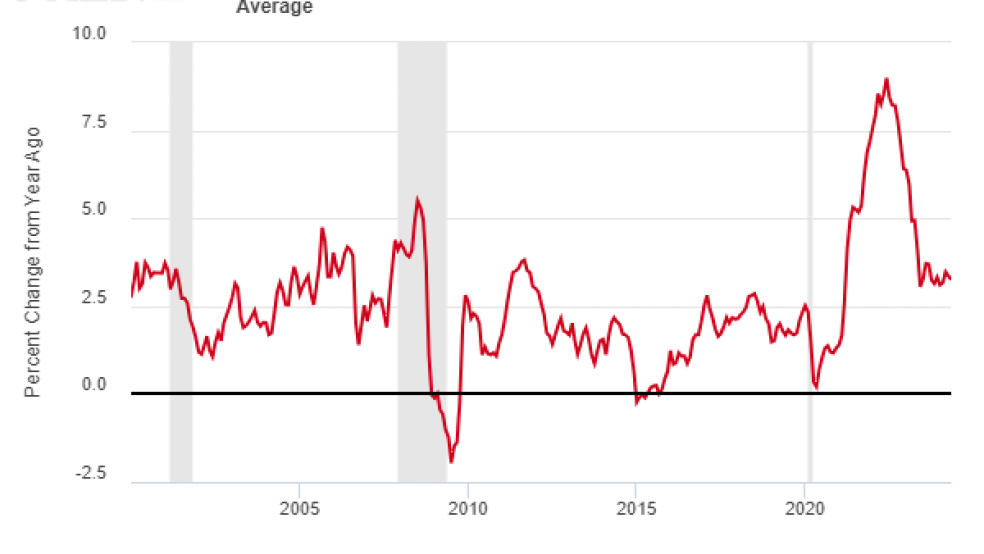

The Consumer Price Index rose 3.3% on an annual basis in May and showed no change on a monthly basis, according to government data released Wednesday. The numbers beat analyst expectations, providing more evidence that inflation is easing its grip on the U.S. economy, albeit more slowly than most people would like to see.

The core rate of inflation, which strips volatile food and fuel prices, rose 3.4% on an annual basis — the smallest increase since April 2021. On a monthly basis, core CPI rose 0.2%.

Some of the most notable components in the price index include food, which rose just 0.1% on a monthly basis and 2.1% on an annual basis — the smallest increase since 2020. Gasoline prices fell 3.6% from month to month, and were up 2.2% over the last year. New vehicle prices fell on both a monthly (-0.5%) and annual (-0.8%) basis, while used vehicle prices dropped -9.3% relative to 12 months ago.

Still, prices are still rising for many goods and services, not least for housing. The overall shelter price index rose 5.4% on an annual basis and 0.4% on a monthly basis, providing the largest inflationary effect in the price index.

Ammunition for the Fed: Saying the report supports the argument that inflation is headed toward the Federal Reserve’s 2% target level, Moody’s Chief Economist Mark Zandi celebrated the latest numbers. “Great inflation report!” he wrote on social media. “All the trend lines look good. It is time for the Fed to cut rates.”

Philip T. Powell of the Indiana Business Research Center was similarly optimistic. “This is the best news we could’ve gotten this morning,” he told CNN. “The Federal Reserve has been watching to make sure this [monthly] number came in below 0.2%.”

Noting that a wonky measure of inflation called core ex-shelter was flat on a monthly basis, economist Paul Krugman said it may be time for the Fed to declare victory. “Inflation has basically been defeated,” he wrote.

Housing costs, though, may not be so easy to ignore, and Robert Frick, corporate economist with Navy Federal Credit Union, noted that they remain a problem. “Finally, some positive surprises as both headline and core inflation beat forecasts,” he said about the overall report, per CNBC. “There was relief at the pump, but unfortunately home and apartment costs continue to rise and remain the main cause of inflation. Until those shelter costs begin their long-awaited fall, we won’t see major drops in CPI.”