Doctors to Trump: Deporting Illegal Immigrants Would Be Bad for U.S. Health

The American College of Physicians has a message for Donald Trump and any other presidential contender advocating for mass deportation of illegal immigrants: Any plan to kick out those 12 million people from the country could have severe public health consequences.

On Tuesday, the doctors’ group, which represents 143,000 internists, released a statement urging physicians to take a stand against proposals for mass deportation.

Related: Vast Majority of Americans Say Illegal Immigrants Should Stay

“Large-scale deportation of undocumented residents would have severe and unacceptable adverse health consequences for many millions of vulnerable people,” Dr. Wayne J. Riley, the groups’ president, said in a statement. “Numerous studies show that deportation itself, as well as the fear of being deported, causes emotional distress, depression, trauma associated with imposed family separations, and distrust of anyone assumed to be associated with federal, state and local government, including physicians and other health care professionals providing care in publicly-funded hospitals and clinics.”

That distrust, in turn, could result in sick people not getting medical attention, and in cases of patients with infectious diseases, it could even lead to a public health emergency with tremendous costs to the to the overall health care system, the group warned.

On the other hand, having illegal immigrants in the country carries health care costs, too. Medicaid pays around $2 billion a year for emergency treatment for illegal immigrants, Kaiser Health News reported in 2013, adding that the total represents less than 1 percent of total Medicaid costs.

Related: Birthright Citizenship, the New Immigration Scam

Still, the American College of Physicians said doctors have an ethical obligation to advocate for the health interests of all people, without consideration of their residency status.

“Physicians and other health professionals must remind politicians and policymakers that deporting millions of vulnerable people would have adverse health care consequences, not only for the people directly affected and their families, but also for their local communities and for the United States as whole,” Riley said in the statement. “Instead, we need a balanced immigration policy that ensures access to healthcare for all U.S. residents while recognizing that we need appropriate controls over who is admitted.”

Top Reads From The Fiscal Times

- The 10 States with the Worst Roads

- 5 Reasons the Trump Immigration Plan Doesn’t Pass the Reality Test

- Scott Walker Adjusts His Immigration Stance. Again.

Wages Are Finally Going Up, Sort of

Average hourly earnings last month rose by 2.9 percent from a year earlier, the Labor Department said Friday — the fastest wage growth since the recession ended in 2009. The economy added 201,000 jobs in August, marking the 95th straight month of gains, while the unemployment rate held steady at 3.9 percent.

Analysts noted, though, that the welcome wage gains merely kept pace with a leading measure of inflation, meaning that pay increases are largely or entirely being canceled out by higher prices. “The last time unemployment was this low, during the dot-com boom, wage growth was significantly faster — well above 3.5 percent,” The Washington Post’s Heather Long wrote. The White House Council of Economic Advisers this week issued a report arguing that wage gains over the past year have been better than they appear in official statistics.

Cost of Trump’s Military Parade Rising Fast

It looks like President Trump’s military parade is going to cost a lot more than the initial estimate suggested – about $80 million more.

The Department of Defense pegged the cost of the parade at roughly $12 million back in July, but CNBC reported Thursday that Pentagon officials have increased their estimate to $92 million. The total consists of $50 million from the Defense Department and $42 million from other agencies, including the Department of Homeland Security.

The parade, which President Trump requested after attending a Bastille Day military parade in Paris last year, is scheduled for November 10 and will reportedly include aircraft, armored vehicles and soldiers in period uniforms. Abrams tanks, which weigh roughly 70 tons apiece, will also be included, CNBC said, despite concerns about heavy military equipment ripping up the streets of Washington. A Pentagon analysis apparently found that the armored vehicle’s treads would not cause any damage.

The parade is expected to begin at the Capitol, continue past the White House and end at the National Mall, according to earlier reports from NBC News.

Quote of the Day: Time to Raise Taxes?

“Tax revenue as a percentage of gross domestic product is expected to be 16.5 percent next year. The long-term average in a full-employment economy is 18.5 percent of GDP; if revenue were at that level for the coming decade, debt would be $3.2 trillion lower and the 10-year fiscal gap would be halved. Returning to past revenue levels, however, will be inadequate over time, because an aging population will increase Medicare and Social Security costs. This need not pose a problem: Revenue was roughly 19 percent of GDP in the late 1990s, and economic conditions were excellent.”

– Former U.S. Treasury Secretary Richard E. Rubin, writing in The Washington Post

Quote of the Day: When Tax Cuts Pay for Themselves

“You … often hear the claim that a lot of tax cuts will ‘pay for themselves,’ that they’ll cause so much additional economic activity that the revenue feedback from that activity will fully offset the direct revenue loss caused by the tax cut so that you end up making money for the federal government, or at least not losing any money. Now, of course that is theoretically possible and it would happen at extreme rates. I mean if a country had a 99 percent flat rate income tax and lowered it to 98 percent, I believe that they almost certainly would collect more revenue at the 98 percent rate than they did at the 99 percent rate. But the idea that this type of effect would occur at today’s tax levels just requires responses that are much bigger than statistical evidence would support and I think much bigger than common sense would indicate if you just ask people how they themselves would react to the tax cut.”

-- Alan Viard, tax policy expert at the American Enterprise Institute

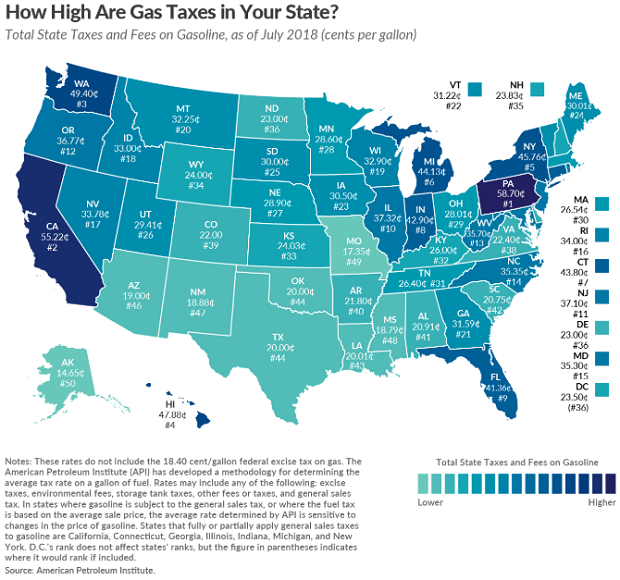

Map of the Day: Gas Taxes

It’s summertime and the driving is anything but easy if you want to get to your favorite beach or mountain cabin for a well-deserved break. As lawmakers consider a plan to raise federal fuel taxes by 15 cents a gallon, here’s a look at the current state-level taxes on gasoline, courtesy of the Tax Foundation: