Congress Sends Tax Bill to the White House

The Republican-controlled U.S. House of Representatives gave final approval on Wednesday to the biggest overhaul of the U.S. tax code in 30 years, sending a sweeping $1.5 trillion bill to President Donald Trump for his signature.

In sealing Trump’s first major legislative victory, Republicans steamrolled opposition from Democrats to pass a bill that slashes taxes for corporations and the wealthy while giving mixed, temporary tax relief to middle-class Americans.

The House approved the measure, 224-201, passing it for the second time in two days after a procedural foul-up forced another vote on Wednesday. The Senate had passed it 51-48 in the early hours of Wednesday.

Trump had emphasized a tax cut for middle-class Americans during his 2016 campaign. At the beginning of a Cabinet meeting on Wednesday, he said lowering the corporate tax rate from 35 percent to 21 percent was “probably the biggest factor in this plan.”

Trump planned a tax-related celebration with U.S. lawmakers at the White House in the afternoon but will not sign the legislation immediately. The timing of the signing was still up in the air.

After Trump repeatedly urged Republicans to get it to him to sign before the end of the year, White House economic adviser Gary Cohn said the timing of signing the bill depends on whether automatic spending cuts triggered by the legislation could be waived. If so, the president will sign it before the end of the year, he said.

The debt-financed legislation cuts the U.S. corporate income tax rate to 21 percent, gives other business owners a new 20 percent deduction on business income and reshapes how the government taxes multinational corporations along the lines the country’s largest businesses have recommended for years.

Millions of Americans would stop itemizing deductions under the bill, putting tax breaks that incentivize home ownership and charitable donations out of their reach, but also making tax returns somewhat simpler and shorter.

The bill keeps the present number of tax brackets but adjusts many of the rates and income levels for each one. The top tax rate for high earners is reduced. The estate tax on inheritances is changed so far fewer people will pay.

Once signed, taxpayers likely would see the first changes to their paycheck tax withholdings in February. Most households will not see the full effect of the tax plan on their income until they file their 2018 taxes in early 2019.

In two provisions added to secure needed Republican votes, the legislation also allows oil drilling in Alaska’s Arctic National Wildlife Refuge and repeals the key portion of the Obamacare health system that fined people who did not have healthcare insurance.

“We have essentially repealed Obamacare and we’ll come up with something that will be much better,” Trump said on Wednesday.

“Pillaging”

Democrats have called the tax legislation a giveaway to the wealthy that will widen the income gap between rich and poor, while adding $1.5 trillion over the next decade to the $20 trillion national debt, which Trump promised in 2016 he would eliminate as president.

“Today the Republicans take their victory lap for successfully pillaging the American middle class to benefit the powerful and the privileged,” said House Democratic leader Nancy Pelosi.

few Republicans, whose party was once defined by its fiscal hawkishness, have protested the deficit-spending encompassed in the bill. But most of them have voted for it anyway, saying it would help businesses and individuals, while boosting an already expanding economy they see as not growing fast enough.

“We’ve had two quarters in a row of 3 percent growth,” Senate Republican leader Mitch McConnell said after the Senate vote. “The stock market is up. Optimism is high. Coupled with this tax reform, America is ready to start performing as it should have for a number of years.”

Despite Trump administration promises that the tax overhaul would focus on the middle class and not cut taxes for the rich, the nonpartisan Tax Policy Center, a think tank in Washington, estimated middle-income households would see an average tax cut of $900 next year under the bill, while the wealthiest 1 percent of Americans would see an average cut of $51,000.

The House was forced to vote again after the Senate parliamentarian ruled three minor provisions violated arcane Senate rules. To proceed, the Senate deleted the three provisions and then approved the bill.

Because the House and Senate must approve the same legislation before Trump can sign it into law, the Senate’s late Tuesday vote sent the bill back to the House.

Democrats complained the bill was a product of a hurried, often secretive process that ignored them and much of the Republican rank-and-file. No public hearings were held and numerous narrow amendments favored by lobbyists were added late in the process, tilting the package more toward businesses and the wealthy.

U.S. House Speaker Paul Ryan defended the bill in television interviews on Wednesday morning, saying support would grow for after it passes and Americans felt relief.

“I think minds are going to change,” Ryan said on ABC’s “Good Morning America” program.

Reporting by David Morgan and Amanda Becker; Additional reporting by Richard Cowan, Roberta Rampton, Gina Chon and Susan Heavey; Editing by Jeffrey Benkoe and Bill Trott.

The Best and Worst States for Student Debt

Where you go to college and what major you pick can have huge financial consequences, but where you live after graduating can also have a big impact on how much your diploma is worth — and how well you can handle your student debt.

How likely are you to land a good paying job? How high will your living expenses be? The answers to those questions and others like them go a long way to determining how burdensome those monthly student loans payments are.

Related: The Best Investment the U.S. Could Make—Affordable Higher Education

To ensure your loan doesn’t break you, experts suggest that your payment should not exceed 8 to 10 percent of your monthly income.

Unsurprisingly, the personal finance website WalletHub says, “Student-loan borrowers will fare better in states that produce a combination of lower college-related debt levels, stronger economies and higher incomes.”

To find those states, WalletHub looked at seven metrics, with special emphasis given to student debt as a percentage of average income, the local unemployment rate for people aged 25 to 34 and the percentage of borrowers aged 50 or older. Here are the 10 best and worst states for student debt. You can click on your state on the map below to see where it ranks.

Related: Private Student Loans: Everything You Need to Know

10 Best States for Student Debt

- Utah

- Wyoming

- North Dakota

- Washington

- Nebraska

- Virginia

- Wisconsin

- Minnesota

- Colorado

- South Dakota

10 Worst States for Student Debt

- Mississippi

- Rhode Island

- Connecticut

- Maine

- Georgia

- South Carolina

- New York

- Alabama

- West Virginia

- Oregon

Top Reads from The Fiscal Times:

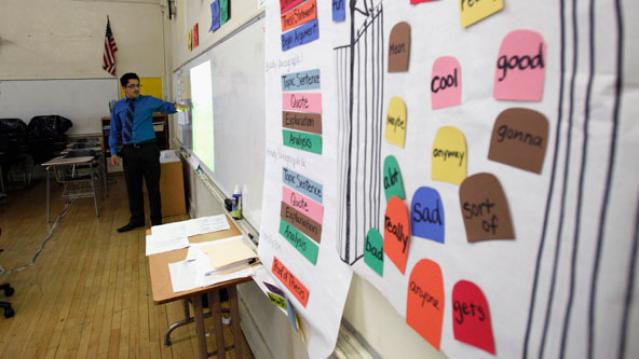

Why We’re Wasting Billions on Teacher Development

School districts spend an average $18,000 per year on teacher development, and teachers devote about 10 percent of their time to professional learning, but a new report finds that such programs may not be producing any measurable results.

The report, released today by TNTP, a nonprofit aimed at addressing educational equality, finds even with development programs, teachers do not show much improvement year over year, and the performance for the vast majority (70 percent) remained constant or declined over the past two to three years.

The report’s authors believe the lack of improvement stems from low expectations for teacher development and performance, and they suggest that schools need to rethink completely the ways that they measure teacher performance and the way they conduct student development.

Related: The Education Department Is Failing Students Who Got Defrauded

The study evaluated information on more than 10,000 teachers at three large school districts and a charter network covering nearly 400,000 students.

The authors report that teachers who do show improvement do not appear to be the result of deliberate, systemic efforts, and show no clear patterns that could improve development for others. “The absence of common threads challenges us to confront the true nature of the problem,” they write. “That as much as we wish we knew how to help all teachers improve, we do not.”

Rather than offer specific solutions, the authors suggest that schools redefine professional development, re-evaluate professional learning programs, and reinvent the ways they support teachers.

Top Reads from The Fiscal Times:

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- The 2016 Presidential Election Is Already a Dumpster Fire

- You’re Richer Than You Think. Really.

Happy Watermelon Day! 16 Sweet, Juicy Facts You Didn’t Know

Frida Kahlo painted them and poets have celebrated them. In his “Ode to the Watermelon,” Pablo Neruda described it as “a fruit from the thirst-tree” and “the green whale of the summer.” He wrote: “its hemispheres open/showing a flag/green, white, red,/ that dissolves into/wild rivers, sugar, delight!” Abundant in summer, watermelons are by their very nature sweet and heavy, plus they’re full of vitamins: A, B6, and C. Aug. 3 is National Watermelon Day. We celebrate it here with 16 fun facts.

Related: Born in the USA: 24 Iconic American Foods

- Watermelons are 92 percent water.

- The word “watermelon” first appeared in English dictionaries in 1615, according to John Mariani’s The Dictionary of American Food and Drink.

- Watermelons are related to pumpkins, as well as cucumbers and squash.

- The world’s largest watermelon was grown by Lloyd Bright of Arkadelphia, Arkansas in 2005 and weighed 268.8 pounds, according to the Guinness Book of World Records.

- Watermelons originated in southern Africa.

- They appear in Egyptian hieroglyphics nearly 5,000 years ago. Watermelon seeds were found in the tomb of King Tut.

- Early explorers carried watermelons on long trips as a source of water, like canteens.

- Watermelons are both fruits and vegetables.

- China is the largest producer of watermelons in the world today, followed by Turkey and Iran.

- The U.S. currently ranks fifth in watermelon production worldwide. Georgia, Florida, Texas, California and Arizona are the states that grow the most watermelon.

- On April 17, 2007, the Oklahoma State Senate passed a bill declaring watermelon as the official state vegetable.

- Over 1,200 varieties of watermelon are grown in 100 countries across the world.

- Watermelons were introduced to the New World by European colonists and African slaves. Spanish settlers started growing watermelon in Florida in 1576.

- One cup of watermelon has more lycopene, a pigment with antioxidant effects, than a large fresh tomato.

- You can eat the seeds. And the rind. Here’s a recipe for pickled watermelon rind.

- Are your muscles feeling sore? Have some watermelon before your next workout. The juice contains L-citrulline, which the body converts to L-arginine, an amino acid that helps relax blood vessels and improves circulation.

Top Reads from The Fiscal Times:

- 16 Companies Taking Some ‘Junk’ Out of Their Food

- Here’s Why Americans Are Keeping Their Cars Longer than Ever

- Amazon’s Prime Concern—A New Online Blitz by Walmart

Why Believing Donald Trump Will Be the GOP Nominee Is Delusional

Despite his commanding lead at this early stage among GOP candidates, the 2016 nomination is anyone’s game.

It is risky to put too much stock in the latest findings, including the NBC/Wall Street Journal poll released Sunday. That’s because the national telephone survey of 1,000 adults included only 252 registered voters who said they would vote for a Republican, and the poll has a margin of error of plus or minus 6.17 points.

Related: Why Jeb Bush’s Pragmatic Immigration Plan Has No Chance of Passing in the House

There are plenty of downsides to Trump’s candidacy – including his threat to mount a third-party campaign if he is denied the Republican nomination -- which has alarmed GOP leaders who are looking down the road to the general election.

Trump has the highest negatives of any of the top tier candidates, and a majority of Americans in the survey said they think Trump is hurting the Republican Party. Not surprisingly, the vast majority of Democrats interviewed said Trump was harming his party’s image, but nearly half the Republicans interviewed said the same thing.

Political analyst Nate Silver notes that Trump ranks just 13th in overall favorability among Republicans in a series of national polls. “If you’re going to imply that a candidate is popular based on their receiving 20 percent of the vote, you ought to consider what the other 80 percent thinks about him,” Silver wrote recently in his FiveThirtyEight blog. “Most Republicans who don’t plan to vote for Trump are skeptical of him instead.”

Related: Donald Trump Just Showed Why His Campaign Is Doomed

What’s more, about three in four Latinos said they have a negative view of Trump – and that more than half consider his comments about lawless Mexican immigrants to be racist or highly inappropriate, according to a separate NBC News/Wall Street Journal Telemundo poll released today.

The survey of 250 Hispanic-American voters revealed widespread hostility towards Trump, with only 13 percent saying they have a positive view of him.

The Republican presidential frontrunner has said repeatedly that many Latino voters “love” and support him, and that he would win the majority of that vote if he ends up as his party’s nominee. There is little evidence in this poll to suggest Trump is dealing with reality.

Top Reads from The Fiscal Times:

- Clinton Tries to Change the Narrative with First Two Campaign Ads

- Super PAC or Not-so-Super PAC? The Difference Between Jeb and Bernie

- States Are Finally Overcoming the Fiscal Headwinds

Cruz Won’t be Trumped—Watch Him Cook Bacon on a Machine Gun

Sen. Ted Cruz (TX) has shown an affinity for breakfast foods he did, after all, famously read "Green Eggs and Ham" on the Senate floor. Now, the Texas senator is the latest Republican presidential contender to ham it up in a stunt video released Monday—this time, he separates himself from the pack by cooking bacon with a machine gun.

“Few things I enjoy more than on weekends cooking breakfast with the family. Of course in Texas, we cook bacon a little differently than most folks," Cruz says in a video. Cruz walks the viewer through the rather unique cooking process, including wrapping strips of bacon around the gun’s nozzle and encasing it in aluminum foil to keep in the heat.

Cruz himself fires off several rounds at a gun range. After he’s finished, and gotten grease all over the cement floor, he uses a fork to pick a piece of still sizzling meat off the barrel and eats it.

“Mmm. Machine gun bacon,” the senator says with a smile before chuckling.

The 66-second clip comes roughly two weeks after Sen. Lindsey Graham (R-SC), another White House hopeful, shot his own video where he used a variety of methods to destroy cellphones after he had his phone number given out by GOP frontrunner Donald Trump.

The video is sure to bounce around the web and get people talking about Cruz’s candidacy just as the Republican field gets ready to take the stage for its inaugural debate.

An NBC/Wall Street Journal poll released on Sunday showed the Texas lawmaker taking fifth in the GOP primary race, with 9 percent support. That put him 10 points behind current polling leader Donald Trump. Cruz also trails Wisconsin Gov. Scott Walker, former Florida Gov. Jeb Bush and neurosurgeon Ben Carson, according to the survey, meaning that the bacon stunt can't hurt: His campaign could definitely use more sizzle.

Top Reads from The Fiscal Times:

- Joe Biden: The Looming Threat to a Republican Presidency

- Trump’s Net Worth Isn’t His Only Claim That’s Fake

- Why the Six Candidates Left Out of the GOP Debate Might Be Winners After All