The professional sports world was in high gear again on Sunday as most National Football League teams held their season openers while Major League Baseball teams continued to slug it out for a spot in the playoffs.

Team owners will rake in tens of billions of dollars as professional sports teams are likely to have another banner year. Yet most of the games will be played in gleaming new stadiums and sports palaces heavily subsidized by federal taxpayers.

Related: Here’s Why It Will Be So Hard for Trump or Clinton to Rebuild America

While they ostensibly are privately owned, sports arenas for football, baseball, basketball and hockey have been showered with billions of dollars of tax subsidies to defray their construction costs according to a new Brookings Institution study called “Tax-exempt municipal bonds and the financing of professional sports stadiums.”

More than three dozen luxurious major league baseball, football, hockey and basketball stadiums and arenas across the country were financed with tax-exempt municipal revenue bonds that have substantially lowered the teams’ cost of borrowing for construction while creating a drain on the federal Treasury.

Since 2000, the federal government has subsidized newly constructed or renovated professional sports stadiums to the tune of $3.2 billion while providing more than $400 million in federal tax write offs for wealthy investors – resulting in a direct revenue loss of $3.7 billion.

The researchers were ambitious in attempting to estimate every dollar of savings on interest costs and taxes that stadium owners were able to achieve by going the route of tax-exempt municipal bonds instead of other taxable bonds or borrowing. To some degree, they engaged in supposition in reaching the total of the subsidy to the owners. They more precisely calculated how much the bond holders avoided in federal taxes, which constituted a more direct drain on the Treasury.

Related: The House Resorts to More Gimmicks to Pass $325 Billion Highway Bill

Major League Baseball claimed the largest share of the subsidy, with $1.41 billion, according to the study, followed by the NFL with $1.1 billion, the National Basketball Association with $444 million and the National Hockey League with $236 million.

Municipal bonds are considered one of the safest-long-term investment because they are backed up by state or local governments. Because they are so secure, they typically carry interest rates well below the going rate for Treasury bills or other forms of bonds.

By having to pay considerably less in interest costs to finance the construction of their stadium using municipal bonds instead of other bonds subject to federal taxation, team owners reaped a substantial federal tax subsidy that helped reduce their overall construction costs, according to the study. Meanwhile, high income investors were willing to accept a lower rate of return because the municipal bonds were exempt from federal taxation.

Related: The NFL’s 10 Most Expensive Stadiums for Fans

One case in point: When the New York Yankees completed work on the new Yankee Stadium in 2009, the total construction cost was roughly $2.5 billion. While the owners had to dig into their pockets to cover part of the cost, nearly $1.7 billion of the total was financed by tax-exempt municipal bonds issued by the city of New York.

“Because the interest earned on the municipal bonds is exempt from federal taxes, a large amount of tax revenue that would have been collected—had the bonds been issued as taxable—went toward the construction of the stadium,” according to the new Brookings study. “In other words, the Yankees received a federal subsidy to build their stadium. How much? About $431 million.”

But that’s just part of it. The government foregoes millions of dollars more in taxes to high-income taxpayers holding the municipal bonds. In the case of Yankee Stadium, the additional tax loss to the Treasury was $61 million.

Taken together, the subsidies for the Yankees and the tax write-offs for municipal bond holders totaled $492 million.

Related: The NFL’s 10 Most Expensive Stadiums for Fans

“With so much money at stake, it’s worth asking: Should the federal government be spending money on these stadiums?” wrote the authors of the report, Ted Gayer, Austin J. Drukker and Alexander K. Gold. “Federal subsidies are justified for infrastructure projects that provide a public good across states, but local sports stadiums clearly do not meet this criterion.”

What’s more, the authors assert, there is scant evidence that new stadiums provide much local economic benefits. “Decades of academic studies consistently find no discernible positive relationship between sports facilities and local economic development, income growth, or job creation,” they concluded. “And local benefits aside, there is clearly no economic justification for federal subsidies for sports stadiums.”

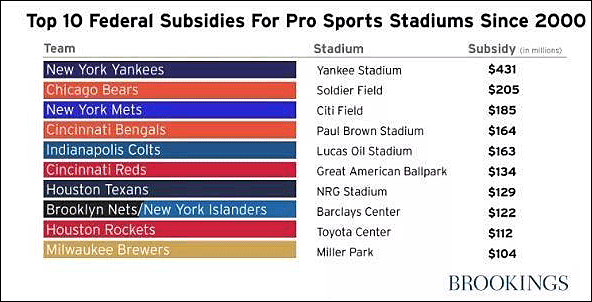

Here is a list of the ten biggest government handouts to the sports world: