When Buying Car Insurance, Young Drivers Should Stick with Mom and Dad

The parents of young drivers have enough to worry about, but a new study from insuranceQuotes.com finds that those who add coverage for an 18-to-24-year-old can expect to see an average annual premium increase of 80 percent on their existing car insurance. The good news: That’s still cheaper than if the young drivers bought insurance on their own. If those young drivers were to buy individual plans of their own, they’d pay 8 percent more on average — and in some cases, over 50 percent more — than their coverage costs on a parental plan.

Related: The Shocking Secret About How Your Car Insurance Rate Gets Set

Premiums can vary widely depending on the driver’s age and state. An 18-year-old can expect to pay an average of 18 percent more for an individual policy than he or she would if added to an existing policy. But in Rhode Island, an 18-year-old will pay an average of 53 percent more for an individual policy. In Connecticut and Oregon, the difference is 47 percent.

In states such as Arizona, Hawaii, and Illinois, it actually becomes cheaper, on average, for a young driver to get his or her own policy after turning 19. When it comes to determining premiums, Hawaii is the only state that doesn’t allow insurance providers to consider age, gender, or length of driving experience.

These are the five states with the greatest difference in premiums for young drivers buying their own coverage.

1. Rhode Island: 19 percent

2. Connecticut: 16 percent

3. North Carolina: 14 percent

4. Vermont: 14 percent

5. Maine: 14 percent

Related: Now 16-Year-Olds Can Double Your Car Insurance

And these five states have the smallest difference:

1. Hawaii: No difference

2. Illinois: No difference

3. Arizona: 2 percent

4. Mississippi: 5 percent

5. South Carolina: 5 percent.

Top Reads from The Fiscal Times:

- As Politicians Bicker Over Funding, Military Families Cut Back on Vacations

- Why We’re Wasting Billions on Teacher Development

- The Future of War Belongs to the Bots

It’s Official: No Government Shutdown – for Now

President Trump signed a short-term continuing resolution today to fund the federal government through Friday, December 22.

Bloomberg called the maneuver “a monumental piece of can kicking,” which is no doubt the case, but at least you’ll be able to visit your favorite national park over the weekend.

Here's to small victories!

Greenspan Has a Warning About the GOP Tax Plan

The Republican tax cuts won’t do much for economic growth, former Federal Reserve Chair Alan Greenspan told CNBC Wednesday, but they will damage the country’s fiscal situation while creating the threat of stagflation. "This is a terrible fiscal situation we've got ourselves into," Greenspan said. "The administration is doing tax cuts and a spending decrease, but he's doing them in the wrong order. What we need right now is to focus totally on reducing the debt."

The US Economy Hits a Sweet Spot

“The U.S. economy is running at its full potential for the first time in a decade, a new milestone for an expansion now in its ninth year,” The Wall Street Journal reports. But the milestone was reached, in part, because the Congressional Budget Office has, over the last 10 years, downgraded its estimate of the economy’s potential output. “Some economists think more slack remains in the job market than October’s 4.1% unemployment rate would suggest. Also, economic output is still well below its potential level based on estimates produced a decade ago by the CBO.”

The New York Times Drums Up Opposition to the Tax Bill

The New York Times editorial board took to Twitter Wednesday “to urge the Senate to reject a tax bill that hurts the middle class & the nation's fiscal health.”

Using the hashtag #thetaxbillshurts, the NYT Opinion account posted phone numbers for Sens. Susan Collins, Bob Corker, Jeff Flake, James Lankford, John McCain, Lisa Murkowski and Jerry Moran. It urged readers to call the senators and encourage them to oppose the bill.

In an editorial published Tuesday night, the Times wrote that “Republican senators have a choice. They can follow the will of their donors and vote to take money from the middle class and give it to the wealthiest people in the world. Or they can vote no, to protect the public and the financial health of the government.”

Like what you're reading? Sign up for our free newsletter.

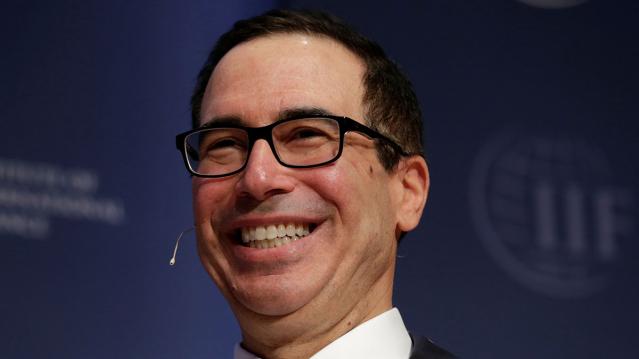

Can Trump Succeed Where Mnuchin and Cohn Have Flopped?

President Trump met with members of the Senate Finance Committee Monday and is scheduled to attend Senate Republicans’ weekly policy lunch and make a personal push for the tax plan on Tuesday. Will he be a more effective salesman than surrogates in his administration?

Politico’s Annie Karni and Eliana Johnson report that both Democrats and Republicans say Mnuchin and chief economic adviser Gary Cohn have repeatedly botched their tax pitches, “in part due to their own backgrounds” as wealthy Goldman Sachs alums. “House Speaker Paul Ryan earlier this month asked the White House not to send Mnuchin to the Hill to talk with Republican lawmakers about the bill, according to two people familiar with the discussions — though Ryan has praised the Treasury secretary’s ability to improve the legislation itself,” Karni and Johnson write.