As it braces for another tax season, the beleaguered Internal Revenue Service has received a highly mixed review on its performance in detecting and thwarting income tax fraud.

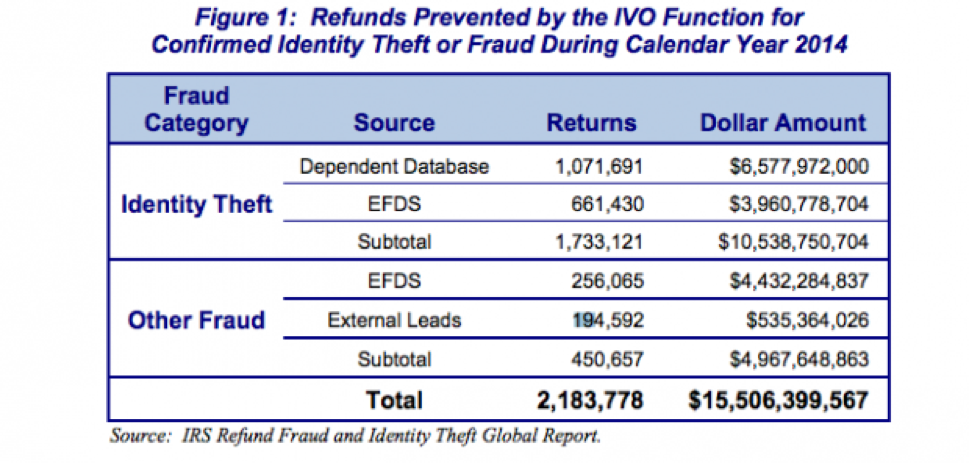

On the positive side, the agency’s monitoring system prevented more than $15 billion in fraud during 2014, according to a new audit report issued this week by the Treasury Inspector General for Tax Administration.

Related: Budget Cuts and Mismanagement Boost IRS Tax Cheats

Based on a review of 2.18 million tax returns, the system uncovered $10.5 billion of fraud due to identity theft and $4.96 billion of other fraudulent activity, according to the report.

However, a computer programming error and what the IG deemed as the ineffective monitoring of potentially fraudulent tax returns resulted in the erroneous release of more than $46 million in refunds last year before the IRS could confirm the information was correct, according to the report.

The IG’s investigative staff initiated the audit after an IRS whistleblower reported that the IRS was not working some taxpayer cases involving refunds. As a result, there was a good chance those refunds would be automatically released by computer before the agency could verify the accuracy of reported income and withholding information.

The IRS and its enforcement operations have become a popular punching bag in Washington in recent years, especially after Republican lawmakers began hammering officials and slashing their budgets amid accusations of legally suspect oversight of conservative, tax-exempt organizations. In this case, the shortcomings in the review process appear relatively minor compared to the billions of dollars of tax fraud thwarted by agency’s Integrity and verification operations.

Related: IRS Scandal Strikes a Severe Blow to Big Government

However, the IG cautioned that even minor errors in issuing tax returns before questions have been cleared up can snowball into much larger losses of tax revenue to the government.

“While the IRS has made important strides in its programs that prevent the issuance of fraudulent refunds, our auditors found that it is not always ensuring that tax examiners timely complete their verification work before releasing refunds,” J. Russell George, Treasury Inspector General for Tax Administration, said in a statement accompanying the audit.

For example, IG investigators found that, because of a computer programming glitch, more than $27 million of refunds were erroneously issued for 13,043 tax returns for 2013. That programming error essentially was overriding the agency’s two-week processing delay on some refund tax returns that the IRS identified as potentially fraudulent, according to the report.

Investigators also identified 3,910 tax returns for 2013 that the IRS had selected for verification with no indication that tax examiners verified the returns. “The IRS issued refunds totaling over $19 million for these tax returns,” according to the report. “Refund holds were either not set correctly or not functioning as intended.”

Related: Obamacare’s Next Challenge: IRS Verification

The IG’s report suggested a number of recommendations for improving the fraud review process and correcting the programing, which IRS officials promptly accepted.