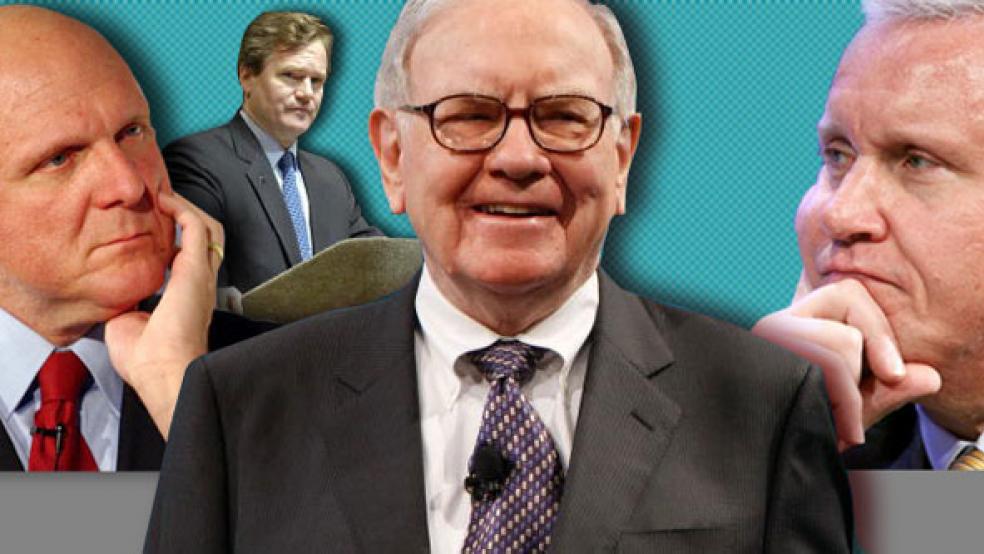

Three cheers for Warren Buffett! Just when the media had convinced many Americans that a double dip recession is inevitable, the “oracle from Omaha” said what's becoming increasingly obvious to many CEOs and economists (save New York University professor Nouriel Roubini and his fellow perma-bears): The U.S. economy is continuing to recover, really.

"I am a huge bull on this country,” Buffett told the Montana Economic Development Summit earlier this week. “We are not going to have a double-dip recession at all. I see our businesses coming back across the board." The legendary octogenarian investor said his company, Berkshire Hathaway, was hiring again. Last year, the conglomerate, which includes transportation, insurance, energy and luxury businesses, cut about 20,000 jobs.

“Anger is not a strategy,” says GE’s

Immelt. “Only optimism creates growth.

Be the contrarian. Everyone is mad today. Be happy.”

Also voicing confidence that the U.S. will not dip back into recession were fellow CEOs Steve Ballmer of Microsoft, Brian Moynihan of Bank of America and Jeffrey Immelt of GE. “Anger is not a strategy,” says Immelt. “Anger does not create growth. Only optimism creates growth. Be the contrarian. Everyone is mad today. Be happy.”

Granted, that's not so easy when the economy grew a puny 1.6 percent in the second quarter, and GDP is only expected to increase 2.5 percent this year, according to economists surveyed by Bloomberg. But, enough with the whining! After all, we are climbing out of a giant economic hole of our own creation — and that's painful and takes time. But, growth is growth. And for my part, I prefer Buffett's glass-half-full analysis to the nabobs of negativism who have been dominating the headlines of late.

Still not convinced? Consider the seven encouraging signals below:

1. Job Growth: No one can be satisfied with a 9.6 percent unemployment rate. But the 0.1 percent uptick in August was due largely to more people returning to the workforce. And there are mounting signs that hiring is beginning to pick up, albeit slowly. Private sector payrolls rose year-over-year in August for the second straight month. Hours worked and temp hiring, typical precursors of permanent hiring, continue to rebound. Temp conversions to permanent jobs have been rising for four straight months. Wages are inching up as well. Unemployment claims fell more than expected last week. And the Challenger-Grey tally of layoff announcements fell to a decade low. Says Lisa Emsbo-Mattingly, Fidelity's research director: “As the recovery progresses, I think it's clear that the only way increased demand, even if feeble, can be met is by raising headcount.”

2. Looser Lending: What makes a recovery from a recession induced by a credit crisis particularly difficult is the reluctance of banks to lend. And this time around we've experienced that in spades. Even though banks have been able to borrow from the Fed at extremely low interest rates, they have generally used that cheap money to strengthen their balance sheets rather than to lend. But there's some evidence that their death grip on lending is beginning to ease. Though mortgage lending still remains tight, big banks particularly are easing up their lending standards with respect to businesses and consumers.

3. Exports Growing: The U.S. trade deficit shrunk more than expected to $42.8 billion in July, marking a reversal from June when the trade gap reached a 20 year high. U.S. exports increased 1.8 percent to their highest level in almost two years, as foreigners bought more U.S. aircraft, industrial machinery and computers. Meanwhile, imports decreased 2 percent on weaker consumer demand for products like clothing, televisions and toys. Given a still weak consumer, U.S. growth will likely depend heavily on export growth in the months ahead.

4. Raw Material Prices Rising. Prices for raw materials — like copper, cotton and rubber that are key inputs into finished goods — have been rising nicely since mid-August and are now approaching their May cyclical highs. Because these prices are particularly sensitive to current and future growth expectations, they are good early indicators of global growth. So, is the Baltic Freight index, which tracks shipping costs, and has also risen recently.

5. Gobs of Corporate Cash: U.S. corporations are sitting on nearly $2 trillion in cash, an unprecedented hoard. Recently, we've seen some of that unleashed for mergers and acquisitions. Witness Hewlett Packard's $2.35 billion purchase of data storage maker 3PAR after a bidding war with Dell. Yesterday, HP said it plans to drop another $1.5 billion to buy California software specialist ArcSight, a move designed to help HP diversify beyond the low-margin personal computer market. As signs of recovery take hold, we will likely begin to see more M&A activity, as well as more business direct investment and dividend payouts, all of which should help sustain the recovery.

6. Help from Washington: Washington continues to shovel money out the door. Much of the fiscal stimulus has yet to be spent. The Fed appears committed to keeping interest rates low, and expanding its quantitative easing program if needed to keep the economy growing. And now it looks like we will get some combination of tax cuts to help stimulate business investment. Among them: the president's proposals making permanent an expanded R&D credit, providing expensing for capital purchases, extending most of the Bush tax cuts, and providing small business tax breaks. Of course, making these incentives permanent would be even more effective. But something is a whole lot better than nothing.

7. A Wave Election? The average total return for the S&P 500 in the third year of a presidential election cycle has been 19.4 percent. Since the S&P is down 2 percent year to date, this is clearly not a classic third year in the election cycle. But what if November turns out to be a wave election as polls increasingly suggest?

Gallup's generic ballot of voter preferences now gives Republicans the largest advantage since the poll was initiated in the 1940s. Political models suggest this could mean a 100 seat loss for the Democrats in the House this November, according to Strategas political analyst Dan Clifton. Online odds maker InTrade now give Republicans a 69 percent chance of taking over the House and a 28 percent shot at the Senate. But, Clifton points out, the House has never switched hands without the Senate following suit. Such a surprise — or the increasing likelihood of one — could trigger a mood-altering stock market rally. “Perhaps sensing a change in political winds, stocks have historically done much better in the second half of midterm election years than they have in the first,” says Clifton. “In this regard, the wave elections of 1994 and 2006 might be interesting parallels — the first half of the year was lackluster, but the second half saw meaningful gains.”

That would be a welcome October surprise.