Facebook Hit a Mind-Boggling Milestone This Week

You know what’s cooler than having hundreds of millions of people use your product every day? Having a billion people use it in one day.

That’s what happened for Facebook for the first time on Monday when more than a billion people logged on to the social network, according to a post on CEO Mark Zuckerberg’s page. That’s one in seven people worldwide.

That means that a billion people potentially saw the ads that help generate the revenue that has powered Facebook’s growth. In particular, Facebook has been at the forefront of the shift toward earning ad dollars via online video, the fastest-growing digital advertising category.

Related: Will Facebook Kill the News Media or Save It?

Zuckerberg didn’t mention revenue in his post. Instead, he wrote that he is proud of the community built by the social network and said that connecting the world is making it a better place. “It brings stronger relationships with those you love, a stronger economy with more opportunities, and a stronger society that reflects all of our values.”

The milestone comes as the social network has been moving aggressively to monitor user habits and expand its product offerings to include instant messaging, photo-sharing and now a new virtual assistant. It has also explored moving into the e-wallet space and is reportedly looking into developing a credit rating system based on a user’s network.

While a billion users a day is nothing to scoff at, the company—as always—is dreaming bigger. Last month, Facebook finished construction of a drone that it hopes will provide Internet access to remote parts of the world. That way everyone everywhere can be wished a “Happy Birthday” by 300 people they haven’t spoken to in years.

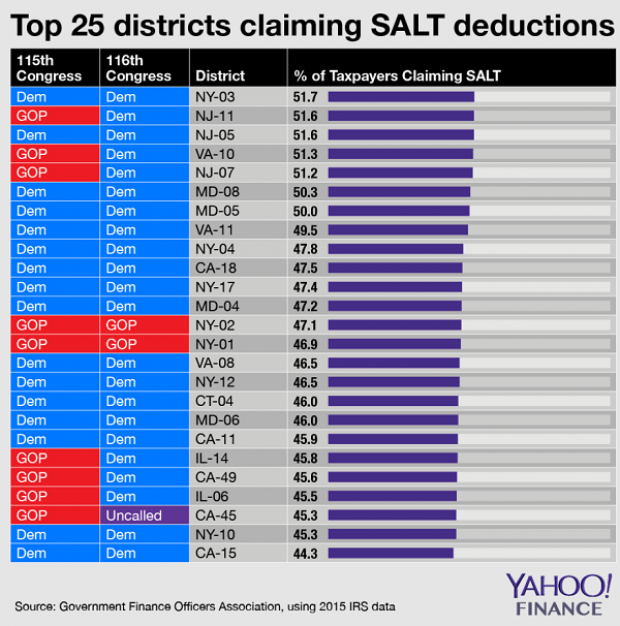

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

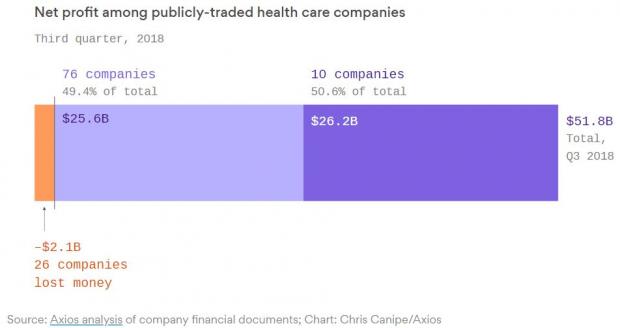

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

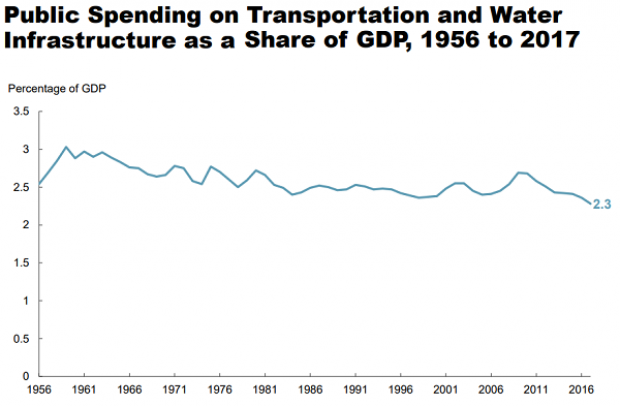

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.