Why Shark Attacks Have a Silver Lining

While recent headlines about the above average number of shark attacks in the U.S. this year may have rethinking your summer vacation, the incidents could be good news for the ocean’s ecosystem.

Conservation measures implemented to prevent the decline of great white sharks are paying off, scientists have found. The global population of great whites has been in recovery since 1990.

One of the key components in this environmental success story is the passage of the Marine Mammal Protection Act in 1972. With the legislation, seal and sea lion populations began to rebound along the West Coast. Great white sharks eat both seals and sea lions and having more food available most likely boosted their comeback.

A healthy shark population makes for a more balanced ecosystem, leading to healthier oceans that support all lives, both human and non-human. Oceans produce over half of the oxygen in the atmosphere and absorb the majority of carbon in it.

The increase in the number of sharks suggests that some of the damage humans have caused in the oceans has been reversed. However, it will take a while for sharks to rebuild their populations completely. It takes sharks at least eight years to reach a reproductive age and gestation periods can last 18 months.

Even though “Sharknado: Oh Hell No!” is getting awful reviews this week, everyone should applaud this other bit of shark-related news.

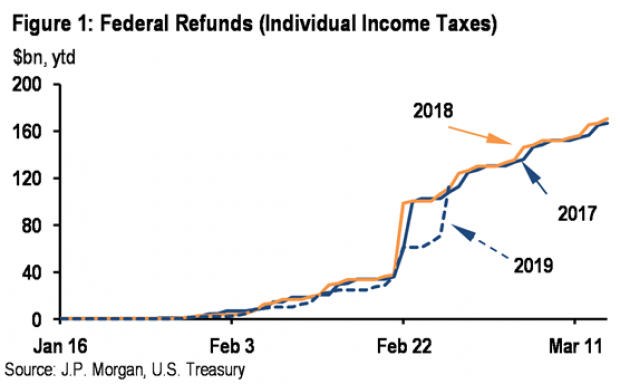

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

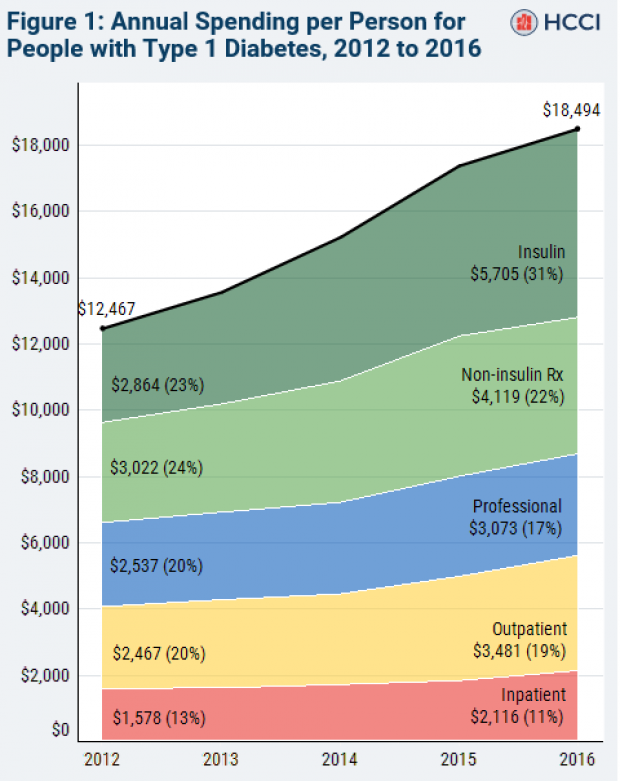

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

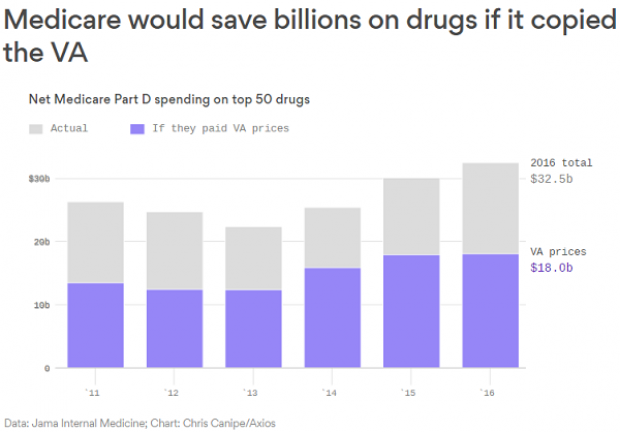

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.