Congress Sends Tax Bill to the White House

The Republican-controlled U.S. House of Representatives gave final approval on Wednesday to the biggest overhaul of the U.S. tax code in 30 years, sending a sweeping $1.5 trillion bill to President Donald Trump for his signature.

In sealing Trump’s first major legislative victory, Republicans steamrolled opposition from Democrats to pass a bill that slashes taxes for corporations and the wealthy while giving mixed, temporary tax relief to middle-class Americans.

The House approved the measure, 224-201, passing it for the second time in two days after a procedural foul-up forced another vote on Wednesday. The Senate had passed it 51-48 in the early hours of Wednesday.

Trump had emphasized a tax cut for middle-class Americans during his 2016 campaign. At the beginning of a Cabinet meeting on Wednesday, he said lowering the corporate tax rate from 35 percent to 21 percent was “probably the biggest factor in this plan.”

Trump planned a tax-related celebration with U.S. lawmakers at the White House in the afternoon but will not sign the legislation immediately. The timing of the signing was still up in the air.

After Trump repeatedly urged Republicans to get it to him to sign before the end of the year, White House economic adviser Gary Cohn said the timing of signing the bill depends on whether automatic spending cuts triggered by the legislation could be waived. If so, the president will sign it before the end of the year, he said.

The debt-financed legislation cuts the U.S. corporate income tax rate to 21 percent, gives other business owners a new 20 percent deduction on business income and reshapes how the government taxes multinational corporations along the lines the country’s largest businesses have recommended for years.

Millions of Americans would stop itemizing deductions under the bill, putting tax breaks that incentivize home ownership and charitable donations out of their reach, but also making tax returns somewhat simpler and shorter.

The bill keeps the present number of tax brackets but adjusts many of the rates and income levels for each one. The top tax rate for high earners is reduced. The estate tax on inheritances is changed so far fewer people will pay.

Once signed, taxpayers likely would see the first changes to their paycheck tax withholdings in February. Most households will not see the full effect of the tax plan on their income until they file their 2018 taxes in early 2019.

In two provisions added to secure needed Republican votes, the legislation also allows oil drilling in Alaska’s Arctic National Wildlife Refuge and repeals the key portion of the Obamacare health system that fined people who did not have healthcare insurance.

“We have essentially repealed Obamacare and we’ll come up with something that will be much better,” Trump said on Wednesday.

“Pillaging”

Democrats have called the tax legislation a giveaway to the wealthy that will widen the income gap between rich and poor, while adding $1.5 trillion over the next decade to the $20 trillion national debt, which Trump promised in 2016 he would eliminate as president.

“Today the Republicans take their victory lap for successfully pillaging the American middle class to benefit the powerful and the privileged,” said House Democratic leader Nancy Pelosi.

few Republicans, whose party was once defined by its fiscal hawkishness, have protested the deficit-spending encompassed in the bill. But most of them have voted for it anyway, saying it would help businesses and individuals, while boosting an already expanding economy they see as not growing fast enough.

“We’ve had two quarters in a row of 3 percent growth,” Senate Republican leader Mitch McConnell said after the Senate vote. “The stock market is up. Optimism is high. Coupled with this tax reform, America is ready to start performing as it should have for a number of years.”

Despite Trump administration promises that the tax overhaul would focus on the middle class and not cut taxes for the rich, the nonpartisan Tax Policy Center, a think tank in Washington, estimated middle-income households would see an average tax cut of $900 next year under the bill, while the wealthiest 1 percent of Americans would see an average cut of $51,000.

The House was forced to vote again after the Senate parliamentarian ruled three minor provisions violated arcane Senate rules. To proceed, the Senate deleted the three provisions and then approved the bill.

Because the House and Senate must approve the same legislation before Trump can sign it into law, the Senate’s late Tuesday vote sent the bill back to the House.

Democrats complained the bill was a product of a hurried, often secretive process that ignored them and much of the Republican rank-and-file. No public hearings were held and numerous narrow amendments favored by lobbyists were added late in the process, tilting the package more toward businesses and the wealthy.

U.S. House Speaker Paul Ryan defended the bill in television interviews on Wednesday morning, saying support would grow for after it passes and Americans felt relief.

“I think minds are going to change,” Ryan said on ABC’s “Good Morning America” program.

Reporting by David Morgan and Amanda Becker; Additional reporting by Richard Cowan, Roberta Rampton, Gina Chon and Susan Heavey; Editing by Jeffrey Benkoe and Bill Trott.

The 10 Worst States to Have a Baby

The birth rate in the U.S. is finally seeing an uptick after falling during the recession. Births tend to fall during hard economic times because having a baby and raising a child are expensive propositions.

Costs are not the same everywhere, though. Some states are better than others for family budgets, and health care quality varies widely from place to place.

A new report from WalletHub looks at the cost of delivering a baby in the 50 states and the District of Columbia, as well as overall health care quality and the general “baby-friendliness” of each state – a mix of variables including average birth weights, pollution levels and the availability of child care.

Mississippi ranks as the worst state to have a baby, despite having the lowest average infant-care costs in the nation. Unfortunately, the Magnolia State also has the highest rate of infant deaths and one of lowest numbers of pediatricians per capita.

Related: Which States Have the Most Unwanted Babies?

On the other end of the scale, Vermont ranks as the best state for having a baby. Vermont has both the highest number of pediatricians and the highest number of child centers per capita. But before packing your bags, it’s worth considering the frigid winters in the Green Mountain State and the amount of money you’ll need to spend on winter clothing and heat.

Here are the 10 worst and 10 best states for having a baby:

Top 10 Worst States to Have a Baby

1. Mississippi

- Budget Rank: 18

- Health Care Rank: 51

- Baby Friendly Environment Rank: 29

2. Pennsylvania

- Budget Rank: 37

- Health Care Rank: 36

- Baby Friendly Environment Rank: 51

3. West Virginia

- Budget Rank: 13

- Health Care Rank: 48

- Baby Friendly Environment Rank: 50

4. South Carolina

- Budget Rank: 22

- Health Care Rank: 43

- Baby Friendly Environment Rank: 49

5. Nevada

- Budget Rank: 39

- Health Care Rank: 35

- Baby Friendly Environment Rank: 46

6. New York

- Budget Rank: 46

- Health Care Rank: 12

- Baby Friendly Environment Rank: 47

7. Louisiana

- Budget Rank: 8

- Health Care Rank: 50

- Baby Friendly Environment Rank: 26

8. Georgia

- Budget Rank: 6

- Health Care Rank: 46

- Baby Friendly Environment Rank: 43

9. Alabama

- Budget Rank: 3

- Health Care Rank: 47

- Baby Friendly Environment Rank: 44

10. Arkansas

- Budget Rank: 12

- Health Care Rank: 49

- Baby Friendly Environment Rank: 37

Top 10 Best States to Have a Baby

1. Vermont

- Budget Ranks: 17

- Health Care Rank: 1

- Baby Friendly Environment Rank: 5

2. North Dakota

- Budget Rank: 10

- Health Care Rank: 14

- Baby Friendly Environment Rank: 10

3. Oregon

- Budget Rank: 38

- Health Care Rank: 2

- Baby Friendly Environment Rank: 14

4. Hawaii

- Budget Rank: 31

- Health Care Rank: 25

- Baby Friendly Environment Rank: 1

5. Minnesota

- Budget Rank: 32

- Health Care Rank: 5

- Baby Friendly Environment Rank: 12

6. Kentucky

- Budget Rank: 1

- Health Care Rank: 33

- Baby Friendly Environment Rank: 20

7. Maine

- Budget Rank: 25

- Health Care Rank: 10

- Baby Friendly Environment Rank: 15

8. Wyoming

- Budget Rank: 22

- Health Care Rank: 17

- Baby Friendly Environment Rank: 7

9. Iowa

- Budget Rank: 14

- Health Care Rank: 25

- Baby Friendly Environment Rank: 9

10. Alaska

- Budget Rank: 50

- Health Care Rank: 6

- Baby Friendly Environment Rank: 2

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Americans Are About to Get a Nice Fat Pay Raise

- You’re Richer Than You Think. Really.

Worried About a Recession? Here’s When the Next Slump Will Hit

The next recession may be coming sooner than you think.

Eleven of the 31 economists recently surveyed by Bloomberg believed the American recession would hit in 2018, and all but two of them expected the recession to begin within the next five years.

If the recession begins in 2018, the expansion would have lasted nine years, making it the second-longest period of growth in U.S. history after the decade-long expansion that ended when the tech bubble burst in 2001. This average postwar expansion averages about five years.

The recent turmoil in the stock market and the slowdown in China has more investors and analysts using the “R-word,” but the economists surveyed by Bloomberg think we have a bit of time. They pegged the chance of recession over the next 12 months to just 10 percent.

Related: Stocks Are Sending a Recession Warning

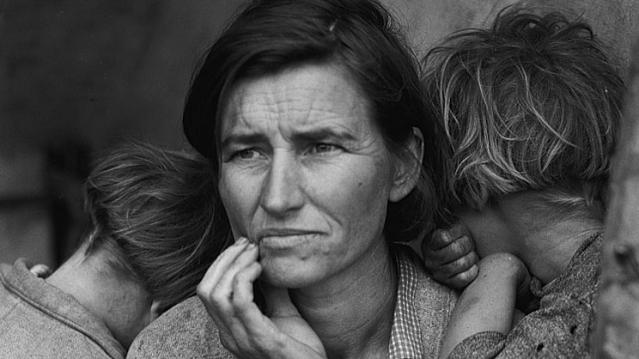

While economists talk about the next official recession, many average Americans feel like they’re still climbing out of the last one. In a data brief released last week, the National Employment Law Project found that wages have declined since 2009 for most U.S. workers, when factoring in cost of living increases.

A full jobs recovery is at least two years away, according to an analysis by economist Elise Gould with the Economic Policy Institute. “Wage growth needs to be stronger—and consistently strong for a solid spell—before we can call this a healthy economy,” she wrote in a recent blog post.

Top Reads from The Fiscal Times:

- This CEO Makes 1,951 Times More Than Most of His Workers

- Seven Reasons Why the Fed Won’t Hike Interest Rates

- $42 Million for 54 Recruits: U.S. Program to Train Syrian Rebels Is a Disaster

The 15 Most Valuable NFL Teams

The New England Patriots may be reigning Super Bowl champs and have the most successful quarterback-coach pair in NFL history -- Tom Brady and Bill Belichick each have four championship rings with the Pats -- but they’re missing something nevertheless.

As they kick off the season tonight against the Pittsburgh Steelers, the Pats aren’t at the top of the NFL in terms of team value. That title still goes to the Dallas Cowboys, according to an analysis at Forbes.

Related: 10 Big Money NFL Draft Busts

Dallas must be feeling pretty good about beating New England at something. They had the same regular season record as the Patriots last year, with 12 wins and 4 losses, but ended the season with a loss to the Green Bay Packers in the divisional playoffs, while the Pats went on to win Super Bowl XLIX (that’s 49 for all you non-Romans out there).

Even though the Washington Redskins have been playing pretty pathetically for the past decade, they still come in third. Washington’s NFC East rival, the New York Giants, rank fourth at $2.1 billion.

Here are the 15 most valuable NFL teams:

- Dallas Cowboys - $3.2 billion

- New England Patriots - $2.6 billion

- Washington Redskins - $2.4 billion

- New York Giants - $2.1 billion

- Houston Texans - $1.85 billion

- New York Jets - $1.8 billion

- Philadelphia Eagles - $1.75 billion

- Chicago Bears - $1.7 billion

- San Francisco 49ers - $1.6 billion

- Baltimore Ravens - $1.5 billion

- Denver Broncos - $1.45 billion

- Indianapolis Colts - $1.4 billion

- Green Bay Packers - $1.38 billion

- Pittsburgh Steelers - $1.35 billion

- Seattle Seahawks - $1.33 billion

Top Reads from the Fiscal Times:

- After the Fiorina Fiasco, What Insult Will Trump Fling Next?

- $42 Million for 54 Recruits? U.S. Program to Train Syrian Rebels Is a Disaster

- A Military Coup in the U.S.? A Surprising Number of Americans Might Support One