Trump Clearly Has No Problem with Debt and Deficits

A self-proclaimed “king of debt,” President Trump has produced a budget that promises red ink as far as the eye can see. With last year's $1.5 trillion tax cut reducing revenues, the White House gave up even trying to pretend that its budget would balance anytime soon, and even the rosy economic projections contained in the budget couldn’t produce enough revenues, however fanciful, to cover the shortfall.

The Trump budget spends as much over 10 years as any budget produced by President Barack Obama, according to Jim Tankersley of The New York Times. And it projects total deficits of more than $7 trillion over the next decade — "a number that could double if the administration turns out to be overestimating economic growth and if the $3 trillion in spending cuts the White House has floated do not materialize in Congress,” Tankersley says.

Trump — who once promised to both balance the budget and pay down the national debt — isn’t the only one throwing off the shackles of fiscal restraint. Republicans as a whole appear to be embracing a new set of economic preferences defined by lower taxes and higher spending, in what Bloomberg describes as a “striking turnabout” in attitudes toward deficits and the national debt.

But some conservatives tell Tankersley that the GOP's core beliefs on spending and debt remain intact — and that spending on Social Security and Medicare, the primary drivers of the national debt, are all that matters when it comes to implementing fiscal restraint.

“They know that right now, a fundamental reform of entitlements won’t happen," John H. Cochrane, an economist at Stanford University’s Hoover Institution, tells Tankersley. "So, they have avoided weekly chaos and gotten needed military spending through by opening the spending bill, and they got an important reduction in growth-distorting marginal corporate rates through by accepting a bit more deficits. They know that can’t be the end of the story.”

Democrats, of course, have warned that the next chapter in the tale will involve big cuts to Social Security and Medicare. Even before we get there, though, Tankersley questions whether the GOP approach stands up to scrutiny: "This is a bit like saying, only regular exercise will keep America from having a fatal heart attack, so, you know, it's ok to eat a few more hamburgers now."

The 10 Worst States to Have a Baby

The birth rate in the U.S. is finally seeing an uptick after falling during the recession. Births tend to fall during hard economic times because having a baby and raising a child are expensive propositions.

Costs are not the same everywhere, though. Some states are better than others for family budgets, and health care quality varies widely from place to place.

A new report from WalletHub looks at the cost of delivering a baby in the 50 states and the District of Columbia, as well as overall health care quality and the general “baby-friendliness” of each state – a mix of variables including average birth weights, pollution levels and the availability of child care.

Mississippi ranks as the worst state to have a baby, despite having the lowest average infant-care costs in the nation. Unfortunately, the Magnolia State also has the highest rate of infant deaths and one of lowest numbers of pediatricians per capita.

Related: Which States Have the Most Unwanted Babies?

On the other end of the scale, Vermont ranks as the best state for having a baby. Vermont has both the highest number of pediatricians and the highest number of child centers per capita. But before packing your bags, it’s worth considering the frigid winters in the Green Mountain State and the amount of money you’ll need to spend on winter clothing and heat.

Here are the 10 worst and 10 best states for having a baby:

Top 10 Worst States to Have a Baby

1. Mississippi

- Budget Rank: 18

- Health Care Rank: 51

- Baby Friendly Environment Rank: 29

2. Pennsylvania

- Budget Rank: 37

- Health Care Rank: 36

- Baby Friendly Environment Rank: 51

3. West Virginia

- Budget Rank: 13

- Health Care Rank: 48

- Baby Friendly Environment Rank: 50

4. South Carolina

- Budget Rank: 22

- Health Care Rank: 43

- Baby Friendly Environment Rank: 49

5. Nevada

- Budget Rank: 39

- Health Care Rank: 35

- Baby Friendly Environment Rank: 46

6. New York

- Budget Rank: 46

- Health Care Rank: 12

- Baby Friendly Environment Rank: 47

7. Louisiana

- Budget Rank: 8

- Health Care Rank: 50

- Baby Friendly Environment Rank: 26

8. Georgia

- Budget Rank: 6

- Health Care Rank: 46

- Baby Friendly Environment Rank: 43

9. Alabama

- Budget Rank: 3

- Health Care Rank: 47

- Baby Friendly Environment Rank: 44

10. Arkansas

- Budget Rank: 12

- Health Care Rank: 49

- Baby Friendly Environment Rank: 37

Top 10 Best States to Have a Baby

1. Vermont

- Budget Ranks: 17

- Health Care Rank: 1

- Baby Friendly Environment Rank: 5

2. North Dakota

- Budget Rank: 10

- Health Care Rank: 14

- Baby Friendly Environment Rank: 10

3. Oregon

- Budget Rank: 38

- Health Care Rank: 2

- Baby Friendly Environment Rank: 14

4. Hawaii

- Budget Rank: 31

- Health Care Rank: 25

- Baby Friendly Environment Rank: 1

5. Minnesota

- Budget Rank: 32

- Health Care Rank: 5

- Baby Friendly Environment Rank: 12

6. Kentucky

- Budget Rank: 1

- Health Care Rank: 33

- Baby Friendly Environment Rank: 20

7. Maine

- Budget Rank: 25

- Health Care Rank: 10

- Baby Friendly Environment Rank: 15

8. Wyoming

- Budget Rank: 22

- Health Care Rank: 17

- Baby Friendly Environment Rank: 7

9. Iowa

- Budget Rank: 14

- Health Care Rank: 25

- Baby Friendly Environment Rank: 9

10. Alaska

- Budget Rank: 50

- Health Care Rank: 6

- Baby Friendly Environment Rank: 2

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Americans Are About to Get a Nice Fat Pay Raise

- You’re Richer Than You Think. Really.

Worried About a Recession? Here’s When the Next Slump Will Hit

The next recession may be coming sooner than you think.

Eleven of the 31 economists recently surveyed by Bloomberg believed the American recession would hit in 2018, and all but two of them expected the recession to begin within the next five years.

If the recession begins in 2018, the expansion would have lasted nine years, making it the second-longest period of growth in U.S. history after the decade-long expansion that ended when the tech bubble burst in 2001. This average postwar expansion averages about five years.

The recent turmoil in the stock market and the slowdown in China has more investors and analysts using the “R-word,” but the economists surveyed by Bloomberg think we have a bit of time. They pegged the chance of recession over the next 12 months to just 10 percent.

Related: Stocks Are Sending a Recession Warning

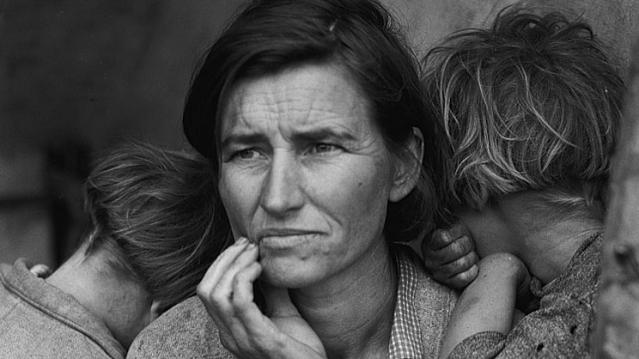

While economists talk about the next official recession, many average Americans feel like they’re still climbing out of the last one. In a data brief released last week, the National Employment Law Project found that wages have declined since 2009 for most U.S. workers, when factoring in cost of living increases.

A full jobs recovery is at least two years away, according to an analysis by economist Elise Gould with the Economic Policy Institute. “Wage growth needs to be stronger—and consistently strong for a solid spell—before we can call this a healthy economy,” she wrote in a recent blog post.

Top Reads from The Fiscal Times:

- This CEO Makes 1,951 Times More Than Most of His Workers

- Seven Reasons Why the Fed Won’t Hike Interest Rates

- $42 Million for 54 Recruits: U.S. Program to Train Syrian Rebels Is a Disaster

The 15 Most Valuable NFL Teams

The New England Patriots may be reigning Super Bowl champs and have the most successful quarterback-coach pair in NFL history -- Tom Brady and Bill Belichick each have four championship rings with the Pats -- but they’re missing something nevertheless.

As they kick off the season tonight against the Pittsburgh Steelers, the Pats aren’t at the top of the NFL in terms of team value. That title still goes to the Dallas Cowboys, according to an analysis at Forbes.

Related: 10 Big Money NFL Draft Busts

Dallas must be feeling pretty good about beating New England at something. They had the same regular season record as the Patriots last year, with 12 wins and 4 losses, but ended the season with a loss to the Green Bay Packers in the divisional playoffs, while the Pats went on to win Super Bowl XLIX (that’s 49 for all you non-Romans out there).

Even though the Washington Redskins have been playing pretty pathetically for the past decade, they still come in third. Washington’s NFC East rival, the New York Giants, rank fourth at $2.1 billion.

Here are the 15 most valuable NFL teams:

- Dallas Cowboys - $3.2 billion

- New England Patriots - $2.6 billion

- Washington Redskins - $2.4 billion

- New York Giants - $2.1 billion

- Houston Texans - $1.85 billion

- New York Jets - $1.8 billion

- Philadelphia Eagles - $1.75 billion

- Chicago Bears - $1.7 billion

- San Francisco 49ers - $1.6 billion

- Baltimore Ravens - $1.5 billion

- Denver Broncos - $1.45 billion

- Indianapolis Colts - $1.4 billion

- Green Bay Packers - $1.38 billion

- Pittsburgh Steelers - $1.35 billion

- Seattle Seahawks - $1.33 billion

Top Reads from the Fiscal Times:

- After the Fiorina Fiasco, What Insult Will Trump Fling Next?

- $42 Million for 54 Recruits? U.S. Program to Train Syrian Rebels Is a Disaster

- A Military Coup in the U.S.? A Surprising Number of Americans Might Support One