How Good Is Your Insurance? ‘Cadillac Tax’ Looms for Large Employer Health Plans

While most companies expect health care cost increases to hold steady next year, nearly half of large employers say that if they can’t find new ways to cut costs, they’re going to cross the “Cadillac tax” threshold in 2018, according to a new study by the National Business Group on Health.

Passed as part of the Affordable Care Act and going into effect in 2018, the Cadillac tax will hit employers whose plans cost more than $10,200 for an individual or $27,500 for a family. The employer will have to pay a 40 percent tax on the cost of each plan above those levels.

Among the companies surveyed, 48 percent said that at least one of their benefit plans would trigger the Cadillac Tax. By 2020, 72 percent of employers say one of their plans will trigger the tax, and 51 percent say their most popular plan will be subject to the tax.

Related: Obamacare’s Cadillac Tax Hits the College Campus

“The need to control rising health care benefits costs has never been greater,” NGBH President and CEO Brian Marcotte said in a statement. “Rising costs have plagued employers for many years and now the looming excise tax is adding pressure.”

Employers expect keep benefit costs increases to 5 percent this year by pushing more costs onto workers via consumer-directed health plans (76 percent) and expanding wellness initiatives (70 percent).

None of the 425 employers surveyed said they planned to eliminate their health care coverage, but nearly a quarter said they’d consider offering employees a private exchange.

Top Reads from the Fiscal Times:

- How ‘King Coal’ Could Swing the 2016 Election

- Kerry to Congress: Sign the Iran Deal or the Dollar Gets Hit

- China’s Currency Devaluation Brings Stocks to a 'Death Cross'

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

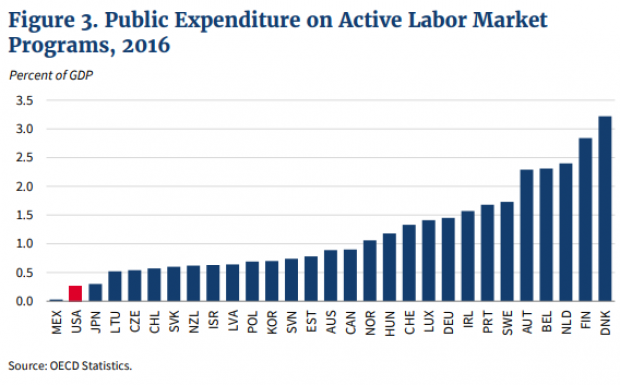

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.