If Congress and the White House do embark on major tax reform, as appears increasingly likely, they may finally get around to one of the most promising and yet least talked-about actions to promote private-sector job creation. Lost amid all the controversy about extending the Bush tax cuts is the fact that slashing the corporate income-tax rate could be one of the greatest elixirs for long-term job growth, and it is one that would not require any additional government spending and need not add a cent to the budget deficit.

Most of the talk about tax reform focuses on the individual code, which would affect each person directly. But many tax economists argue that reforming the corporate tax code could have a greater overall impact on investment, output and jobs, and that failing to reform it will needlessly impair the country’s ability to compete in world markets.

Everybody rails about the corporate tax code, from the Business Roundtable to the AFL-CIO, and it is always on the table in Washington. But the perennial tugging and hauling usually centers on extending this credit or closing that loophole and never gets to the fundamental problems.

the three worst features of the corporate income tax,

they usually respond with the rate, the rate and the rate.

Nothing else comes close. That’s because corporate tax rates have become a hugely important factor in the global competition for investment and jobs, and the U.S. hasn’t even been in the game for more than 20 years.

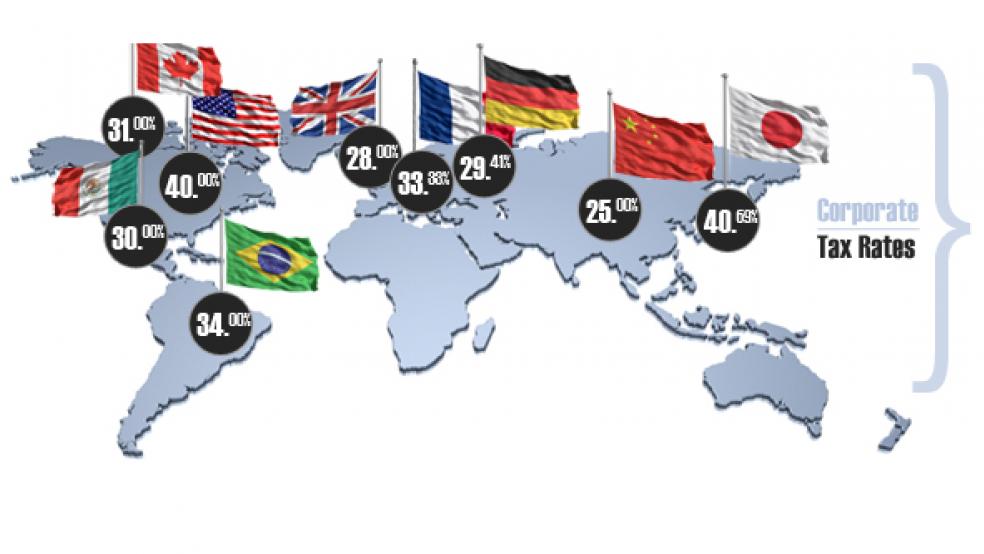

U.S. Corporate Rates: Third Highest Globally

The U.S. now has the third-highest statutory corporate tax rate in the world, behind the United Arab Emirates (55 percent) and Japan (40.69 percent) – and the second highest with its top 10 trading partners (see list below). While the top U.S. federal rate is 35 percent, the average U.S. rate, including state and local income taxes, is 40 percent, fully 15 percentage points above the average for the 30 other countries in the OECD (their rates also include local tax levies). Even Japan’s rate is going down, possibly to as low as 30 percent, this year.

The U.S. also has one of the highest “effective” tax rates, which are the actual taxes paid after deductions, credits and the like. A study by Duanjie Chen and Jack Mintz of the University of Calgary for the World Bank put the effective U.S. rate at 35 percent in 2009, also 15 percentage points higher than the OECD average. Other studies put the effective U.S. rate lower, but still way above the OECD average.

to reinvest more of their profits overseas

rather than in job-creating expansion at home.

A significantly higher corporate tax rate hurts U.S. companies in several ways. Taxes are a cost of doing business, just like wages and raw materials, so tax rates directly affect competitiveness. Domestic companies that compete with imports pay higher taxes than their competitors. U.S. exporters pay higher taxes than domestic producers in the markets where they send their goods, and higher taxes than other importers into those markets. The high corporate rate also discourages foreign companies from investing in the U.S., encourages new companies to locate elsewhere, and most important, causes U.S. multinationals to reinvest more of their profits overseas rather than in job-creating expansion at home.

U.S. multinationals face a double-barreled incentive to invest abroad because the U.S. is one of the few OECD countries that still taxes the global profits of its companies. If a U.S. multinational reinvests foreign profits abroad, it pays only the local tax rate. But when those multinationals bring foreign profits home, they have to pay a “repatriation” tax on the difference between the higher U.S. rate and the taxes they already paid in the countries where they operate. Most industrial countries that are home to the largest multinational companies, including Canada, Germany, France, Italy and Japan, operate under so-called territorial tax regimes, and do not tax the foreign profits of their companies.

Global taxation means that a U.S. investment funded by foreign profits has to clear two hurdles — the repatriation tax the company pays for bringing the funds home, and then the higher tax rate it will pay because the expansion is in the U.S. Since multinationals can defer the repatriation tax indefinitely and pay lower ongoing tax rates by reinvesting foreign profits abroad, that’s what they do.

$1 trillion of profits reinvested

overseas at the end of 2008.

Haroldene Wunder, a professor at the California State University at Sacramento, calculated last year that 273 Fortune 500 companies had more than $1 trillion of profits reinvested overseas at the end of 2008. And that is after corporations brought back $300 billion in 2005 in response to a one-year cut in the repatriation tax to a flat 4.5 percent.

Peter Merrill, a tax expert with PriceWaterhouseCoopers, notes that the high rate and global taxation also put U.S. companies at a distinct disadvantage in the global merger and acquisition market. “There is a strong incentive in cross-border transactions for the U.S. company to be the acquiree,” he says. It also makes their foreign operations increasingly more valuable to foreign companies than they are to the U.S. owners, and could lead to a round of U.S. multinationals selling off international operations if the tax-rate gap continues to widen.

The Global Rate Wars

Ironically, the U.S. had one of the lowest corporate tax rates following the 1986 tax reform, when it followed Margaret Thatcher’s lead in slashing corporate rates. The 1986 reform cut the U.S. federal rate to 34 percent and put the average U.S. federal and state rates 6 percentage points lower than the OECD average, compared with 15 points higher than the average now.

The U.S. and UK cuts, and the pressure of globalization, launched a round of global rate cuts as countries competed to attract increasingly mobile investment capital. All the U.S. did, though, was raise the corporate rate to 35 percent in 1993. If anything, the tax-rate competition accelerated in the last decade. Among OECD countries, 27 have cut their corporate rates by an average of 7 percentage points since 2000, and more cuts are planned. “The U.S. has been oblivious to the accumulated wisdom of the world’s finance ministers,” says Chris Edwards, head of tax policy at the Cato Institute.

The rate competition didn’t escape notice entirely, of course. Charles Rangel had a plan to cut the corporate rate to 30.5 percent when he chaired the Ways & Means Committee, and Senators Judd Gregg, R-N.H., and Ron Wyden, D-Ore., had a plan to slash tax expenditures and cut the rate to just 24 percent. But none of those initiatives or others like them ever gained traction. One reason is that Congress had too many other things on its plate, and no call for major reform has had White House backing since the 1986 package. Another is that many corporations themselves are leery of opening the issue for fear of losing preferences without getting the offsetting rate reduction. And, of course, there are those who argue that corporations should be taxed more either to fund spending, or reduce the deficit.

A Moment of Opportunity

But now it appears there is a chance that the U.S. might catch up if reform gathers momentum. The President’s Deficit Commission, for one, advocated a thorough overhaul of the corporate code that by its calculations would take the corporate rate down to at most 29 percent, and perhaps as low as 23 percent. It would get there without increasing the deficit by doing away with more than 75 tax expenditures in the code and more than 30 tax credits. Eliminate all corporate tax breaks and the commission suggests the rate could be reduced to 26 percent -- that’s based on a static revenue analysis that assumes no additional economic growth. The deficit commission also recommends shifting to a territorial tax system and doing away altogether with the taxation of foreign profits.

at least to 20 percent without

adding to the budget deficit.

Others believe the rate cut could, and should, go much deeper. Chris Edwards and Dan Mitchell of Cato argue that the federal rate should be cut to just 15 percent, so that combined federal and state tax rates will be on a par with the OECD average. They argue that rates can be cut deeply because rate reduction will cause revenues to rise, based on the Laffer curve. Economist Arthur Laffer argued that raising rates above an inflection point triggers tax avoidance that causes revenues to decline. The other side of the Laffer curve is that rate reductions above the inflection point cause revenues to climb.

The Laffer Curve at Work

Critics claim that Laffer overstates the impact on behavior of rates cuts. But there is ample evidence that the Laffer curve is at work in the corporate code. Edwards and Mitchell, for example, studied 19 OECD countries that cut their corporate rates from an average of 45 percent in 1985 to 29 percent in 2005. Corporate tax revenues in those countries actually went up as a percentage of GDP, from an average of 2.6 to 3.7 percent. Edwards and Mitchell say the higher revenues came not from base broadening, but from higher investment, higher reported profits, and less tax avoidance. In the U.S., they believe, going to a territorial system also would prompt huge profit repatriation, as happened in 2005 when the repatriation tax was cut.

low rate corporate tax could be workers.

Other research leads to similar conclusions. Kevin Hassett and Alex Brill of the American Enterprise Institute examined the response of tax revenues to rates and concluded that revenues fall when the corporate rate goes above 26 percent. Which means, of course, that corporate tax revenues rise as the rate falls towards 26 percent. Jack Mintz of Calgary put the revenue-maximizing rate at 28 percent in a 2007 study. And Greg Mankiw and Matthew Weinzierl of Harvard studied the issue and concluded that the investment response to lower rates is so strong that the revenue loss is only half as large as a static analysis would suggest.

No one can say with certainty, or even with high confidence, what the revenue impact would be from a given set of rate reductions and the elimination of corporate tax preferences. The size of a dynamic revenue response versus a static revenue calculation is likely to be one of the more contentious issues in the reform debate. But the Mankiw-Weinzierl study and others make it clear that wholesale elimination of corporate credits and preferences could allow a much deeper rate reduction than the 23 to 28 percent rate the Deficit Commission recommended.

The Winners

An inevitable question about any major tax change is who benefits. Wiping the tax code clean of special exemptions and credits would shift the corporate burden among industries, and any attempt at wholesale reform is sure to set off a lobbying frenzy by those that enjoy the biggest preferences now. Shareholders clearly would benefit, but they already can escape the high U.S. corporate rate by investing in foreign companies, as they increasingly have been doing. Multinational companies also would be big winners, which is why the Business Roundtable advocates both rate reduction and territorial treatment.

The biggest winners of all from a flat, low-rate corporate tax could be workers. Numerous studies, including ones by the Congressional Budget Office, the Federal Reserve and Hassett at the AEI, conclude that as much as 70 percent of the corporate income tax falls on workers, in the form of fewer jobs and lower wages, rather than on shareholders. Everywhere else, the result of sharp cuts in corporate income tax rates has been more investment, more jobs and higher wages. There is no reason to presume that the result would be different here. As Edwards says, “Corporate taxation should be front and center in debates about economic growth, jobs and incomes.”