On Campaign Trail, Rubio Truant in the Senate

Last week Sen. Marco Rubio warned it’s “important to be qualified, but if this election is a resume competition, then Hillary Clinton's gonna be the next president” because of her long history in office and in federal government.

For his sake, he’d better hope the GOP primary doesn’t turn into a disqualifying truancy competition, too.

A study by The Tampa Bay Times found that of the four Republican senators running for the White House, Rubio has missed the most Senate votes.

In June alone, Rubio missed 67 percent of the Senate votes, and he wasn’t there for more than half of them in July, according to The Times.

Related: The New York Times Just Made Rubio the Hero of the Struggling Middle Class

In all, the first-term lawmaker missed 29 percent of Senate votes, or 76 of 262 recorded, in the first six months of 2015. Over 50 of those came after his April 13 campaign announcement.

The numbers show how much time Rubio has had to spend off Capitol Hill and on the campaign trail as he looks to break out of a crowded GOP field that includes his friend and former Florida Gov. Jeb Bush.

By contrast, Sen. Ted Cruz (R-TX) has missed 54 votes since declaring his candidacy in March, while Sen. Lindsey Graham (R-SC) was truant for 35 votes since he launched his presidential bid on June 1.

Sen. Rand Paul (R-KY) has skipped only three votes throughout 2015 and only one since declaring for president.

On the Democratic side, Sen. Bernie Sanders (I-VT) has missed four votes since hitting the campaign trail.

Rubio has missed nearly 11 percent of votes since he joined the Senate in January 2011, The Times analysis shows, well above the median 1.6 percent rate for the lifetimes of current senators.

A Rubio spokesperson did not respond to a request for comment.

Top Reads from The Fiscal Times:

- Trump’s Debate Performance Should Kill His Candidacy … but Won’t

- Battle Lines Form in the Fight Over Social Security Payment Reductions

- Robert Gates Says U.S. Got ‘Out-Negotiated’ on Iran Deal, Backs It Anyway

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

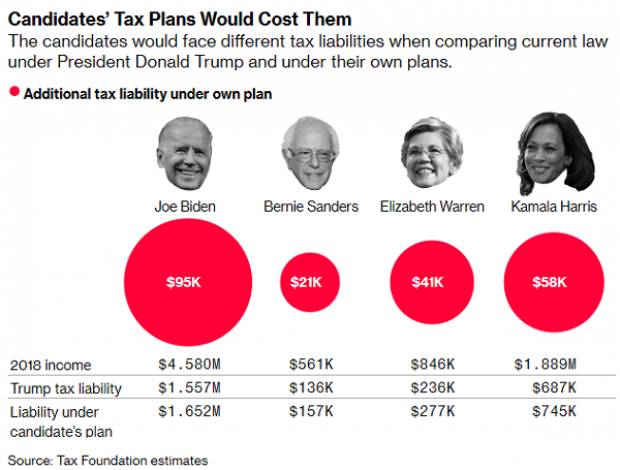

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.