There is certain to be some excitement Thursday morning when officials from two notorious pharmaceutical companies appear before a House committee to explain huge increases in the price of some of their drugs.

The atmosphere will be especially combative if Martin Shkreli, the former CEO of Turing Pharmaceuticals, shows up and agrees to testify. Shkreli, the media-savvy, one-time hedge fund manager, became the scourge of the pharmaceutical industry after his company acquired the rights to Daraprim – a decades-old drug used to treat parasitic infections in cancer and HIV patients – and then raised the price from $13.50 to $750 a pill.

Related: Ignoring Warnings, Drug Companies Hike Prices By 10 Percent

The cocky, 32-year-old executive was ousted from his company last December after being arrested and charged in an unrelated securities fraud case. He has said he is likely to invoke his Fifth Amendment right against self-incrimination and refuse to answer the committee’s questions, assuming he is in attendance.

Valeant Pharmaceuticals is another company that will be on the hot seat for the same practice of purchasing the rights to drugs that have been on the market for years and then jacking up their prices.

For example, the price of Mephyton, a blood-coagulating drug, has been raised eight times since July 2014, from $9.37 a tablet to $58.76, according to The New York Times. In similar fashion, the price of Edecrin, a diuretic, has been raised nine times since May 2014, from $470 a vial to an eye-popping $4,600.

And according to thousands of pages of documents obtained by the House committee, Turing and Valeant appear to have built their business models around significantly increasing the prices of drugs they did not invent or develop.

Related: Extreme Rise in Some Drug Prices Reaches a Tipping Point

Rep. Elijah E. Cummings of Maryland, the ranking Democrat on the House Committee on Oversight and Government Reform, voiced outrage and shock that many drug companies are “lining their pockets at the expense of some of the most vulnerable families in our nation.”

But he shouldn’t have been all that surprised. As Shkreli has freely acknowledged, plenty of drug companies have pursued the same business model -- either jacking up the price of a drug after acquiring the rights or simply boosting prices on drugs that have long been part of a company’s line.

"It's a great business decision that also benefits all of our stakeholders," Shkreli tweeted last year.

Gilead Sciences, for example, purchased Pharmasset in 2011 for $11 billion and then made a fortune bringing out the hepatitis-C miracle drugs Sovaldi and Harvoni and charging a retail price of $84,000 for a single course of treatment.

The wholesale price for 30 of the top-selling U.S. drugs increased 76 percent between 2010 and 2014, according to the House oversight committee – eight times the general rate of inflation.

Related: Drug Company Profits Soar as Taxpayers Foot the Bill

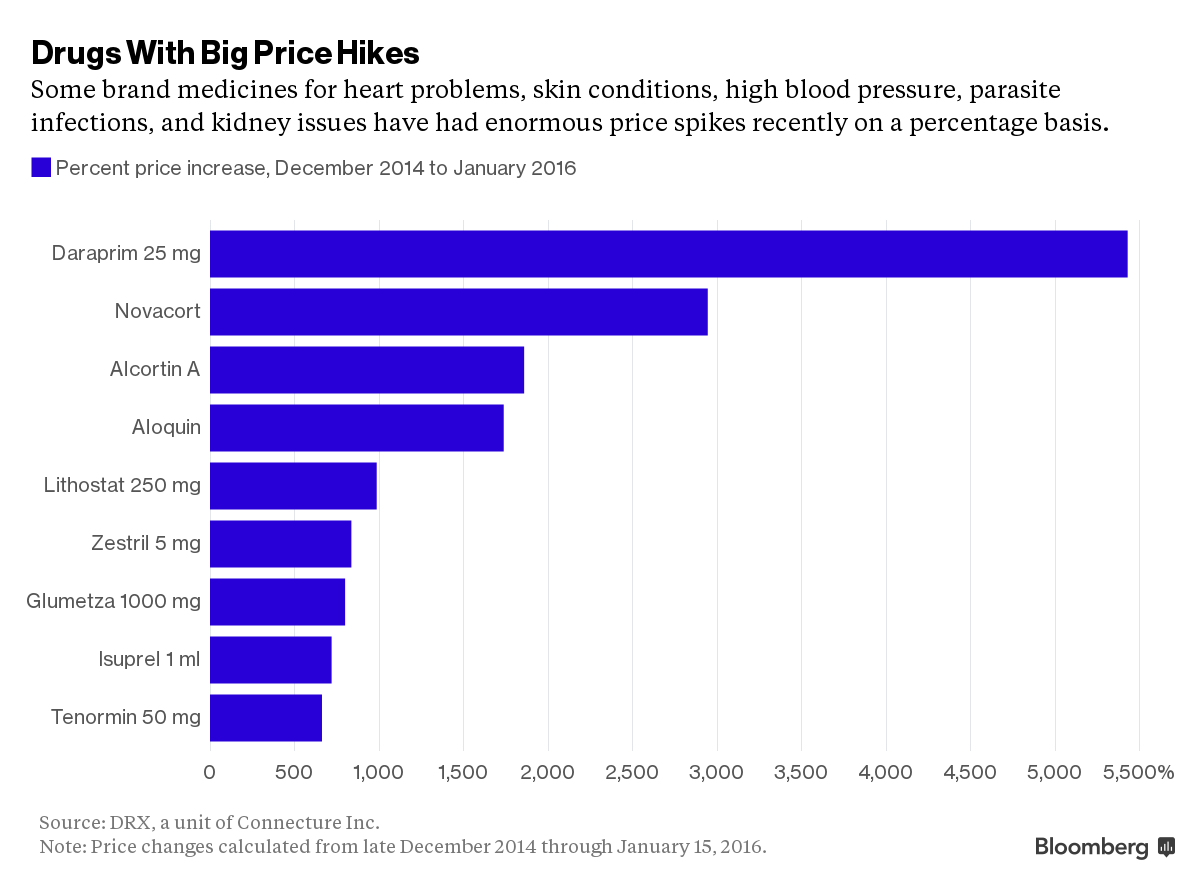

The latest confirmation of these trends comes from a new survey released this week of roughly 3,000 brand-name prescription drugs. The survey by DRX found that prices had doubled for 60 of the drugs and at least quadrupled for 20 others since December 2014, according to Bloomberg.

Among the more notable price hikes found by DRX, which provides price data within the health industry:

- The price of Alcortin A, a steroid and antibiotic gel to treat eczema and skin infections manufactured by Novum Pharma, soared by 1,860 percent during the period surveyed.

- Pfizer raised prices for 24 drugs by at least 12 percent, with Viagra increasing about 13 percent and the price of two heart drugs going up 44 percent and 86 percent.

- GlaxoSmithKline increased prices by 15 percent on 22 products, including Lamictal XR for epilepsy.

Here is a chart that highlights the survey’s findings: