The Kids Aren’t Alright: More Millennials Are Living with Their Parents

Pity the millennial, poster child of the Great Recession. A popular meme portrays the typical millennial as a basement-dwelling economic loser, forever condemned to live in the nether regions of his parent’s house. Unfortunately, that meme is not without basis. The recession seem to have hit millennials particularly hard, making it even more difficult for young people to find good jobs and to establish their own households.

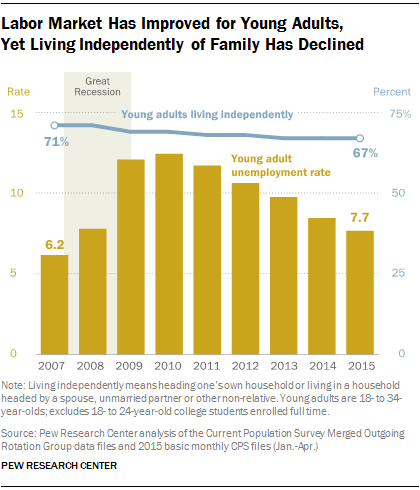

In some respects, things are looking up for millennials. The U.S. job market is strengthening, making it easier to find work, and wages are starting to creep higher. The unemployment rate for young adults (ages 18 to 34, excluding full-time college students) has been heading lower since peaking near 12 percent in 2010; the latest unemployment reading for millennials is 7.7 percent.

However, there is one notable sticking point, and it echoes that basement-dwelling meme. Even though household formation rates have rebounded overall, millennials are still not moving out and establishing their own households like they used to. In fact, more millennials are living with parents or relatives than before the recession, according to new research from Pew.

In 2007, before the recession hit, 71 percent of millennials were living independently. In 2015, that number has fallen to 67 percent, with no sign of bottoming.

On the flip side, 22 percent of young adults were living in their parents’ homes in 2007. That number has risen to 26 percent this year.

The Pew report doesn’t look at why millennials are sticking so close to home. However, it does suggest that the relatively simple economic argument about the lack of good jobs no longer tells the whole story. Since the economy is recovering, however unevenly, there are likely other factors in play. One could be cultural: More young people simply enjoy living at home and are in no hurry to move out. Perhaps the U.S. is becoming more like Italy, where adult children often live at home until they marry.

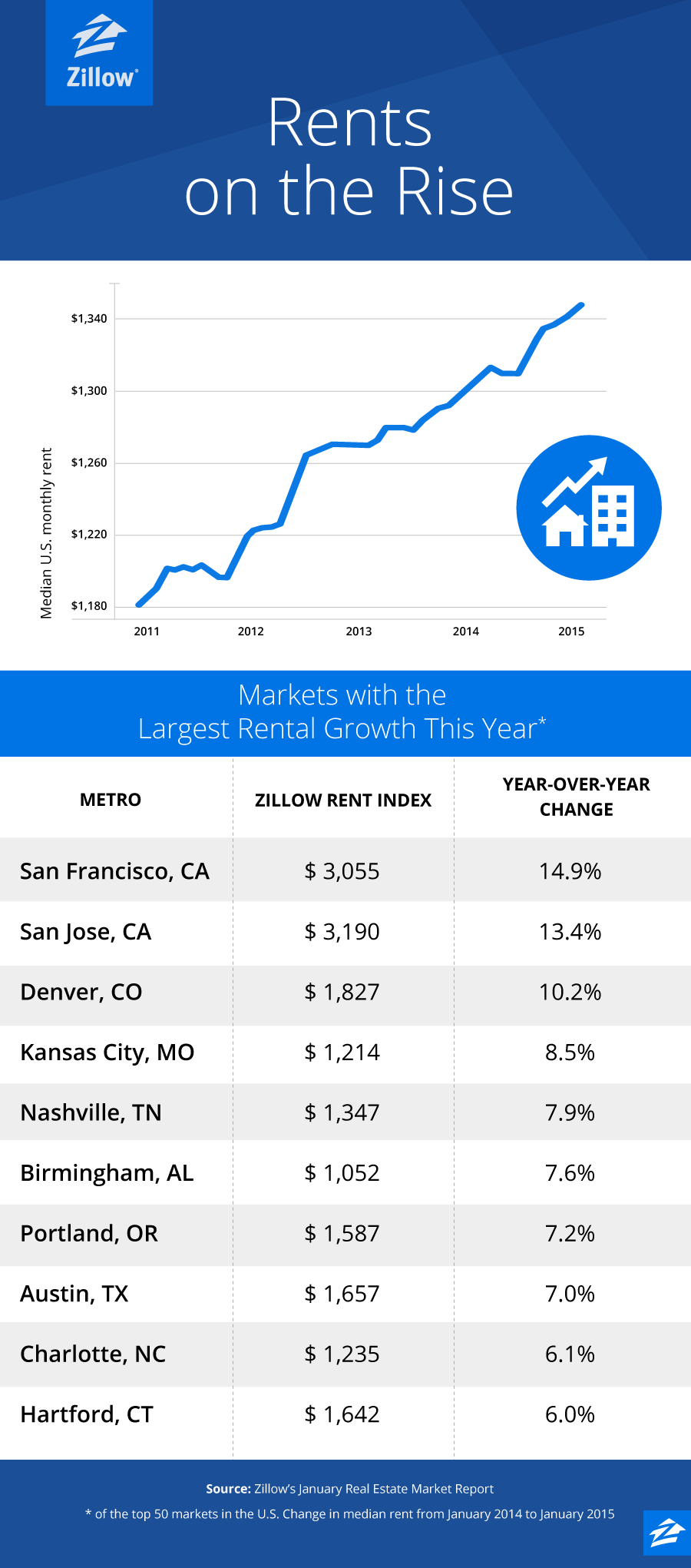

That’s not to say that money plays no role in the trend, though. One big economic factor not addressed in the Pew report is pretty basic: rising rents. This graphic from Zillow makes it clear that rents have been soaring all over the country. More than $3,000 for a one bedroom in San Francisco? With those kind of numbers, living at home makes all the sense in the world.

Number of the Day: 51%

More than half of registered voters polled by Morning Consult and Politico said they support work requirements for Medicaid recipients. Thirty-seven percent oppose such eligibility rules.

Martin Feldstein Is Optimistic About Tax Cuts, and Long-Term Deficits

In a new piece published at Project Syndicate, the conservative economist, who led President Reagan’s Council of Economic Advisers from 1982 to 1984, writes that pro-growth tax individual and corporate reform will get done — and that any resulting spike in the budget deficit will be temporary:

“Although the net tax changes may widen the budget deficit in the short term, the incentive effects of lower tax rates and the increased accumulation of capital will mean faster economic growth and higher real incomes, both of which will cause rising taxable incomes and lower long-term deficits.”

Doing tax reform through reconciliation — allowing it to be passed by a simple majority in the Senate, as long as it doesn’t add to the deficit after 10 years — is another key. “By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses,” Feldstein argues.

Of course, the big questions remain whether tax and spending changes are really designed as Feldstein describes — and whether “future revenue increases” ever come to fruition. Otherwise, those “long-term surpluses” Feldstein says we need won’t ever materialize.

JP Morgan: Don’t Expect Tax Reform This Year

Gary Cohn, President Trump’s top economic adviser, seems pretty confident that Congress can produce a tax bill in a hurry. He told the Financial Times (paywall) last week that the Ways and Means Committee should be write a bill “in the next three of four weeks.” But most experts doubt that such a complicated undertaking can be accomplished so quickly. In a note to clients this week, J.P. Morgan analysts said they don’t expect to see a tax bill passed until mid-2018, following months of political wrangling:

“There will likely be months of committee hearings, lobbying by affected groups, and behind-the-scenes horse trading before final tax legislation emerges. Our baseline forecast continues to pencil in a modest, temporary, deficit-financed tax cut to be passed in 2Q2018 through the reconciliation process, avoiding the need to attract 60 votes in the Senate.”

Trump Still Has No Tax Reform Plan to Pitch

Bloomberg’s Sahil Kapur writes that, even as President Trump prepares to push tax reform thus week, basic questions about the plan have no answers: “Will the changes be permanent or temporary? How will individual tax brackets be set? What rate will corporations and small businesses pay?”

“They’re nowhere. They’re just nowhere,” Henrietta Treyz, a tax analyst with Veda Partners and former Senate tax staffer, tells Kapur. “I see them putting these ideas out as though they’re making progress, but they are the same regurgitated ideas we’ve been talking about for 20 years that have never gotten past the white-paper stage.”

The Fiscal Times Newsletter - August 28, 2017

|