Martin Feldstein Is Optimistic About Tax Cuts, and Long-Term Deficits

In a new piece published at Project Syndicate, the conservative economist, who led President Reagan’s Council of Economic Advisers from 1982 to 1984, writes that pro-growth tax individual and corporate reform will get done — and that any resulting spike in the budget deficit will be temporary:

“Although the net tax changes may widen the budget deficit in the short term, the incentive effects of lower tax rates and the increased accumulation of capital will mean faster economic growth and higher real incomes, both of which will cause rising taxable incomes and lower long-term deficits.”

Doing tax reform through reconciliation — allowing it to be passed by a simple majority in the Senate, as long as it doesn’t add to the deficit after 10 years — is another key. “By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses,” Feldstein argues.

Of course, the big questions remain whether tax and spending changes are really designed as Feldstein describes — and whether “future revenue increases” ever come to fruition. Otherwise, those “long-term surpluses” Feldstein says we need won’t ever materialize.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

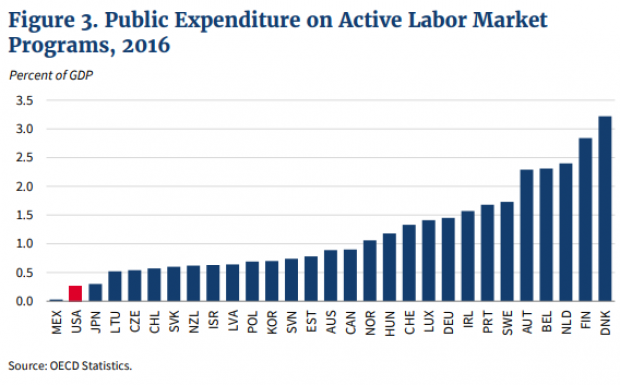

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.