Even as millions of Millennials find themselves reaching the secure financial footing necessary to consider homeownership, in many parts of the country there just aren’t many houses for them to buy.

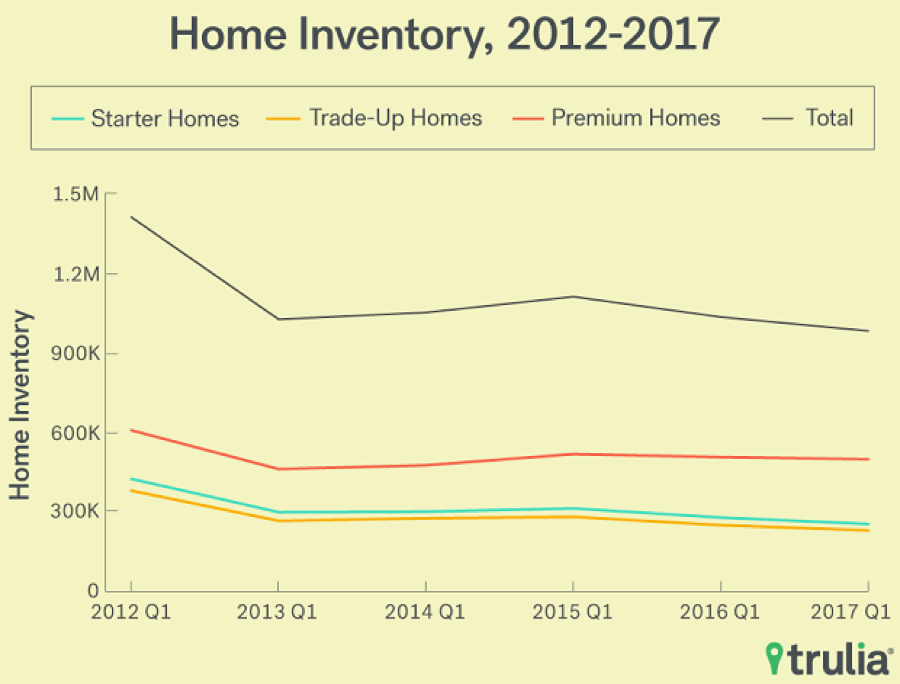

The number of starter homes on the market nationally has fallen 8.7 percent over the past five years, according to a new report from Trulia. At the same time, starter homes have gotten less affordable.

Related: The 9 Hottest Housing Markets to Start 2017

The typical starter-home buyer would need to spend 38 percent of their income on a home purchase, up from 35 percent in 2012. Many expert advise that housing costs shouldn’t eat up more than a third of your income.

The report suggests that investors may be partly to blame for the lack of inventory, since many starter homes were purchased during the recession and converted into rental properties. Another factor may be the lower inventory of trade-up homes, which means that move-up buyers aren’t selling their starter homes as quickly as they may have in previous markets.

While the market for trade-up homes is slightly more favorable to buyers than the starter–home market, inventory in that space has declined 7.9 percent in the past five years. Buyers of trade-up homes will need to spend 25.6 percent of their income on housing, up from 24 percent in 2012.

One thing that homebuyers have going in their favor is a loosening of credit. Credit availability improved in February, according to the Mortgage Bankers Association, marking the sixth-consecutive month of increases.