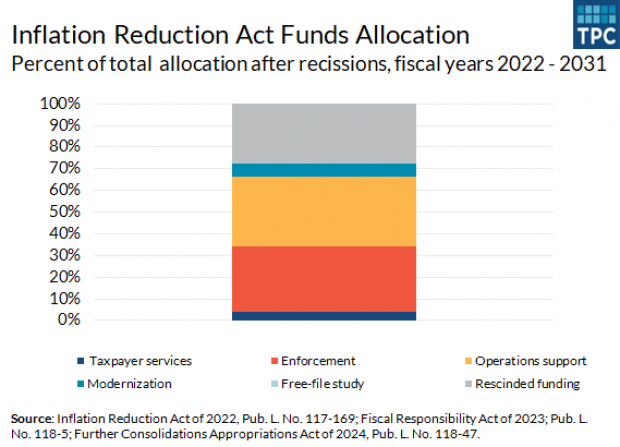

The Inflation Reduction Act of 2022 provided roughly $80 billion for the IRS over 10 years for the purpose of modernizing operations and boosting staff, with the ultimate goal of collecting more revenues, especially from those wealthy households and corporations that had been avoiding or underpaying their taxes for years due in part to chronic underfunding of the agency. This new chart from the Urban-Brookings Tax Policy Center summarizes how the IRS intends to use those funds; the chart includes the roughly 25% reduction in the initial funding approved by Congress amid fierce opposition to the plan from Republican lawmakers.

“Despite the rollback, the IRS still has big goals, with plans to use about 44 percent for operations support, 41 percent for enforcement, 8 percent for modernization, and 6 percent funds taxpayer services, and less than .05 percent for a study of a direct-file system,” TPC said.