Cockroaches, Rats and Mice: These Are the Country’s Most Infested Cities

New York really is the most infested city in the country, at least according to a Bloomberg analysis of Census Bureau data on cockroach, mouse and rat sightings.

The Big Apple doesn’t lead in any of those individual categories. Homes in Tampa, Fla., have the most roaches, and those in Seattle may have the most rats. Philadelphia houses had the most mouse sightings in the country. But when Bloomberg combined all three categories, New York came out with the highest cumulative score.

Perhaps surprising given the economic state of the city, Detroit residents were the least likely to report seeing a mouse, rat or roach.

Related: The Top 9 Summer Insects to Avoid and How

The data covered only 25 metro areas, so some large cities like Dallas, Los Angeles and San Francisco don’t appear on the list.

Roaches appear to enjoy nice weather. Nearly 40 percent of homes in Tampa had evidence in roaches in the past year, followed by Houston and Austin. Cities with the fewest roach sightings were Seattle, Minneapolis and Detroit.

Mice, on the other, hand, seem to prefer the northeast. Nearly 20 percent of Philly homes had evidence of mice, followed by Baltimore and Boston. Tampa, Jacksonville, and Las Vegas had the lowest percentage of mouse sightings.

More than 20 percent of homes in Seattle and Austin had rats, with Miami rounding out the top three. Richmond, Va., Hartford, Conn., and Minneapolis had the lowest level of rat sightings.

All those vermin lead to big business. Last year, the U.S. pest control industry generated nearly $7.5 billion in revenue, a 3.5 percent increase year-over-year.

Bloomberg reported that the data also showed a difference in infestation levels of homes with families living below the poverty line and minority families, which were more likely to report evidence of rats and roaches.

Top Reads from The Fiscal Times:

- Cecil the Lion Gives Voice to a Growing List of Illegal Slaughters

- How the Media and You Are Misled by False Data

- America’s 10 Top Selling Medications

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

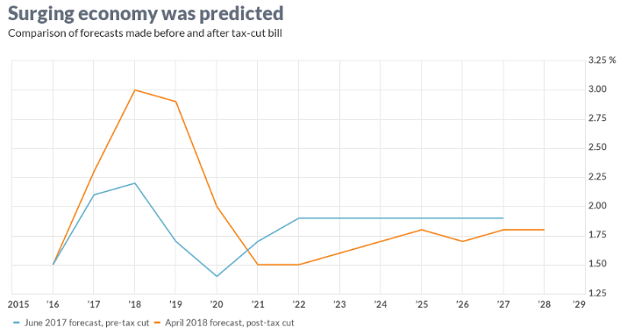

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

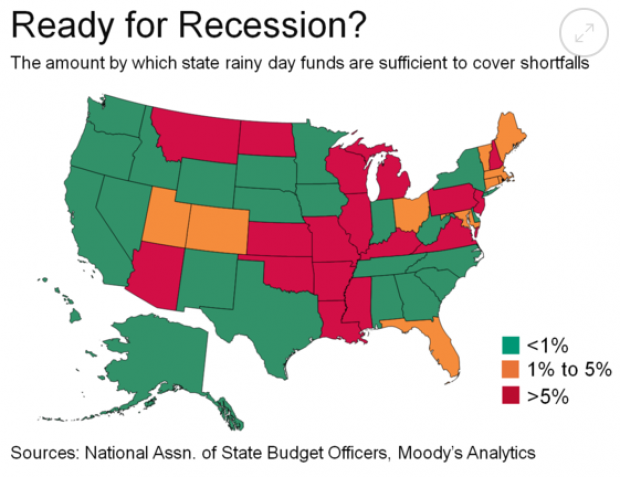

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

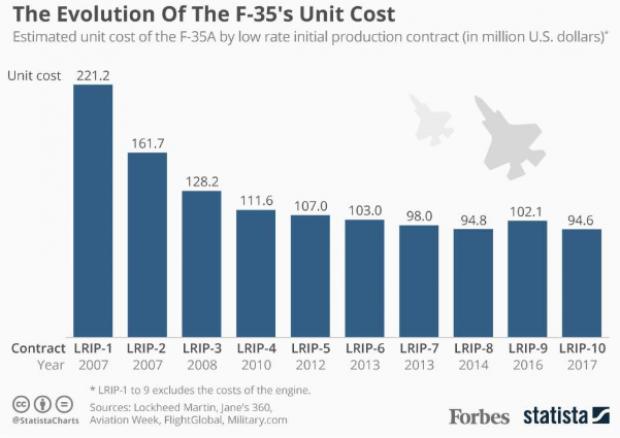

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.