Congress Sends Tax Bill to the White House

The Republican-controlled U.S. House of Representatives gave final approval on Wednesday to the biggest overhaul of the U.S. tax code in 30 years, sending a sweeping $1.5 trillion bill to President Donald Trump for his signature.

In sealing Trump’s first major legislative victory, Republicans steamrolled opposition from Democrats to pass a bill that slashes taxes for corporations and the wealthy while giving mixed, temporary tax relief to middle-class Americans.

The House approved the measure, 224-201, passing it for the second time in two days after a procedural foul-up forced another vote on Wednesday. The Senate had passed it 51-48 in the early hours of Wednesday.

Trump had emphasized a tax cut for middle-class Americans during his 2016 campaign. At the beginning of a Cabinet meeting on Wednesday, he said lowering the corporate tax rate from 35 percent to 21 percent was “probably the biggest factor in this plan.”

Trump planned a tax-related celebration with U.S. lawmakers at the White House in the afternoon but will not sign the legislation immediately. The timing of the signing was still up in the air.

After Trump repeatedly urged Republicans to get it to him to sign before the end of the year, White House economic adviser Gary Cohn said the timing of signing the bill depends on whether automatic spending cuts triggered by the legislation could be waived. If so, the president will sign it before the end of the year, he said.

The debt-financed legislation cuts the U.S. corporate income tax rate to 21 percent, gives other business owners a new 20 percent deduction on business income and reshapes how the government taxes multinational corporations along the lines the country’s largest businesses have recommended for years.

Millions of Americans would stop itemizing deductions under the bill, putting tax breaks that incentivize home ownership and charitable donations out of their reach, but also making tax returns somewhat simpler and shorter.

The bill keeps the present number of tax brackets but adjusts many of the rates and income levels for each one. The top tax rate for high earners is reduced. The estate tax on inheritances is changed so far fewer people will pay.

Once signed, taxpayers likely would see the first changes to their paycheck tax withholdings in February. Most households will not see the full effect of the tax plan on their income until they file their 2018 taxes in early 2019.

In two provisions added to secure needed Republican votes, the legislation also allows oil drilling in Alaska’s Arctic National Wildlife Refuge and repeals the key portion of the Obamacare health system that fined people who did not have healthcare insurance.

“We have essentially repealed Obamacare and we’ll come up with something that will be much better,” Trump said on Wednesday.

“Pillaging”

Democrats have called the tax legislation a giveaway to the wealthy that will widen the income gap between rich and poor, while adding $1.5 trillion over the next decade to the $20 trillion national debt, which Trump promised in 2016 he would eliminate as president.

“Today the Republicans take their victory lap for successfully pillaging the American middle class to benefit the powerful and the privileged,” said House Democratic leader Nancy Pelosi.

few Republicans, whose party was once defined by its fiscal hawkishness, have protested the deficit-spending encompassed in the bill. But most of them have voted for it anyway, saying it would help businesses and individuals, while boosting an already expanding economy they see as not growing fast enough.

“We’ve had two quarters in a row of 3 percent growth,” Senate Republican leader Mitch McConnell said after the Senate vote. “The stock market is up. Optimism is high. Coupled with this tax reform, America is ready to start performing as it should have for a number of years.”

Despite Trump administration promises that the tax overhaul would focus on the middle class and not cut taxes for the rich, the nonpartisan Tax Policy Center, a think tank in Washington, estimated middle-income households would see an average tax cut of $900 next year under the bill, while the wealthiest 1 percent of Americans would see an average cut of $51,000.

The House was forced to vote again after the Senate parliamentarian ruled three minor provisions violated arcane Senate rules. To proceed, the Senate deleted the three provisions and then approved the bill.

Because the House and Senate must approve the same legislation before Trump can sign it into law, the Senate’s late Tuesday vote sent the bill back to the House.

Democrats complained the bill was a product of a hurried, often secretive process that ignored them and much of the Republican rank-and-file. No public hearings were held and numerous narrow amendments favored by lobbyists were added late in the process, tilting the package more toward businesses and the wealthy.

U.S. House Speaker Paul Ryan defended the bill in television interviews on Wednesday morning, saying support would grow for after it passes and Americans felt relief.

“I think minds are going to change,” Ryan said on ABC’s “Good Morning America” program.

Reporting by David Morgan and Amanda Becker; Additional reporting by Richard Cowan, Roberta Rampton, Gina Chon and Susan Heavey; Editing by Jeffrey Benkoe and Bill Trott.

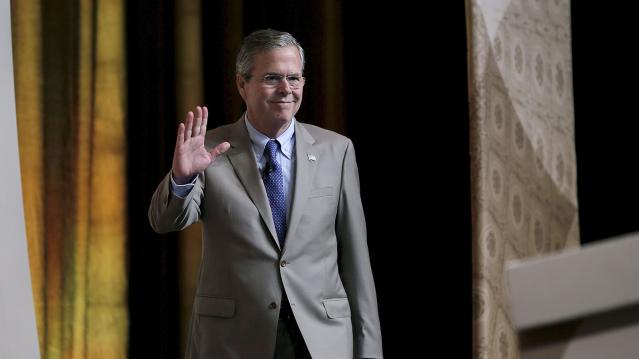

Watch Jeb Bush Do His Best Donald Trump Impression with Stephen Colbert

Unless you've been in your own personal media blackout for the last few days, you're probably aware that Stephen Colbert kicked off his new show Tuesday night and that Jeb Bush was one of his first guests. While the maiden voyage of the new “Late Show” has drawn mixed reviews -- “promising, if he relaxes” says USA Today, referring to the host – the show provided plenty of entertaining bits and compelling if somewhat odd moments.

Like much of the show, Colbert’s conversation with Bush was a mixed bag. Both host and guest seemed a bit nervous and some of their lines fell flat. Surprisingly, one of the more entertaining parts of their conversation never made it on air: Colbert had Bush read some text written in the bombastic voice of Donald Trump. Bush was game for the joke, and the results are worth a look.

The fun at Trump's expense starts at the 2:32 mark, when Stephen Colbert refers to the "big, orange elephant in the room."

Top Reads from The Fiscal Times:

- Fading Fast in New Hampshire, Bush Dips into War Chest

- The 2016 Presidential Primary Carnival Rages On

- There’s Only One Candidate People Actually Like – and It’s Not Trump or Clinton

Here’s Why Home Prices Are Climbing So Quickly

Want to buy a home but finding slim pickings? Blame the builders.

New home construction has not kept pace with the improving job market in recent years and is part of the reason that housing inventory is so scarce and home prices are growing so quickly, according to a report released today by the National Association of Realtors.

After over-building leading up to the housing bubble, developer laid off workers and scaled back construction by more than 75 percent. After the crash many of those workers migrated to other industries, making it harder for builders to quickly ramp up work. There are also fewer builders now than there were a decade ago, with many going bust in the bubble and others consolidating with competitors.

Related: How a Smart Home Can Save You Time and Money

While home starts have come back since the recession, the new NAR report finds that in two-thirds of markets homebuilding activity has not kept pace with the number of newly employed workers. In particular, construction of single-family homes remains at less than half its prerecession levels.

Many of the markets with the largest disparity of jobs versus home construction were hit hardest by the housing crisis but have fully rebounded, including San Jose, San Francisco, San Diego and Miami. New York is also among the top cities where home building has not kept pace.

There are several reasons that new home construction has grown so slowly in recent years, including rising construction and labor costs and tight credit. Despite those headwinds, new home construction is expected to grow by more than 25 percent this year.

Top Reads From The Fiscal Times:

- Can Anyone Stop the $38 Billion Airline Fee Squeeze?

- 7 Common Myths That Can Ruin Your Retirement

- The 25 Most Expensive Cities for Renters

Millennials to Employers: Show Us the Money

When it comes to company loyalty, money matters to millennials. Twenty-nine percent of millennials say that a higher salary is the biggest contributor to their loyalty, according to data released Tuesday by the Staples Advantage Workplace Index.

That compares to 20 percent of the overall workforce who place a priority on salary. The difference could be related to the fact that millennials tend to make lower wages than other workers and face higher fixed costs on things like student loans and rent.

Still, the job market is tightening, making it easier for millennials who feel they are underpaid to look elsewhere for work. The unemployment rate for millennials has fallen by nearly 40 percent since its peak in 2010.

Related: 18 Companies Americans Hate Dealing With the Most

Millennials are willing to work long hours but they want to be able to do so on their own terms. More than half of younger workers said that they work from home after the work day is over, compared to 39 percent of the all workers. Nearly half of millennials said that increased flexibility would improve their happiness.

Other important factors for millennials are office perks such as a gym or free lunches, having an eco-friendly office and a company culture that encourages breaks.

Whether or not they’re happy with their current roles, millennials are looking toward the future with ambition. Seventy percent of those surveyed said they expect to be in a management position in the next five years.

Top Reads from The Fiscal Times:

- Stocks Are Sending a Recession Warning

- The 10 Fastest-Growing Jobs Right Now

- Mark Cuban: The Lesson Investors Can Learn From China

Gas Prices at an 11-Year Low for Labor Day Weekend

Drivers will be paying less at the pump as we head into one of the largest travel weekends of the year. Gas prices over Labor Day weekend haven’t been this low since 2004.

The national average price of gas is currently $2.44 per gallon, 99 cents less than this time last year, according to AAA. The average consumer can expect to save $15 to $25 on each trip to the gas station.

Related: 6 Reasons Gas Prices Could Fall Below $2 A Gallon

AAA estimates that 35.5 million people are planning to travel this weekend, a 1 percent increase from last year. The majority of travelers, 30.4 million, are expected to drive to their destinations, a rise of 1.1 percent from last year.

Gasoline prices are moving lower thanks to the falling price of crude oil. Oil has been hit by worries over economic growth in emerging markets, Iranian oil flooding the market and crude oil inventories rising due to economic and weather factors, a U.S. Energy Information Administration report finds.

For drivers, there’s more good news ahead. AAA expects gas prices to keep falling, with gas selling for $2 or less a gallon by Christmas in many parts of the U.S.

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Obama to GOP: Don’t Kill the Economy This Fall

- Why China’s Slowdown Will Lead to Sustainable Growth

SAT Scores Drop to Lowest Levels in a Decade

Student scores on the SAT have slipped to the lowest level in 10 years, according to new statistics from the College Board, again raising questions about education-reform efforts meant to improve student performance in high schools.

Just under 1.7 million students took the test this year, more than ever before. Only 41.9 percent of them reached the “SAT Benchmark” score of 1550, which indicates whether an individual is prepared for college or a career. Based on the SAT’s measure, more than 1 million students are not ready for college or for work.

Related: 10 Public Universities with the Worst Graduation Rates

The average score for high-schoolers in the class of 2015 was 1490 out of a possible 2400, down 7 points from last year. The three sections of the test — reading, writing, and math — all saw declines of at least two points.

As has been the pattern for years, certain demographic groups performed better than others. Whites and Asians, on average, received higher scores than blacks and Latinos. Students from higher-earning families received higher scores than those from families with lower income. But scores among all demographic groups except for Asians went down.

Related: The Lucrative Business of SAT Test Prep is About to Get Disrupted

The low scores are an indication that improved testing scores for elementary school students aren’t translating to gains by high-schoolers. The stark contrast in scores among racial and ethnic groups may also be a sign of systemic problems that remain a barrier to educational success. Since 2006, the scores among white students have fallen six points, pulling the average down to 1,576. The average scores for black students have dropped 14 points to 1,277.

The College Board plans to introduce a new SAT exam next year. Changes will include more of a focus on math, fewer questions on vocabulary words and an elimination of the penalty for guessing. The idea, the College Board has said, is to make the test more about what students learn in high school and the skills that college will require.

Top Reads From The Fiscal Times

- Average Family Has Saved Enough to Send One Kid to College for Half a Year

- The 5 Best and Worst Jobs for New Grads

- This College Choice Could Make You $3 Million Richer