The 15 Most Valuable NFL Teams

The New England Patriots may be reigning Super Bowl champs and have the most successful quarterback-coach pair in NFL history -- Tom Brady and Bill Belichick each have four championship rings with the Pats -- but they’re missing something nevertheless.

As they kick off the season tonight against the Pittsburgh Steelers, the Pats aren’t at the top of the NFL in terms of team value. That title still goes to the Dallas Cowboys, according to an analysis at Forbes.

Related: 10 Big Money NFL Draft Busts

Dallas must be feeling pretty good about beating New England at something. They had the same regular season record as the Patriots last year, with 12 wins and 4 losses, but ended the season with a loss to the Green Bay Packers in the divisional playoffs, while the Pats went on to win Super Bowl XLIX (that’s 49 for all you non-Romans out there).

Even though the Washington Redskins have been playing pretty pathetically for the past decade, they still come in third. Washington’s NFC East rival, the New York Giants, rank fourth at $2.1 billion.

Here are the 15 most valuable NFL teams:

- Dallas Cowboys - $3.2 billion

- New England Patriots - $2.6 billion

- Washington Redskins - $2.4 billion

- New York Giants - $2.1 billion

- Houston Texans - $1.85 billion

- New York Jets - $1.8 billion

- Philadelphia Eagles - $1.75 billion

- Chicago Bears - $1.7 billion

- San Francisco 49ers - $1.6 billion

- Baltimore Ravens - $1.5 billion

- Denver Broncos - $1.45 billion

- Indianapolis Colts - $1.4 billion

- Green Bay Packers - $1.38 billion

- Pittsburgh Steelers - $1.35 billion

- Seattle Seahawks - $1.33 billion

Top Reads from the Fiscal Times:

- After the Fiorina Fiasco, What Insult Will Trump Fling Next?

- $42 Million for 54 Recruits? U.S. Program to Train Syrian Rebels Is a Disaster

- A Military Coup in the U.S.? A Surprising Number of Americans Might Support One

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

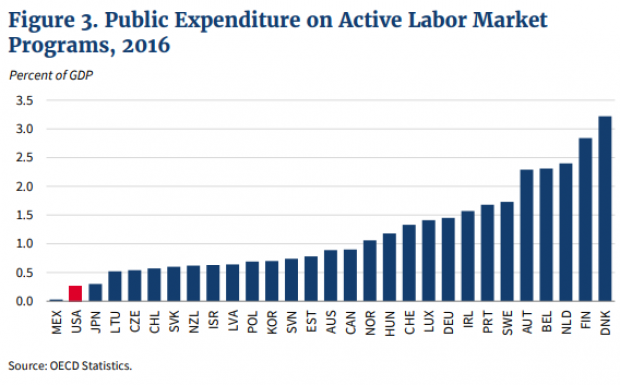

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.