In a political culture that pays lip service to transparency, press conferences can be either revealing or a window onto the expected. Wednesday’s first-ever press conference by Federal Reserve Board chairman Ben Bernanke was a little bit of both. He gave the expected vague answers to specific questions about inflation and unemployment – the primary economic concerns for Fed policymakers.

But he also signaled that despite his growing concerns about inflation, he wasn’t ready to pull the punch bowl of accommodative monetary policy, which many believe has kept a weak economic recovery from toppling into a double-dip recession.

Central bankers have gone before the cameras to answer questions before. It’s done routinely in Europe and in Japan. In the U.S. the Federal Reserve Board chairman treks up to Capitol Hill twice a year to explain the decisions behind monetary policy, and to offer views on everything from the direction of the economy to the need for balanced budgets. Bernanke has even appeared on CBS’s “60 Minutes” to defend Fed policies.

But holding a press conference in the wake of a routine meeting of the Federal Open Markets Committee, which sets monetary policy, opened up the possibility that officials would clarify decisions that in past years could only be guessed at by investors, economists and the general public. There was nothing earthshaking about what Bernanke had to say, but it clarified important nuances of monetary policy that traders and financial institutions carefully follow.

Yesterday’s revelation came when Bernanke said that, although the Fed was going to let its policy of quantitative easing (QE2) expire at the end of June as expected, it wasn’t going to start liquidating its $2.8 trillion portfolio of government bonds and mortgage-backed securities. That portfolio was amassed over the past few years in the Fed’s bold campaign to bolster an economy devastated by the worst financial crisis since the Great Depression. It will continue to reinvest the proceeds in Treasury securities.

“Bernanke was very explicit. He expects it to continue beyond June,” said Robert V. DiClemente, an economist at Citigroup. The openness that provided that clarity was a welcome development, at least from one major bank’s perspective. “If I had a choice between the statement and the press conference, I would take the press conference, ”DiClemente said.

Reacting positively to the Fed’s announcement, stock markets rallied broadly Wednesday with the Standard and Poor’s index of 500 stocks closing up 0.6 percent at 1,356, its fifth gain in the last six days. The Russell 2000 Index of small companies rose 0.6 percent to 858.31, a record high.

For nearly three decades, the Federal Reserve Board has been traveling the path toward greater transparency.

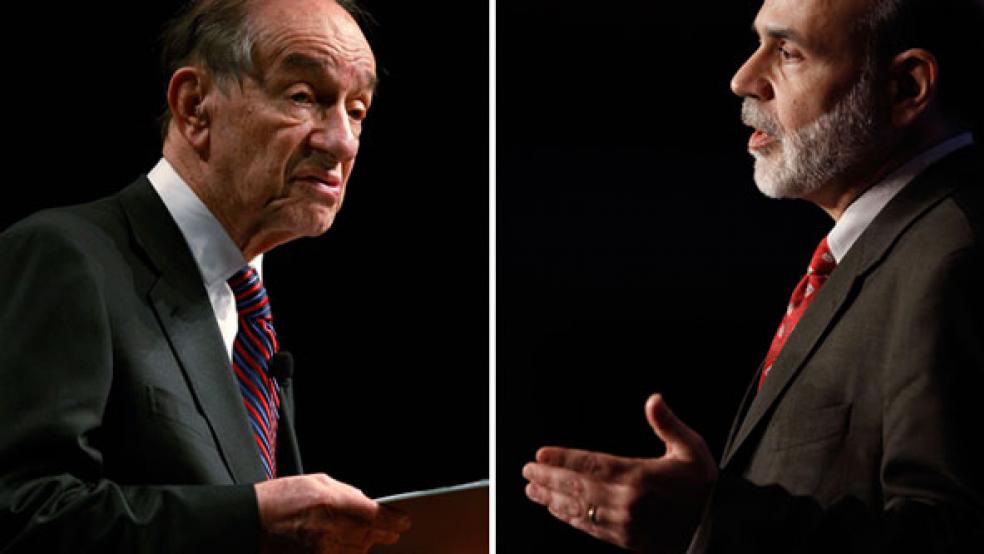

When Alan Greenspan took the helm in 1987, the Fed didn’t even announce its target interest rate at the conclusion of its regular meetings. By the time Bernanke took over in 2006, the Fed was issuing detailed statements that included those target rates, publishing minutes from the meetings, revealing its analyses of economic conditions across the country, and publishing all of its governors’ speeches.

Holding press conferences is just an extension of the trend toward greater transparency, made possible in part by the stark contrast between the current chairman and the previous occupant of that office. Bernanke, a former Princeton University economics professor, is a plain speaking South Carolinian who seems to delight in explaining complex economic concepts to his audiences. In yesterday’s case, the roomful of reporters at Federal Reserve headquarters waived their hands and looked like eager graduate students trying to get their professor’s attention.

Greenspan, on the other hand, would routinely confound the public and reporters with his Delphic musings, whose meaning could only be divined by experts who spent their careers mulling the meanderings of his perorations. He must be right, was the conventional wisdom, until, of course, he went spectacularly wrong by pursuing policies that inadvertently fueled a housing bubble whose collapse bedevils the economy to this day.

Yet there are limits to Bernanke’s and the Fed’s openness. An economy with rising oil and commodity prices, a shrinking dollar and an unemployment rate that remains depressingly high probably grew at less than two percent last quarter. It will have to grow significantly faster if the Fed is going to hit its long-term target unemployment rate of 5.2 to 5.6 percent.

Bernanke was clear in response to questions that there is little more that the Fed can do to spur economic activity. The interest rate target remains at near zero, and, additional quantitative easing – the purchase of large sums of Treasury bonds to stimulate spending and lending -- is off the table, at least for now. “We do have to worry about rate of growth, but also inflation rate,” he said.

“If inflation expectations were to rise significantly, the employment loss that would result if we had to respond to that would be significant.”

And that was a huge disappointment to those observers hoping for more aggressive action. “I would have hoped that the reason for holding a press conference was to counter all the pressure coming from the right,” said Josh Bivens, an economist at the liberal-leaning Economic Policy Institute. “He should have explained that all the inflation fears are overblown.”

Yet it was just fine for economists on the other side of the political spectrum. “Mission accomplished,” said Vincent Reinhart, a resident scholar at the conservative American Enterprise Institute. “QE2 has run its course and they hope to not have to respond to inflation.”

Related Links:

Bernanke Defends Fed’s Role in Running Economy (New York Times)

Bernanke Must Have Lost My List of Questions (Business Week)