Why Believing Donald Trump Will Be the GOP Nominee Is Delusional

Despite his commanding lead at this early stage among GOP candidates, the 2016 nomination is anyone’s game.

It is risky to put too much stock in the latest findings, including the NBC/Wall Street Journal poll released Sunday. That’s because the national telephone survey of 1,000 adults included only 252 registered voters who said they would vote for a Republican, and the poll has a margin of error of plus or minus 6.17 points.

Related: Why Jeb Bush’s Pragmatic Immigration Plan Has No Chance of Passing in the House

There are plenty of downsides to Trump’s candidacy – including his threat to mount a third-party campaign if he is denied the Republican nomination -- which has alarmed GOP leaders who are looking down the road to the general election.

Trump has the highest negatives of any of the top tier candidates, and a majority of Americans in the survey said they think Trump is hurting the Republican Party. Not surprisingly, the vast majority of Democrats interviewed said Trump was harming his party’s image, but nearly half the Republicans interviewed said the same thing.

Political analyst Nate Silver notes that Trump ranks just 13th in overall favorability among Republicans in a series of national polls. “If you’re going to imply that a candidate is popular based on their receiving 20 percent of the vote, you ought to consider what the other 80 percent thinks about him,” Silver wrote recently in his FiveThirtyEight blog. “Most Republicans who don’t plan to vote for Trump are skeptical of him instead.”

Related: Donald Trump Just Showed Why His Campaign Is Doomed

What’s more, about three in four Latinos said they have a negative view of Trump – and that more than half consider his comments about lawless Mexican immigrants to be racist or highly inappropriate, according to a separate NBC News/Wall Street Journal Telemundo poll released today.

The survey of 250 Hispanic-American voters revealed widespread hostility towards Trump, with only 13 percent saying they have a positive view of him.

The Republican presidential frontrunner has said repeatedly that many Latino voters “love” and support him, and that he would win the majority of that vote if he ends up as his party’s nominee. There is little evidence in this poll to suggest Trump is dealing with reality.

Top Reads from The Fiscal Times:

- Clinton Tries to Change the Narrative with First Two Campaign Ads

- Super PAC or Not-so-Super PAC? The Difference Between Jeb and Bernie

- States Are Finally Overcoming the Fiscal Headwinds

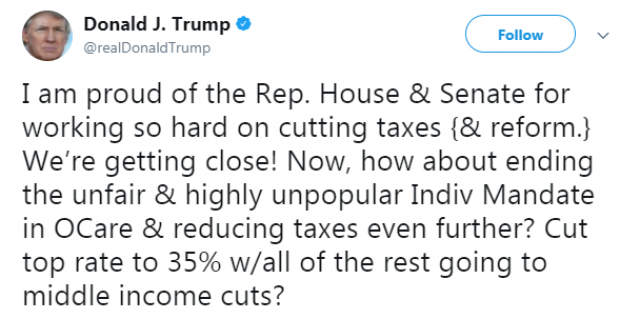

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.