Why Investors Prefer Real Estate to Stocks, Bond and Gold

Americans still feel skittish about the stock market. When it comes to long-term investments, real estate is still preferred over cash or the stock market, Bankrate.com reports in a new study. For long term investments over 10 years or more, 27 percent chose real estate, 23 percent preferred cash investments, and 17 percent opted for the stock market. Gold and precious metals came in fourth at 14 percent, and bonds debuted at 5 percent.

Related: Clinton’s Capital Gains Tax Plan Aims at Long-Term Investment

Although the S&P 500 has risen 27 percent over the past two years, Americans were only slightly more inclined to favor stocks in 2015 than they were in 2013.

The only exception to the brick and mortar policy? Households headed by college graduates were the most likely to prefer stocks. In the western U.S., real estate was preferred nearly two to one over any other investment choice.

The survey of 1,000 adults living in the continental U.S. yielded some surprises across gender, age, income, location, and political party. Men were more likely to favor real estate, while women were more likely to favor cash investments.

At 32 percent, the majority of millennials--those between 18 and 29 years old--favored cold, hard cash, while 32 percent of participants between the ages of 30 and 40 stuck with real estate.

Related: U.S. Real Estate ETF Rally Faces Test With Rate Rise

Lower-income workers with salaries of less than $50,000 felt “more secure” than their higher earning counterparts, who were making $50,000 to $74,900. And Republicans were three times more likely to say they felt “less secure” about their jobs as Democrats.

Bankrate’s Financial Security Index for July remained positive for the 14th consecutive month. However the July reading was the second lowest in 2015, due in part to a decline in job security with 22 percent feeling “more secure” about their jobs than 12 months ago and 14 percent feeling “less secure.” Sixty-two percent felt “about the same.”

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

Special Tax Break Zones Defined for All 50 States

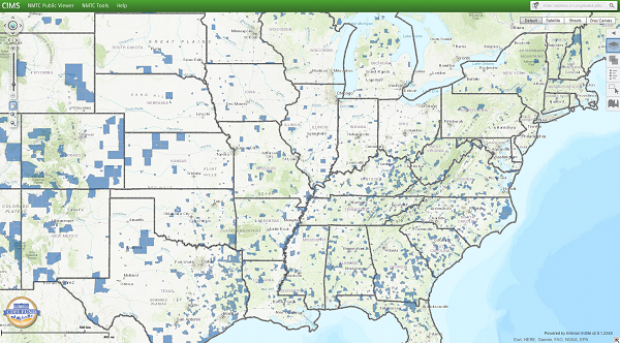

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

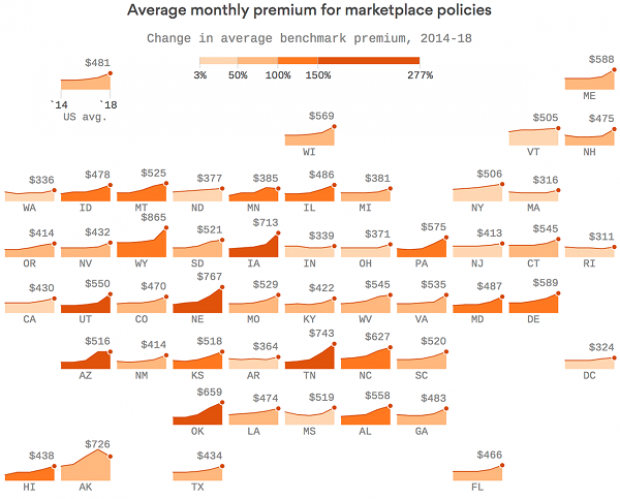

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).