Household incomes in the U.S. became less equal between 1979 and 2018, both before and after interventions by the government, the Congressional Budget Office said in a new analysis released Wednesday.

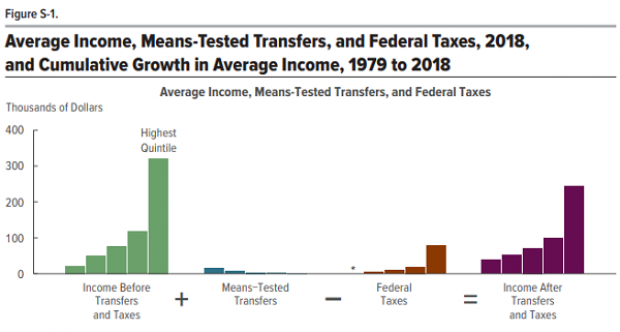

The top 20% of households saw their pre-tax and pre-transfer incomes grow by 111% over that time, with an average income of $321,700 in 2018. By comparison, households in the bottom 20% saw their pre-tax and pre-transfer incomes grow by 40%, to $22,500, while the middle quintiles saw growth of 37%. (Transfers refer to means-tested aid programs, including Medicaid, food assistance, rental subsidies, and aid to needy families.)

The tax and transfer systems reduced the overall level of inequality, boosting incomes at the bottom while reducing those at the top. The poorest 20% of households saw incomes increase by $15,200 on average, or 68%, to $37,700, after taxes and transfers. At the other end of the spectrum, the top 20% of households saw incomes decrease by $77,800 on average, or 24%, to $243,900.

The CBO noted, however, that the averages conceal considerable variation, especially at the very top, where the 1% saw much greater income growth. “In 2018, real income after transfers and taxes for that income group was 268 percent greater than it was in 1979,” the report says.