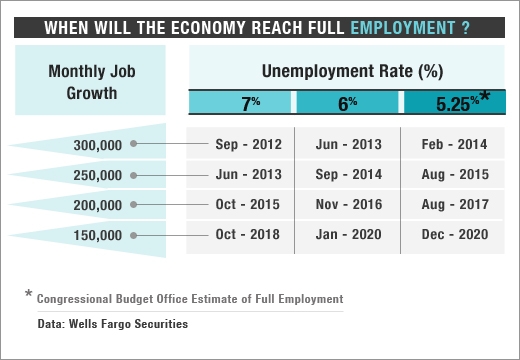

• 7 percent unemployment may be the best the economy can achieve. • 200,000: the number of jobs needed per month to reach 7 percent unemployment by October 2015. • 63.4 percent of working-age Americans are in the labor force, a 26-year low. |

Persistently high unemployment is shaping up to be one of the unfortunate legacies of the Great Recession. A key question is what policymakers can do about it. If joblessness is simply a case of weak demand, then efforts by the Federal Reserve and Congress to stimulate spending would seem to be the ticket. However, there is growing evidence that the recession and the financial crisis have wrought lasting changes in the labor markets that will greatly complicate policy decisions in coming years. It’s not just that a return to full employment will take a long time. It’s that what we have come to think of as full employment may now be unachievable.

Before the recession, economists generally believed that unemployment of about 5 percent was the rate at which everyone who wanted a job could find one—basically full employment. The jobless rate cannot go to zero because labor markets are always churning, as people shift from being employed to unemployed and back to employed. Trying to push the rate below the so-called full employment level doesn’t generate any more output; it just creates shortages and fuels upward pressure on inflation. The new question economists are grappling with is: What is full employment? Moreover, what will it take to get there, and how long will it take?

Many economists now believe the recession changed the labor market so radically that 6 percent or even 7 percent unemployment may be the best policymakers can hope for without raising inflation. “Significant structural impediments to stronger job growth have arisen out of the recession,” says economist Mark Vitner at Wells Fargo Securities, who believes full employment is now a jobless rate of around 6 percent. Economists at Barclays Capital say it has risen to about 7 percent.

Whatever the number is, getting there is going to take a long time. As Federal Reserve Chairman Ben Bernanke told a Senate panel on Jan. 7, “It could take four to five years for the job market to normalize fully.” Even that could be overly optimistic. Economists generally believe monthly payroll gains will average about 200,000 jobs this year. At that pace, the Wells Fargo analysts estimate the unemployment rate would fall to 7 percent by October 2015. It would reach 6 percent by November 2016. The rate would not get to the Congressional Budget Office’s 5.25 percent estimate of full employment until August 2017. At the 112,000 monthly pace of private-sector job gains in 2010, the economy would never get back to full employment, because the working-age population would be growing even faster.

Several new factors are at work. First of all, skills are atrophying amid unprecedented long-term unemployment. Those out of work for 27 weeks or more now account for 44 percent of all joblessness. Construction, manufacturing and financial services, especially, have shown large increases in long-term joblessness. The unemployment rate in construction is above 20 percent, with long-term unemployment accounting for more than half of that. Skill erosion also can create mismatches between available skills and those in demand, which could result in spot labor shortages, although none are yet evident.

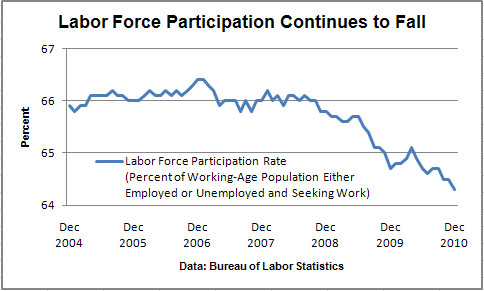

The large decline in the December jobless rate, to 9.4 percent from 9.8 percent in November, was not as hopeful as it looked. Much of the drop reflected the third consecutive month of shrinkage in the labor force, that is people who are either employed or looking for work. Unemployment declined not so much because people found work but because many simply dropped out of the labor force. Usually in a recovery, the percentage of the population in the labor force rises, as the unemployed return to the market seeking work. A more typical trend would result in a much higher jobless rate. Since the recession ended a year and a half ago, however, the labor force participation rate has fallen to 64.3 percent, a 26-year low, from 65.7 percent.

That trend may well continue, especially as the labor force continues to age. For now, labor force participation of older workers has risen, but as workers retire that trend won’t continue. At the same time, participation by all other age groups is plummeting, especially among the youngest workers who are increasingly opting for longer stays in school or choosing to live with their parents. Teenage unemployment, at 25.4 percent in December, remains near a record level. “The long-term downtrend is likely to remain in place as these structural factors continue to weigh on labor force participation,” says economist Peter Newland at Barclays Capital.

Also, lasting weakness in the housing market makes workers less mobile. With one in four homeowners underwater with their mortgage, they can’t just pick up and go. The domestic immigration rate fell to 12.5 percent in 2009, close to the lowest rate on record. Plus, extended jobless benefits may be creating a disincentive to look for work. One study estimates that recent benefits extensions added between 0.7 and 1.8 percentage points to the unemployment rate.

Finally, global competition appears to have made U.S. industry more capital intensive, which means labor may be more productive. Each percentage point of GDP growth now generates fewer jobs. Between the last two recessions, from 2001 to 2007, the economy grew 2.7 percent per year, while monthly gains in private payrolls averaged only 86,000 jobs. Since the last recession ended in 2009, the economy has grown at a 3 percent annual rate, but the jobless rate is no lower now than it was then.

These structural changes mean the labor markets are a long way from recovery. Moreover, falling labor force participation and a higher jobless rate associated with full employment could have enormous implications for both politics and policy in coming years. “Fiscal policymakers will have to adjust to an extended period during which a greater proportion of the population is out of work and out of the labor force,” says Newland. That means both weaker tax receipts and the need for more expenditure on Social Security and Medicare at a time when Washington’s fiscal condition is already dire.

Related Links:

The New Normal of Unemployment (The Guardian)

The Unemployment Rate’s Most Persistent Myth (Huffington Post)

Boston Fed Chief Predicts Solid Growth, Not Enough Jobs (Boston Globe)