How CNN Is Cashing In on Trump-Mania

Fox News’s GOP debate last month generated blockbuster ratings — 24 million viewers saw Donald Trump and the other top Republican presidential contenders mix it up, making it the most-watched non-sports cable show ever. Now Fox News rival CNN is poised to cash in on that success.

The news network is asking advertisers to pay 40 times its usual rate, or as much as $200,000 for a 30-second commercial, during the second GOP debate, which it is scheduled to host on Sept. 16, according to Ad Age. CNN is also charging $50,000 to $60,000 for commercials airing that day in the earlier debate between second-tier candidates.

Related: Two New Polls Show Exactly Why Donald Trump Is Winning

Ad Age says CNN isn’t expected to pull in quite the same level of viewership as Fox News did, but even if the next primetime debate fails to match the earlier numbers, it is still likely to be the most-watched debate CNN has ever aired. The network can thank Trump for that, just as it could thank another outspoken and unpredictable GOP phenomenon for helping to set its previous debate record: In 2008, almost 11 million viewers tuned in to the vice presidential debate between Joe Biden and — you betcha! — Sarah Palin.

If the Palin example holds, news networks aren’t going to be the only ones to benefit from the Trump surge. “Saturday Night Live” saw its viewership and buzz soar in 2008 as Tina Fey’s impersonation of Palin became a sensation in its own right. And when the former Alaska governor appeared on SNL in October 2008, the show drew its highest ratings in 14 years.

Related: Trump Is Still Surging — Here’s Who Can Stop Him

The new season of SNL starts Oct. 3, so it’s probably a safe bet that Lorne Michaels — and other executives at NBC, even after the network dumped Trump from The Celebrity Apprentice in the wake of his comments about Mexican immigrants — are rooting for Trump mania to keep going for another month, at least. In the meantime, NBC announced Tuesday that Trump will appear on “The Tonight Show” next week.

Top Reads from The Fiscal Times:

- Doctors to Trump: Deporting Illegal Immigrants Would Be Bad for U.S. Health

- How Much Does Our Social Safety Net Cost? $742 Billion a Year and Rising

- If Clinton Loses Her Security Clearance, Could She Still Be President?

Economists See More Growth Ahead

Most business economists in the U.S. expect the economy to keep chugging along over the next three months, with rising corporate sales driving additional hiring and wage increases for workers.

The tax cuts, however, don’t seem to be playing a role in hiring and investment plans. And the trade conflicts stirred up by the Trump administration are having a negative influence, with the majority of economists at goods-producing firms who replied to the most recent survey by the National Association for Business Economics saying that their companies were putting investments on hold as they wait to see how things play out.

New Tax on Non-Profits Hits Public Universities

The Republican tax bill signed into law late last year imposed a 21 percent tax on employees at non-profits who earn more than $1 million a year. According to data from the Chronicle of Higher Education cited by Bloomberg, there were 12 presidents of public universities who received compensation of at least $1 million in 2017, with James Ramsey of the University of Louisville topping the list at $4.3 million. Endowment managers could also get hit with the tax, as could football coaches, some of whom earn substantially more than the presidents of their institutions.

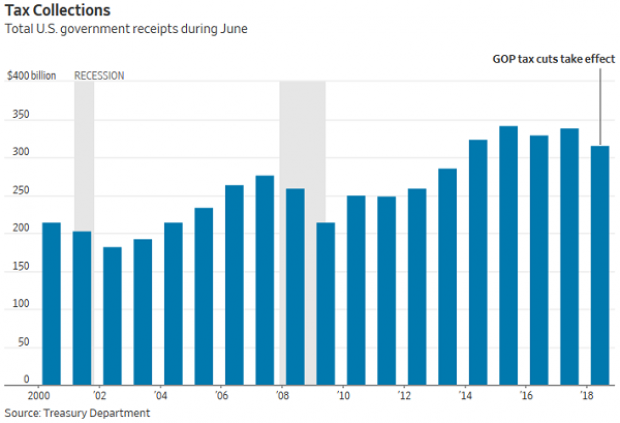

Government Revenues Drop as Tax Cuts Kick In

Corporate tax receipts in June were 33 percent lower than a year ago, according to data released by the Treasury Department Thursday, as companies made smaller estimated payments due to the reduction in their tax rates. Total receipts were down 7 percent, while payroll taxes were 5 percent lower compared to June 2017.

“June receipts to US government were our first mostly-clear look at the revenue effects of the new tax law, with lots of estimated payments and little noise from the 2017 tax year,” The Wall Street Journal’s Richard Rubin tweeted Friday.

Surprisingly, the deficit was smaller in June compared to a year ago, narrowing to $74.86 billion from $90.23 billion last year. The drop was driven by a 9 percent reduction in government outlays that reflected accounting changes rather than any real changes in spending, Rubin said in the Journal.

“More broadly, the federal deficit is swelling as government spending outpaces revenues,” Rubin wrote. “The budget gap totaled $607.1 billion in the first nine months of the 2018 fiscal year, 16% larger than the same point a year earlier.”

Kyle Pomerleau of the Tax Foundation pointed out that the drop in corporate tax receipts is a permanent feature of the Republican tax cuts, tweeting: “Even in a Trump dream world in which these cuts paid for themselves, corporate tax collections would remain below baseline forever. It would be higher income and payroll receipts that made up the difference.”

Deficit Jumps in Trump’s First Fiscal Year

The federal budget deficit rose by 16 percent in the first nine months of the 2018 fiscal year, which began last October. The shortfall came to $607 billion, compared to $523 billion in the same period the year before, according to a U.S. Treasury report released Thursday and reported by Bloomberg. Both revenue and spending rose, but spending rose faster. Revenues came to $2.54 trillion, up 1.3 percent from the same nine-month period in 2017, while spending came to $3.15 trillion, up 3.9 percent.

Where’s the Obamacare Navigator Funding for 2019, PA Insurance Commissioner Asks

Pennsylvania’s insurance commissioner sent a letter this week to Health and Human Services Secretary Alex Azar and Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma requesting that they “immediately release the funding details for the Navigator program for the upcoming open enrollment period for 2019.” Navigators are the state and local groups that help people sign up for Affordable Care Act plans.

“In years past, grant applications and new funding opportunities were released by CMS in April, CMS required Navigator organizations to apply by June and approved applications and new funding by late August,” Pennsylvania’s Jessica Altman wrote. “The current lack of guidance has put Navigator organizations – and states - far behind in their planning and creates an inability for the Navigator organizations to design a successful plan for helping people enroll during the 2019 open enrollment period.”