John Kasich’s Latest Endorsement Could Be a Game-Changer

Ohio’s Republican Gov. John Kasich on Monday sought to enshrine his status as a top-tier presidential candidate when he rolled out the endorsement of Alabama Gov. Robert Bentley.

“John Kasich is a leader whose readiness to lead our nation on his first day in the Oval Office is unmatched,” Bentley said during a joint appearance at the Alabama Sports Hall of Fame. “America needs John Kasich, and I am going to do everything I can to help make sure he is our next president.”

Related: 10 Things You Need to Know About John Kasich

On paper, the Republican governor of a deep-red Southern state endorsing a GOP presidential candidate months before the first primary votes are cast may not come as much of a surprise, but it could ultimately mean a great deal for Kasich’s White House bid.

The Ohio Republican, with his compassionate conservative message, has touted himself as a moderate in the crowded GOP field; winning the support of the executive of one of the most conservative states in the nation could help him broaden his appeal in the party.

Alabama is set to play a major role in the GOP’s 2016 nomination process. The state is one of eight in the South that will hold a vote on March 1 in the so-called “SEC primary.”

Sen. Ted Cruz (R-TX), another White House hopeful, has called the cluster of states the “firewall” for his candidacy and wrapped up a southern bus tour last week, drawing large crowds in Tennessee, Mississippi and Arkansas.

Related: Did Kasich Just Do an About-Face on Climate Change?

By making hay of Bentley’s endorsement, Kasich also aims to stay in the spotlight and secure his place on the main stage when Republicans meet again next month for their second debate.

Kasich announced his candidacy just a few weeks before the first debate in Cleveland earlier this month in the hope that his initial splash in the polls would be enough for him to make the cut-off for the prime time event. The strategy paid off; Kasich received standing ovations and thunderous applause whenever he answered a question before the home state crowd.

But surveys taken since the debate show former Hewlett-Packard CEO Carly Fiorina surging in the polls, meaning another contender is likely to get bumped off stage.

After Bentley’s announcement, Kasich, who has bet his candidacy on winning the New Hampshire primary and watched his numbers steadily rise there, will make a campaign swing through the Granite State, Iowa and South Carolina.

Top Reads from The Fiscal Times

- Mark Cuban: Here’s Why Republicans Will Lose the Election

- Here Are 5 Democrats Who Could Scuttle the Iran Deal

- 9 Trump Positions that Make Liberals Want to Move to Canada

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

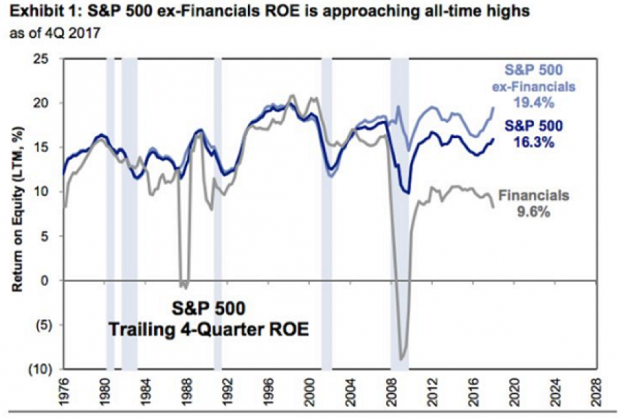

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.