Although some of the more enthusiastic true believers continue to insist that tax cuts pay for themselves through higher growth, the economic data has long proved otherwise. As policymakers gear up for a fight over the expiration of the 2017 Trump tax cuts at the end of next year, a new set of analyses bring that point home once again.

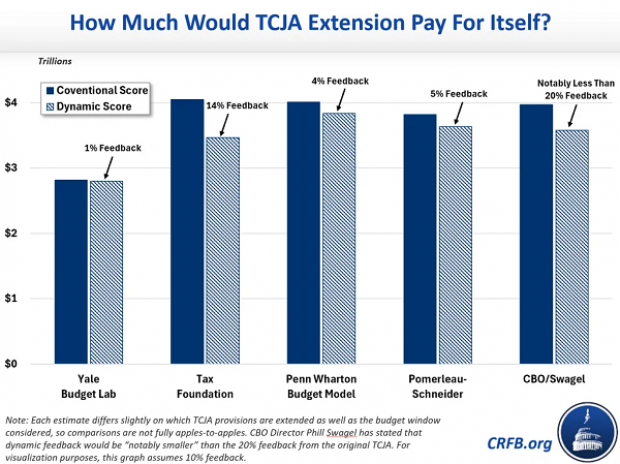

Reviewing reports and comments from five different sources, analysts at the nonpartisan Committee for a Responsible Federal Budget found that an extension of the Trump tax cuts would have a fairly modest effect on economic growth, with an estimated change in long-run output in a range between a 0.5% reduction and a 1.1% increase. The result would be just a trickle of extra tax revenue, equal to between 1% and 14% of the cost.

“While almost no tax cut would pay for itself,” the analysts at CRFB write, “the dynamic effects of extending the TCJA would be particularly modest due to the composition of the expiring tax cuts and the high economic cost of growing the national debt.”