Congress Sends Tax Bill to the White House

The Republican-controlled U.S. House of Representatives gave final approval on Wednesday to the biggest overhaul of the U.S. tax code in 30 years, sending a sweeping $1.5 trillion bill to President Donald Trump for his signature.

In sealing Trump’s first major legislative victory, Republicans steamrolled opposition from Democrats to pass a bill that slashes taxes for corporations and the wealthy while giving mixed, temporary tax relief to middle-class Americans.

The House approved the measure, 224-201, passing it for the second time in two days after a procedural foul-up forced another vote on Wednesday. The Senate had passed it 51-48 in the early hours of Wednesday.

Trump had emphasized a tax cut for middle-class Americans during his 2016 campaign. At the beginning of a Cabinet meeting on Wednesday, he said lowering the corporate tax rate from 35 percent to 21 percent was “probably the biggest factor in this plan.”

Trump planned a tax-related celebration with U.S. lawmakers at the White House in the afternoon but will not sign the legislation immediately. The timing of the signing was still up in the air.

After Trump repeatedly urged Republicans to get it to him to sign before the end of the year, White House economic adviser Gary Cohn said the timing of signing the bill depends on whether automatic spending cuts triggered by the legislation could be waived. If so, the president will sign it before the end of the year, he said.

The debt-financed legislation cuts the U.S. corporate income tax rate to 21 percent, gives other business owners a new 20 percent deduction on business income and reshapes how the government taxes multinational corporations along the lines the country’s largest businesses have recommended for years.

Millions of Americans would stop itemizing deductions under the bill, putting tax breaks that incentivize home ownership and charitable donations out of their reach, but also making tax returns somewhat simpler and shorter.

The bill keeps the present number of tax brackets but adjusts many of the rates and income levels for each one. The top tax rate for high earners is reduced. The estate tax on inheritances is changed so far fewer people will pay.

Once signed, taxpayers likely would see the first changes to their paycheck tax withholdings in February. Most households will not see the full effect of the tax plan on their income until they file their 2018 taxes in early 2019.

In two provisions added to secure needed Republican votes, the legislation also allows oil drilling in Alaska’s Arctic National Wildlife Refuge and repeals the key portion of the Obamacare health system that fined people who did not have healthcare insurance.

“We have essentially repealed Obamacare and we’ll come up with something that will be much better,” Trump said on Wednesday.

“Pillaging”

Democrats have called the tax legislation a giveaway to the wealthy that will widen the income gap between rich and poor, while adding $1.5 trillion over the next decade to the $20 trillion national debt, which Trump promised in 2016 he would eliminate as president.

“Today the Republicans take their victory lap for successfully pillaging the American middle class to benefit the powerful and the privileged,” said House Democratic leader Nancy Pelosi.

few Republicans, whose party was once defined by its fiscal hawkishness, have protested the deficit-spending encompassed in the bill. But most of them have voted for it anyway, saying it would help businesses and individuals, while boosting an already expanding economy they see as not growing fast enough.

“We’ve had two quarters in a row of 3 percent growth,” Senate Republican leader Mitch McConnell said after the Senate vote. “The stock market is up. Optimism is high. Coupled with this tax reform, America is ready to start performing as it should have for a number of years.”

Despite Trump administration promises that the tax overhaul would focus on the middle class and not cut taxes for the rich, the nonpartisan Tax Policy Center, a think tank in Washington, estimated middle-income households would see an average tax cut of $900 next year under the bill, while the wealthiest 1 percent of Americans would see an average cut of $51,000.

The House was forced to vote again after the Senate parliamentarian ruled three minor provisions violated arcane Senate rules. To proceed, the Senate deleted the three provisions and then approved the bill.

Because the House and Senate must approve the same legislation before Trump can sign it into law, the Senate’s late Tuesday vote sent the bill back to the House.

Democrats complained the bill was a product of a hurried, often secretive process that ignored them and much of the Republican rank-and-file. No public hearings were held and numerous narrow amendments favored by lobbyists were added late in the process, tilting the package more toward businesses and the wealthy.

U.S. House Speaker Paul Ryan defended the bill in television interviews on Wednesday morning, saying support would grow for after it passes and Americans felt relief.

“I think minds are going to change,” Ryan said on ABC’s “Good Morning America” program.

Reporting by David Morgan and Amanda Becker; Additional reporting by Richard Cowan, Roberta Rampton, Gina Chon and Susan Heavey; Editing by Jeffrey Benkoe and Bill Trott.

The Surprising Reason for the Boom in Snack Sales

Americans are increasingly dining alone, and they’re opting for snacks rather than full meals, according to a new report from NPD group.

A key driver of the trend is the growing number of single-person households, since solo eaters are more likely to opt for snack foods for dinner. Nearly a quarter of all snack foods consumed last year were consumed at mealtime.

“Smaller household sizes and eating alone are among the growing factors with snacking,” NPD food and beverage industry analyst Darren Seifer said in a statement. “Food manufacturers should think about the unique needs of the solo consumer when developing products and packaging, and marketing messages should be crafted to be relevant to them and their snacking behaviors.”

Related: The 12 Hottest Food Trends for 2015

A separate report released by Nielsen last year found that more than half of global diners had selected snacks in the past 30 days to replace a lunch, 48 percent had snacked for breakfast and 41 percent had snacked for dinner.

When making their selection, single diners prefer single-serve packages and are increasingly turning to “better-for-you” snacks, like fresh fruit, breakfast bars, and yogurt, NPD found.

Food manufacturers are starting to adapt to the demand for healthier options. In June, General Mills said it would stop using artificial colors and flavors by 2016, and Kellogg Co. has vowed to do so by 2018.

Even as demand grows for healthier snacks, the most popular snacks in North Americans might make a nutritionist cringe. Nielsen found that the most popular snacks were chips, followed by chocolate and cheese.

Top Reads from the Fiscal Times:

- The $1 Trillion Question for the F-35: Is the U.S. Buying an Inferior Plane?

- Hillary’s College Plan—Debt Free College Now, Tax Them When They Make Money

- You Won’t Believe What Some Job Seekers Are Putting on Their Resumes

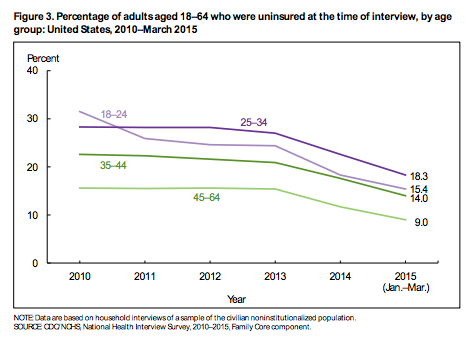

Obamacare Drives Uninsured Rate to Record Low

With the number of Americans lacking health insurance in decline, the rate of uninsured Americans has hit a record low, reaching levels not seen since the National Center for Disease Statistics began keeping records in 1972.

In the first quarter of 2015, 9.2 percent of all Americans were uninsured, according to new data from the Center for Disease Control and Prevention, down from 11.5 percent in 2014. The total number of uninsured Americans fell by 7 million over the past year, from 36 million in 2014 to 29 million in the first three months of 2015.

The largest declines were seen among adults who were poor or near-poor, suggesting that the Affordable Care Act was responsible for the most significant gains in coverage. Both groups dropped from uninsured rates near 50 percent in 2010 to 28 percent among poor adults and 23.8 percent among near-poor adults in 2015.

While Democrats are citing data as evidence that the Affordable Care Act is working, Republicans will likely argue that the reduction is being driven by an improving economy and a steadily declining unemployment rate.

Arkansas and Kentucky continue to record the most noticeable reductions in uninsured rates since Obamacare took effect at the beginning of 2013, according to a new report by Gallup. Texas is the only state to still have an uninsured rate higher than 20 percent.

We Built a $335 Million Power Plant in Afghanistan that Can Barely Turn on Lightbulb

USAID is denying that a $335 million “vital component” of their mission to aid the massive energy deficit in Kabul, Afghanistan is an utter failure, but a new report contradicts that claim.

A power plant built by U.S. Agency for International Development (USAID) is extremely underused and in danger of being wasted, according to the Special Inspector General for Afghanistan Reconstruction (SIGAR). USAID attempted to defend itself by saying the plant was only built to provide occasional backup and insurance for Kabul’s electrical grid, not for electrical power on a continuous basis. SIGAR’s report provides evidence that the plant was built for regular usage.

Related: U.S. Military Builds a $15 Million Warehouse That Nobody Wants

First, the basis of design was for a base load plant, built to operate 24 hours per day, 7 days a week. Also, the plant hasn’t made any impact on reducing Kabul’s massive energy deficit that USAID says is one of the plant’s main priorities. Not only is it not being used regularly, but it’s not even contributing additional electricity to increase the overall power supply in Kabul.

The Tarakhil Power Plant was built in July 2007 on the outskirts of Kabul, with the intention of supplying 18 diesel engines worth of operating power. Since Da Afghanistan Breshna Sherkat (DABS) – Afghanistan’s national power utility – assumed responsibility for the operation and maintenance of the facility in 2010, the plant has only performed at a shred of its total capability. Between July 2010 and December 2013, the USAID IG found that the plant performed at a mere 2.2 percent of its potential.

Since the Tarakhil Power Plant was used incorrectly and only on an intermittent basis, the plant has suffered premature wear and tear on its engine and electrical components. The damage is expected to raise already steep operation and maintenance costs.

Top Reads from the Fiscal Times:

- How ‘King Coal’ Could Swing the 2016 Election

- Kerry to Congress: Sign the Iran Deal or the Dollar Gets Hit

- China’s Currency Devaluation Brings Stocks to a 'Death Cross'

We Built a $335 Million Power Plant in Afghanistan that Can Barely Turn on Lightbulb

USAID is denying that a $335 million “vital component” of their mission to aid the massive energy deficit in Kabul, Afghanistan is an utter failure, but a new report contradicts that claim.

A power plant built by U.S. Agency for International Development (USAID) is extremely underused and in danger of being wasted, according to the Special Inspector General for Afghanistan Reconstruction (SIGAR). USAID attempted to defend itself by saying the plant was only built to provide occasional backup and insurance for Kabul’s electrical grid, not for electrical power on a continuous basis. SIGAR’s report provides evidence that the plant was built for regular usage.

Related: U.S. Military Builds a $15 Million Warehouse That Nobody Wants

First, the basis of design was for a base load plant, built to operate 24 hours per day, 7 days a week. Also, the plant hasn’t made any impact on reducing Kabul’s massive energy deficit that USAID says is one of the plant’s main priorities. Not only is it not being used regularly, but it’s not even contributing additional electricity to increase the overall power supply in Kabul.

The Tarakhil Power Plant was built in July 2007 on the outskirts of Kabul, with the intention of supplying 18 diesel engines worth of operating power. Since Da Afghanistan Breshna Sherkat (DABS) – Afghanistan’s national power utility – assumed responsibility for the operation and maintenance of the facility in 2010, the plant has only performed at a shred of its total capability. Between July 2010 and December 2013, the USAID IG found that the plant performed at a mere 2.2 percent of its potential.

Since the Tarakhil Power Plant was used incorrectly and only on an intermittent basis, the plant has suffered premature wear and tear on its engine and electrical components. The damage is expected to raise already steep operation and maintenance costs.

How Good Is Your Insurance? ‘Cadillac Tax’ Looms for Large Employer Health Plans

While most companies expect health care cost increases to hold steady next year, nearly half of large employers say that if they can’t find new ways to cut costs, they’re going to cross the “Cadillac tax” threshold in 2018, according to a new study by the National Business Group on Health.

Passed as part of the Affordable Care Act and going into effect in 2018, the Cadillac tax will hit employers whose plans cost more than $10,200 for an individual or $27,500 for a family. The employer will have to pay a 40 percent tax on the cost of each plan above those levels.

Among the companies surveyed, 48 percent said that at least one of their benefit plans would trigger the Cadillac Tax. By 2020, 72 percent of employers say one of their plans will trigger the tax, and 51 percent say their most popular plan will be subject to the tax.

Related: Obamacare’s Cadillac Tax Hits the College Campus

“The need to control rising health care benefits costs has never been greater,” NGBH President and CEO Brian Marcotte said in a statement. “Rising costs have plagued employers for many years and now the looming excise tax is adding pressure.”

Employers expect keep benefit costs increases to 5 percent this year by pushing more costs onto workers via consumer-directed health plans (76 percent) and expanding wellness initiatives (70 percent).

None of the 425 employers surveyed said they planned to eliminate their health care coverage, but nearly a quarter said they’d consider offering employees a private exchange.

Top Reads from the Fiscal Times:

- How ‘King Coal’ Could Swing the 2016 Election

- Kerry to Congress: Sign the Iran Deal or the Dollar Gets Hit

- China’s Currency Devaluation Brings Stocks to a 'Death Cross'