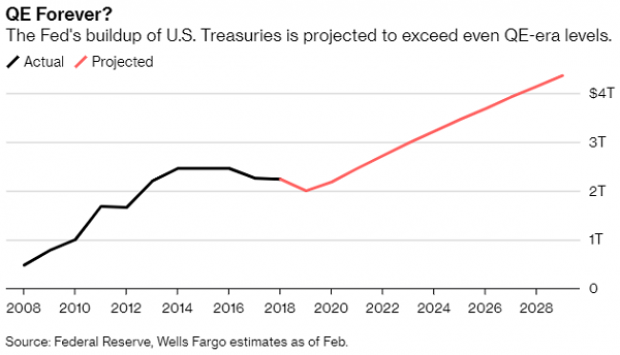

The Federal Reserve Bank is selling off about $1 trillion worth of mortgage-backed securities it acquired in the wake of the financial crisis as it brings its qualitative easing program to a close, but that doesn’t mean we’ll see much of a reduction in the Fed’s overall balance sheet. According to a new report from Wells Fargo, the Fed is expected to replace much of the mortgage-backed securities with U.S. Treasuries. The analysts said the Fed could purchase as much as $2 trillion worth of Treasury debt over the next decade.

Why would the Fed do this, rather than permanently shrinking its balance sheet? Bloomberg’s Liz McCormick and Alex Harris provide an explanation:

“Part of it simply has to do with accounting. While attention has been focused on the asset side of the Fed’s balance sheet, it also has liabilities, which mainly come in the form of currency in circulation and bank reserves. As with any balance sheet, the two sides need to net out. Since those liabilities tend to naturally increase over time with the economy, so too must the Fed’s assets.”

The purchases could be good news for the cost of servicing the nation’s ballooning debt. Priya Misra, global head of rates strategy at TD Securities, said that the Fed will once again become the largest buyer of Treasuries, which should be bullish for the Treasury market and put downward pressure on interest rates. Misra expects the Fed to buy as much as $300 billion of Treasuries next year – about a third of the $1 trillion in debt the U.S. is forecast to issue.