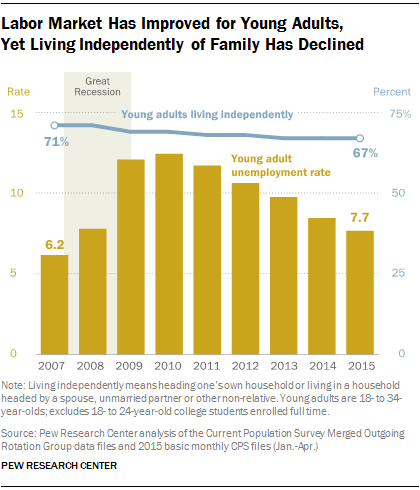

The Kids Aren’t Alright: More Millennials Are Living with Their Parents

Pity the millennial, poster child of the Great Recession. A popular meme portrays the typical millennial as a basement-dwelling economic loser, forever condemned to live in the nether regions of his parent’s house. Unfortunately, that meme is not without basis. The recession seem to have hit millennials particularly hard, making it even more difficult for young people to find good jobs and to establish their own households.

In some respects, things are looking up for millennials. The U.S. job market is strengthening, making it easier to find work, and wages are starting to creep higher. The unemployment rate for young adults (ages 18 to 34, excluding full-time college students) has been heading lower since peaking near 12 percent in 2010; the latest unemployment reading for millennials is 7.7 percent.

However, there is one notable sticking point, and it echoes that basement-dwelling meme. Even though household formation rates have rebounded overall, millennials are still not moving out and establishing their own households like they used to. In fact, more millennials are living with parents or relatives than before the recession, according to new research from Pew.

In 2007, before the recession hit, 71 percent of millennials were living independently. In 2015, that number has fallen to 67 percent, with no sign of bottoming.

On the flip side, 22 percent of young adults were living in their parents’ homes in 2007. That number has risen to 26 percent this year.

The Pew report doesn’t look at why millennials are sticking so close to home. However, it does suggest that the relatively simple economic argument about the lack of good jobs no longer tells the whole story. Since the economy is recovering, however unevenly, there are likely other factors in play. One could be cultural: More young people simply enjoy living at home and are in no hurry to move out. Perhaps the U.S. is becoming more like Italy, where adult children often live at home until they marry.

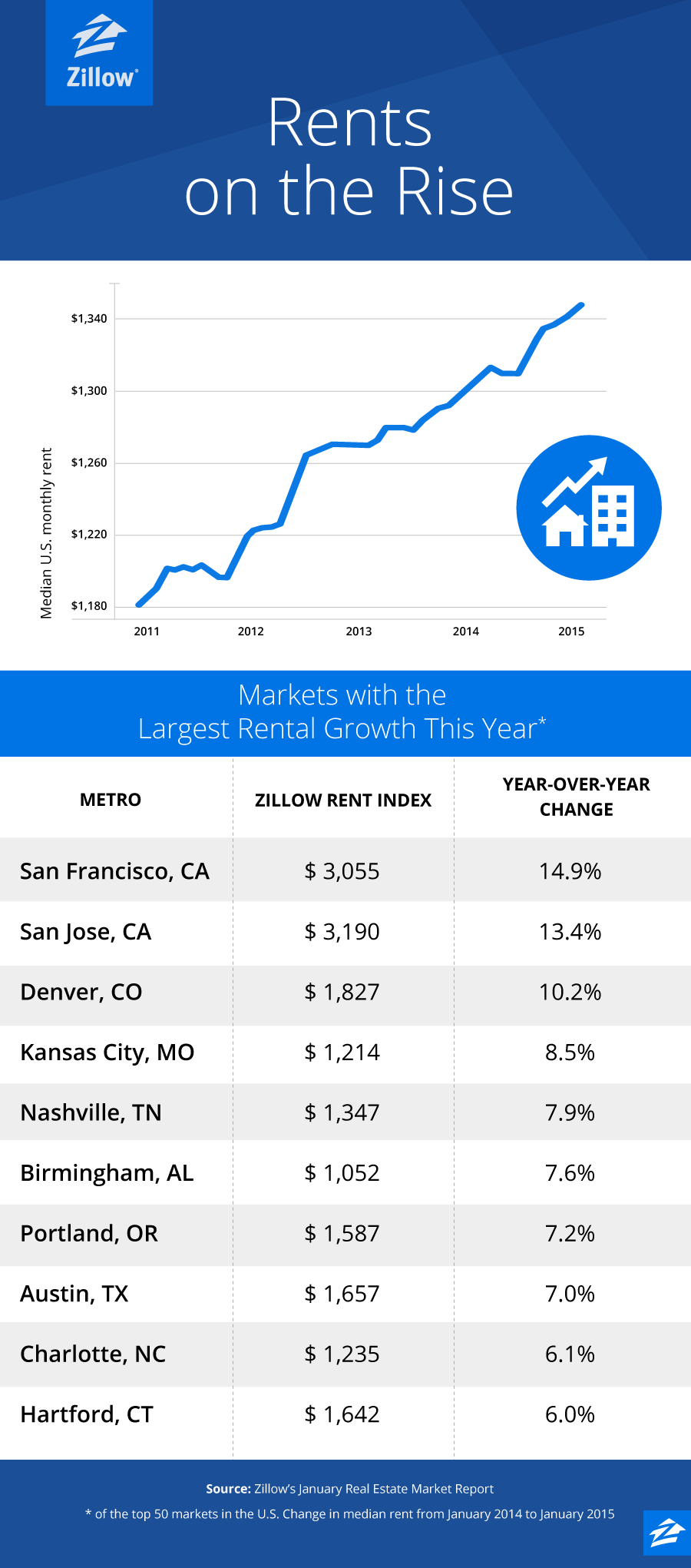

That’s not to say that money plays no role in the trend, though. One big economic factor not addressed in the Pew report is pretty basic: rising rents. This graphic from Zillow makes it clear that rents have been soaring all over the country. More than $3,000 for a one bedroom in San Francisco? With those kind of numbers, living at home makes all the sense in the world.

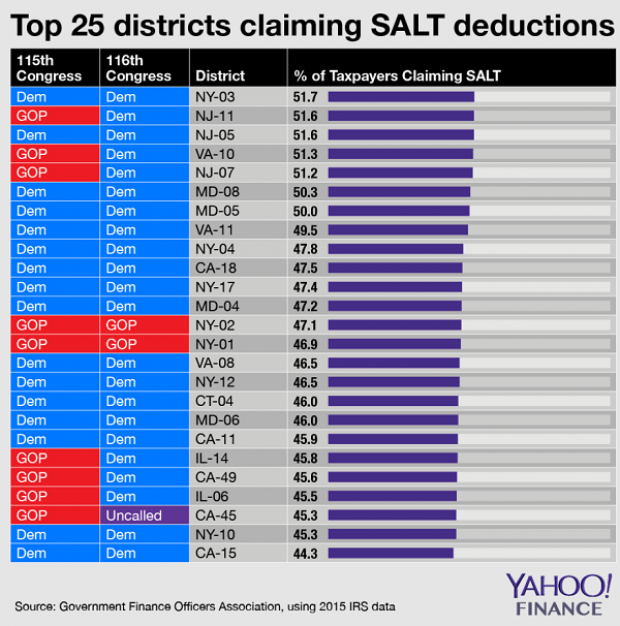

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

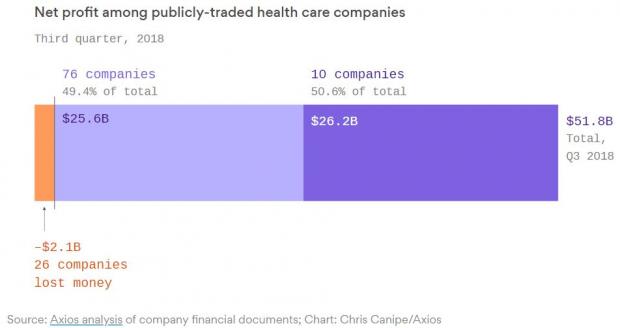

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

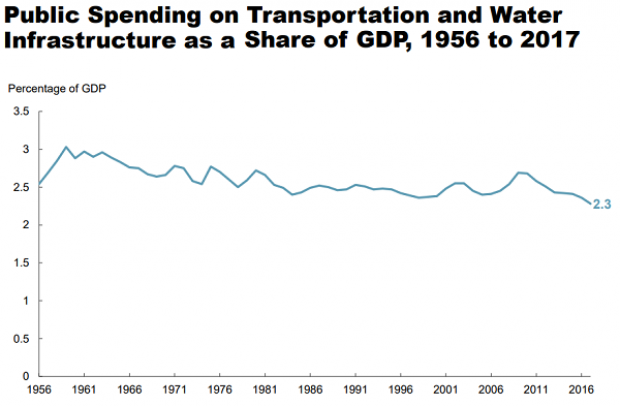

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.