On Campaign Trail, Rubio Truant in the Senate

Last week Sen. Marco Rubio warned it’s “important to be qualified, but if this election is a resume competition, then Hillary Clinton's gonna be the next president” because of her long history in office and in federal government.

For his sake, he’d better hope the GOP primary doesn’t turn into a disqualifying truancy competition, too.

A study by The Tampa Bay Times found that of the four Republican senators running for the White House, Rubio has missed the most Senate votes.

In June alone, Rubio missed 67 percent of the Senate votes, and he wasn’t there for more than half of them in July, according to The Times.

Related: The New York Times Just Made Rubio the Hero of the Struggling Middle Class

In all, the first-term lawmaker missed 29 percent of Senate votes, or 76 of 262 recorded, in the first six months of 2015. Over 50 of those came after his April 13 campaign announcement.

The numbers show how much time Rubio has had to spend off Capitol Hill and on the campaign trail as he looks to break out of a crowded GOP field that includes his friend and former Florida Gov. Jeb Bush.

By contrast, Sen. Ted Cruz (R-TX) has missed 54 votes since declaring his candidacy in March, while Sen. Lindsey Graham (R-SC) was truant for 35 votes since he launched his presidential bid on June 1.

Sen. Rand Paul (R-KY) has skipped only three votes throughout 2015 and only one since declaring for president.

On the Democratic side, Sen. Bernie Sanders (I-VT) has missed four votes since hitting the campaign trail.

Rubio has missed nearly 11 percent of votes since he joined the Senate in January 2011, The Times analysis shows, well above the median 1.6 percent rate for the lifetimes of current senators.

A Rubio spokesperson did not respond to a request for comment.

Top Reads from The Fiscal Times:

- Trump’s Debate Performance Should Kill His Candidacy … but Won’t

- Battle Lines Form in the Fight Over Social Security Payment Reductions

- Robert Gates Says U.S. Got ‘Out-Negotiated’ on Iran Deal, Backs It Anyway

Coming Soon: Deductible Relief Day!

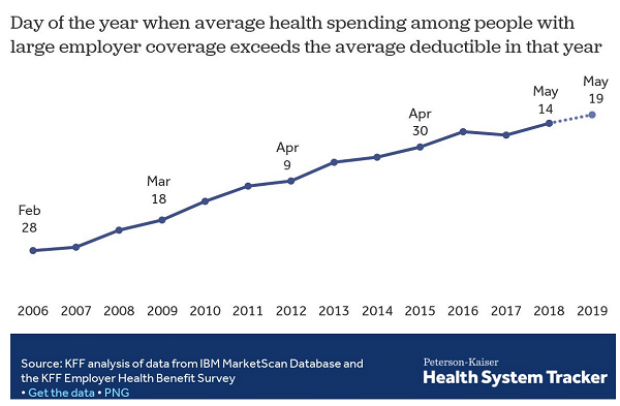

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

Chart of the Day: Families Still Struggling

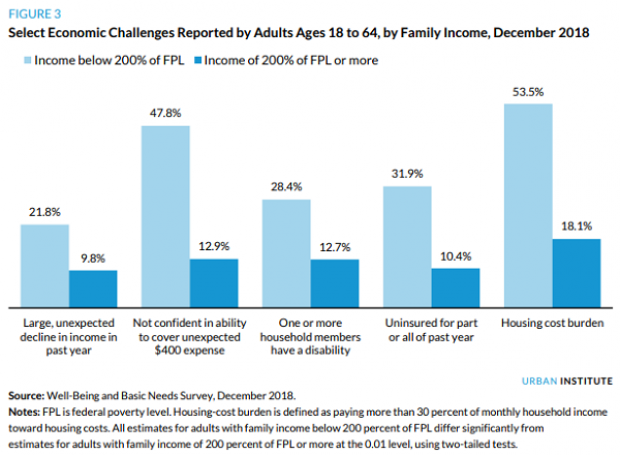

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

Chart of the Day: Pragmatism on a Public Option

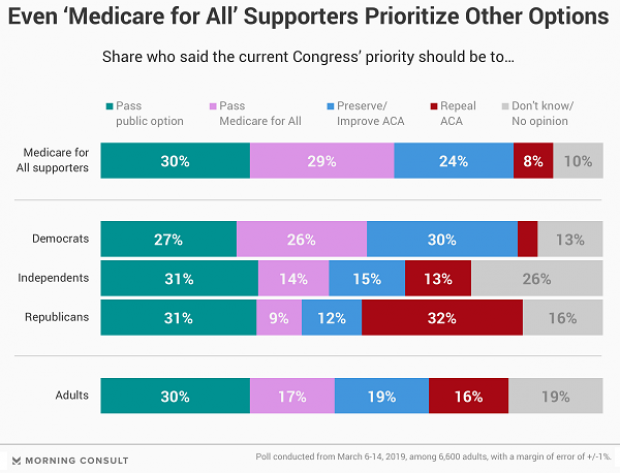

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

Chart of the Day: The Big Picture on Health Care Costs

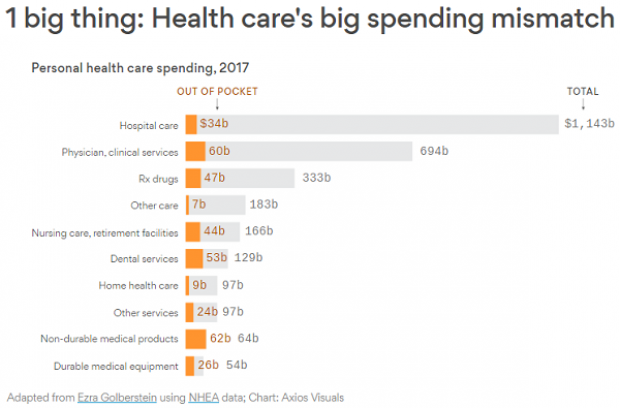

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.