Did Kasich Just Do an About-Face on Climate Change?

Maybe it’s because he is still feeling his way as a late entrant into the GOP presidential campaign, but Ohio Gov. John Kasich did a fairly dramatic about-face over the weekend on the politically charged issue of climate change.

Kasich, a former House Budget Committee chair and Wall Street business executive, has positioned himself as a “kinder, gentler” conservative than Jeb Bush, Ted Cruz and the dozen other Republicans running for the 2016 presidential nomination. So it wasn’t surprising that he would take a more moderate stand on global warming during the first nationally televised GOP presidential debate Thursday evening.

Related: 10 Things You Need to Know About John Kasich

Kasich, a devout Christian, declared during the two-hour debate sponsored by Fox News that climate change is a real problem requiring government and society to protect the “creation that the Lord has given us.”

While the vast majority of Republicans on Capitol Hill and the campaign trail are highly skeptical of President Obama’s campaign to curb industrial carbon emissions to prevent the disastrous long term effects of global warming on the environment and economy, Kasich appeared to be one of the few who took the threat seriously.

He emphasized the importance of unity and cooperation, saying at one point that “we’ve got to unite our country again, because we’re stronger when we are united and we are weaker when we are divided.”

Just a few days later, though, after winning plaudits for his Thursday night performance – with some even favorably comparing his views on environmental threats to those of Pope Francis – Kasich sounded much like a climate-change doubter.

Related: Does Kasich Have a Chance? How He Can Catch Up to the GOP

During an appearance on NBC News’ “Meet the Press,” Kasich told moderator Chuck Todd that “I think man absolutely affects the environment, but as to whether, you know, what the impact is, the overall impact, I think that’s a legitimate debate.”

Kasich went on to say that in Ohio, “we preciously take care of Lake Erie, and we’ve reduced emissions by 30 percent over the last ten years.”

“We believe in alternative energy,” he added. “So of course we have to be sensitive to it, but we don’t want to destroy people’s jobs, based on some theory that’s not proven.”

According to National Journal, the Kasich 2016 campaign attempted to clarify his remarks following his appearance on “Meet the Press.” "The governor has long believed climate change is real and we need to do something about it,” according to the statement. “The debate over exact percentages of why it is happening is less important than what can be done about it. We know it is real, we know man has an impact, and we know we need to do something."

A number of prominent presidential candidates -- including former Florida governor Jeb Bush and Sens. Ted Cruz, Marco Rubio, and Rand Paul -- are climate change doubters or deniers. Sen. Lindsey Graham of South Carolina is one of the few who unquestionably accepts scientific evidence that man-made greenhouse gas emissions are a principal cause of global warming, and has sharply criticized his party for lacking a comprehensive environmental platform.

Top Reads From The Fiscal Times:

- How GOP Candidates Would Steer U.S. Foreign Policy

- Fiorina Takes on Trump in a Brave Battle of the Sexes

- As Politicians Bicker Over Funding, Military Families Cut Back on Vacations

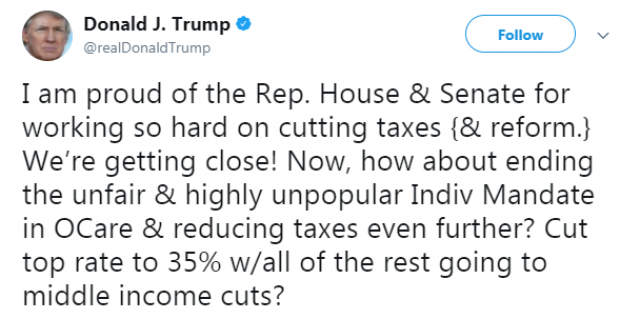

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.