'Tax Reform Is Hard. Keeping Tax Reform Is Harder': Highlights from the House Tax Cuts Hearing

The House Ways and Means Committee held a three-hour hearing Wednesday on the effects of the Republican tax overhaul. We tuned in so you wouldn’t have to.

As you might have expected, the hearing was mostly an opportunity for Republicans and Democrats to exercise their messaging on the benefits or dangers of the new law, and for the experts testifying to disagree whether the gains from the law would outweigh the costs. But there was also some consensus that it’s still very early to try to gauge the effects of the law that was signed into effect by President Trump less than five months ago.

“I would emphasize that, despite all the high-quality economic research that’s been done, never before has the best economy on the planet moved from a worldwide system of taxation to a territorial system of taxation. There is no precedent,” said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office. “And in that way we do not really know the magnitude and the pace at which a lot of these [effects] will occur.”

Some key quotes from the hearing:

Rep. Richard Neal (D-MA), ranking Democrat on the committee: “This was not tax reform. This was a tax cut for people at the top. The problem that Republicans hope Americans overlook is the law’s devastating impact on your health care. In search of revenue to pay for corporate cuts, the GOP upended the health care system, causing 13 million Americans to lose their coverage. For others, health insurance premiums will spike by at least 10 percent, which translates to about $2,000 a year of extra costs per year for a family of four. … These new health expenses will dwarf any tax cuts promised to American families. … The fiscal irresponsibility of their law is stunning. Over the next 10 years they add $2.3 trillion to the nation’s debt to finance tax cuts for people at the top – all borrowed money. … When the bill comes due, Republicans intend to cut funding for programs like Medicare, Medicaid and Social Security.”

David Farr, chairman and CEO of Emerson, and chairman of the National Association of Manufacturers: “We recently polled the NAM members, and the responses heard back from them on the tax reform are very significant and extremely positive: 86 percent report that they’ve already planned to increase investments, 77 percent report that they’ve already planned to increase hiring, 72 percent report that they’ve already planned to increase wages or benefits.”

Holtz-Eakin: “No, tax cuts don’t pay for themselves. If they did there would be no additional debt from the Tax Cuts and Jobs Act, and there is. The question is, is it worth it? Will the growth and the incentives that come from it be worth the additional federal debt. My judgment on that was yes. Reasonable people can disagree. … When we went into this exercise, there was $10 trillion in debt in the federal baseline, before the Tax Cuts and Jobs Act. There was a dangerous rise in the debt-to-GDP ratio. It was my belief, and continues to be my belief, that those problems would not be addressed in a stagnant, slow-growth economy. Those are enormously important problems, and we needed to get growth going so we can also take them on.”

“Quite frankly, it’s not going to be possible to hold onto this beneficial tax reform if you don’t get the spending side under control. Tax reform is hard. Keeping tax reform is harder, and the growth consequences of not fixing the debt outlook are entirely negative and will overwhelm what you’ve done so far.”

Steven Rattner: "We would probably all agree that increases in our national debt of these kinds of orders of magnitude have a number of deleterious effects. First, they push interest rates up. … That not only increases the cost of borrowing for the federal government, it increases the cost of borrowing for private corporations whose debt is priced off of government paper. Secondly, it creates additional pressure on spending inside the budget to the extent anyone is actually trying to control the deficit. … And thirdly, and in my view perhaps most importantly, it’s a terrible intergenerational transfer. We are simply leaving for our children additional trillions of dollars of debt that at some point are going to have to be dealt with, or there are going to have to be very, very substantial cuts in benefits, including programs like Social Security and Medicare, in order to reckon with that.”

The Obamacare Mandate That Could Produce $12 Billion in Fines in 2018

Republicans effectively eliminated the individual Obamacare mandate in the tax package signed late last year. Although the new regulation reducing the mandate penalty to zero doesn’t take effect until 2019, President Trump has cited the rule change as a victory over the health law so many conservatives oppose. “Essentially, we are getting rid of Obamacare. Some people would say, essentially, we have gotten rid of it," Trump told a crowd in Michigan two weeks ago.

However, many parts of the Affordable Care Act are still in effect and will continue to operate even after the individual mandate is eliminated in 2019.

In particular, the employer mandate, which requires companies with more than 50 employees to offer health benefits or face fine of roughly $2,000 per worker, will continue to play a significant role in the Obamacare system. The Congressional Budget Office estimates that the mandate will produce more than $12 billion in fines in 2018 alone.

Some conservative groups are pushing lawmakers to stop enforcing the employer mandate, but the IRS is still working to enforce the law. According to The New York Times Monday, the IRS is sending out notices to more than 30,000 businesses that have failed to comply.

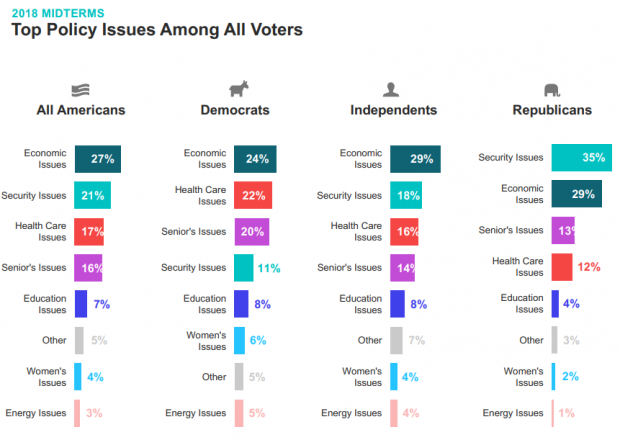

Chart of the Day: It’s Still the Economy, Stupid

Security may be the top policy issue for Republican voters, but the economy is the top concern for Democrats, independents and voters overall, according to Morning Consult’s latest polling on the midterm elections. Health care is third on the list, followed by “seniors’ issues.” The results are based on surveys with more than 275,000 registered U.S. voters from February 1 to April 30.

Number of the Day: $13 Billion

An analysis by Bloomberg finds that the roughly 180 companies in the S&P 500 that have reported earnings for the first three months of the year saved almost $13 billion thanks to the corporate tax cut enacted late last year. Those companies’ effective tax rate dropped by more than 6 percentage points on average. About a third of the tax savings went to 44 financial firms.

How a Florida Doctor with Social Ties to Trump Delayed a $16B Billion VA Project

A West Palm Beach doctor who is friends with Ike Perlmutter, the chairman of Marvel Entertainment and an informal adviser to President Trump on veterans’ issues, has held up “the biggest health information technology project in history — the transformation of the VA’s digital records system,” Politico’s Arthur Allen reports. Dr. Bruce Moskowitz “objected to the $16 billion Department of Veterans Affairs project because he doesn’t like the Cerner Corp. software he uses at two Florida hospitals, according to four former and current senior VA officials. Cerner technology is a cornerstone of the VA project. … Moskowitz’s concerns effectively delayed the agreement for months, the sources said.” Read the full story.

Marco Rubio Says There’s No Proof Tax Cuts Are Helping American Workers

Sen. Marco Rubio (R-FL) told The Economist that his party’s defense of the massive tax cuts passed last year may be off base: “There is still a lot of thinking on the right that if big corporations are happy, they’re going to take the money they’re saving and reinvest it in American workers,” Rubio said. “In fact they bought back shares, a few gave out bonuses; there’s no evidence whatsoever that the money’s been massively poured back into the American worker.”