Did Kasich Just Do an About-Face on Climate Change?

Maybe it’s because he is still feeling his way as a late entrant into the GOP presidential campaign, but Ohio Gov. John Kasich did a fairly dramatic about-face over the weekend on the politically charged issue of climate change.

Kasich, a former House Budget Committee chair and Wall Street business executive, has positioned himself as a “kinder, gentler” conservative than Jeb Bush, Ted Cruz and the dozen other Republicans running for the 2016 presidential nomination. So it wasn’t surprising that he would take a more moderate stand on global warming during the first nationally televised GOP presidential debate Thursday evening.

Related: 10 Things You Need to Know About John Kasich

Kasich, a devout Christian, declared during the two-hour debate sponsored by Fox News that climate change is a real problem requiring government and society to protect the “creation that the Lord has given us.”

While the vast majority of Republicans on Capitol Hill and the campaign trail are highly skeptical of President Obama’s campaign to curb industrial carbon emissions to prevent the disastrous long term effects of global warming on the environment and economy, Kasich appeared to be one of the few who took the threat seriously.

He emphasized the importance of unity and cooperation, saying at one point that “we’ve got to unite our country again, because we’re stronger when we are united and we are weaker when we are divided.”

Just a few days later, though, after winning plaudits for his Thursday night performance – with some even favorably comparing his views on environmental threats to those of Pope Francis – Kasich sounded much like a climate-change doubter.

Related: Does Kasich Have a Chance? How He Can Catch Up to the GOP

During an appearance on NBC News’ “Meet the Press,” Kasich told moderator Chuck Todd that “I think man absolutely affects the environment, but as to whether, you know, what the impact is, the overall impact, I think that’s a legitimate debate.”

Kasich went on to say that in Ohio, “we preciously take care of Lake Erie, and we’ve reduced emissions by 30 percent over the last ten years.”

“We believe in alternative energy,” he added. “So of course we have to be sensitive to it, but we don’t want to destroy people’s jobs, based on some theory that’s not proven.”

According to National Journal, the Kasich 2016 campaign attempted to clarify his remarks following his appearance on “Meet the Press.” "The governor has long believed climate change is real and we need to do something about it,” according to the statement. “The debate over exact percentages of why it is happening is less important than what can be done about it. We know it is real, we know man has an impact, and we know we need to do something."

A number of prominent presidential candidates -- including former Florida governor Jeb Bush and Sens. Ted Cruz, Marco Rubio, and Rand Paul -- are climate change doubters or deniers. Sen. Lindsey Graham of South Carolina is one of the few who unquestionably accepts scientific evidence that man-made greenhouse gas emissions are a principal cause of global warming, and has sharply criticized his party for lacking a comprehensive environmental platform.

Top Reads From The Fiscal Times:

- How GOP Candidates Would Steer U.S. Foreign Policy

- Fiorina Takes on Trump in a Brave Battle of the Sexes

- As Politicians Bicker Over Funding, Military Families Cut Back on Vacations

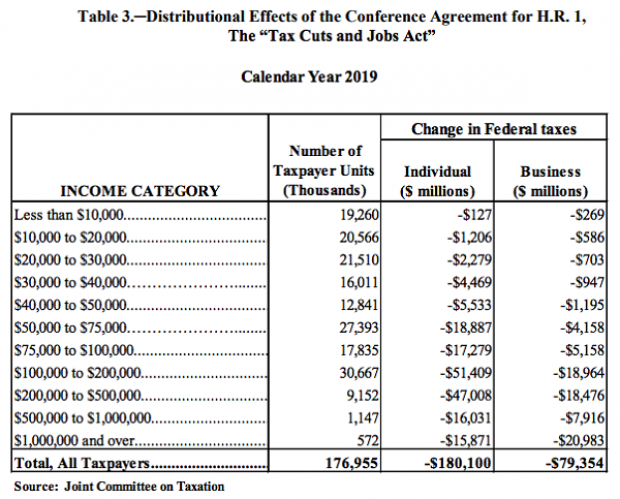

Majority of Tax Cuts Going to Filers Earning More Than $100K: JCT

Ahead of a House Ways and Means Committee hearing scheduled for Wednesday, the Joint Committee on Taxation prepared an analysis of the distributional effects of the 2017 Republican tax bill. The New York Times’ Jim Tankersley highlighted the fact that according to the JCT analysis, about 75 percent of the individual and business benefits of the tax cuts will go to filers earning more than $100,000 in 2019. And nearly half of the benefits will flow to filers earning over $200,000.

The Trump Budget's $1.2 Trillion in 'Phantom Revenues'

President Trump’s 2020 budget includes up to $1.2 trillion in “potentially phantom revenues” — money that comes from taxes the administration opposes or from tax hikes that face strong opposition from businesses, The Wall Street Journal’s Richard Rubin reports, citing data from the Committee for a Responsible Federal Budget. That total, covering 2020 through 2029, includes as much as $390 billion in taxes created under the Affordable Care Act, which the president wants to repeal.

The $1.2 trillion in questionable revenue projections is in addition to the White House budget’s projected deficits of $7.3 trillion for the 10-year period. That total is itself questionable, given that the president’s budget relies on optimistic assumptions about economic growth and some unrealistic spending cuts, meaning that the deficits could be significantly higher than projected.

Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

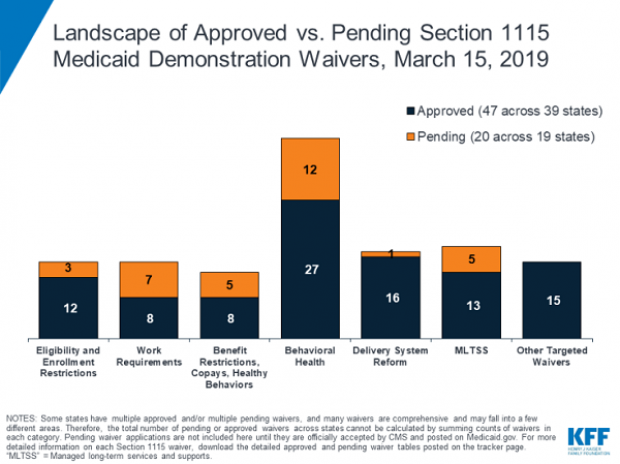

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

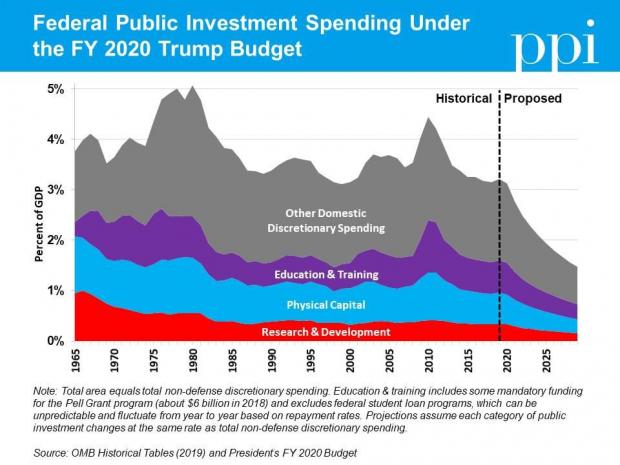

Chart of the Day: Trump's Huge Proposed Cuts to Public Investment

Ben Ritz of the Progressive Policy Institute slams President Trump’s new budget:

“It would dismantle public investments that lay the foundation for economic growth, resulting in less innovation. It would shred the social safety net, resulting in more poverty. It would rip away access to affordable health care, resulting in more disease. It would cut taxes for the rich, resulting in more income inequality. It would bloat the defense budget, resulting in more wasteful spending. And all this would add up to a higher national debt than the policies in President Obama’s final budget proposal.”

Here’s Ritz’s breakdown of Trump’s proposed spending cuts to public investment in areas such as infrastructure, education and scientific research:

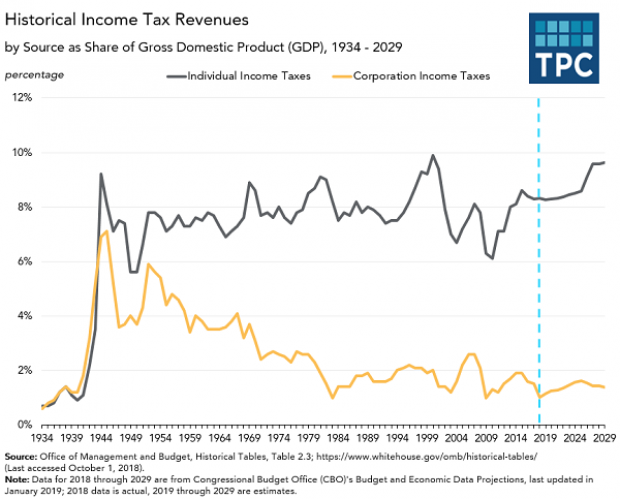

Chart of the Day: The Decline in Corporate Taxes

Since roughly the end of World War Two, individual income taxes in the U.S. have equaled about 8 percent of GDP. By contrast, the Tax Policy Center says, “corporate income tax revenues declined from 6% of GDP in 1950s to under 2% in the 1980s through the Great Recession, and have averaged 1.4% of GDP since then.”