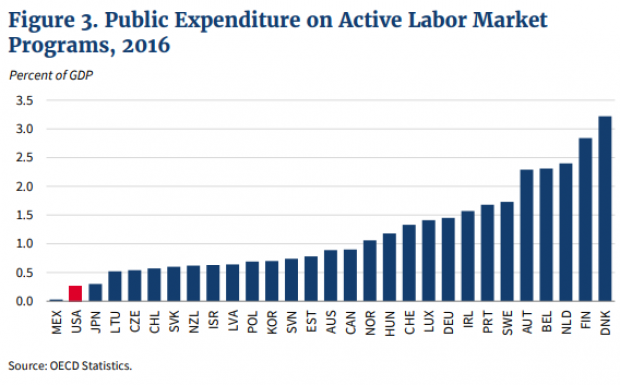

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.